Great Britain and Prime Minister Theresa May are running out of time if their Brexit plan is rejected next Monday, which will likely cause extreme weakness in the British pound, according to Fawad Razaqzada.

Next week’s major market risk event is most likely to be the UK parliament’s so-called “meaningful vote” on the withdrawal agreement Prime Minister Theresa May negotiated with the European Union at the back end of last year.

The deal covers the terms of Britain’s departure from the EU and the framework of future relations with the bloc. It was originally scheduled to take place in December, but May decided to delay the vote after it became obvious that members of Parliament would vote against it. The embattled Prime Minister has since made little progress, if any, to win support. Brexit proponents argue that this deal is not what people actually voted for in 2016, as it could keep the UK tied to the EU indefinitely, without any say over its rules.

“Remainers” are obviously against any Brexit deal, but some from this camp also argue that under this deal, the UK will be worse off than staying within the EU. Therefore, it is likely that members of Parliament would still vote against May’s deal on Tuesday, which could lead to more uncertainty and confusion, not to mention volatility in the markets. The impact of the vote is obviously going to be felt on UK assets first and foremost, but such is the importance of the vote that it could impact the global markets as well. If, for example, it triggers a sell-off in the stock markets then we could see safe haven assets such as gold and Japanese yen gain further support.

As far as today is concerned, well the pound has risen on the back of a report from the Evening Standard, which suggested that a Brexit delay beyond March 29 looks increasingly likely, citing Cabinet ministers on the matter. The pound’s positive reaction suggests investors are betting that the potential delay in the official exit date means the chance for a no-deal outcome would decrease.

But as it stands, the UK is scheduled to leave the EU on March 29, with or without a deal. However, things could change dramatically next week, depending on the outcome of the vote. It is possible, for example, that May might resign if the parliament rejects her deal, which could pave the way for a whole host of possibilities and uncertainties. But May is likely to fight her corner even if defeated. So, instead of immediately resigning, she may come up with plan B, but the Prime Minister will then only have three parliamentary days to do so. That would take us to Monday Jan. 21 for a potential second parliamentary vote. If her plan B is also then defeated, she may either resign or call for a general election. Other options include leaving the EU without a deal, which is the worst-case outcome for the pound, while calling another EU referendum is an alternative scenario. Unless May’s Brexit proposal passes the vote, any other options would probably involve delaying the official exit date of March 29, provided the EU agrees to it.

As we approach Tuesday’s eagerly-awaited vote, the pound is likely to turn even more headline-driven and volatile as some speculators try to pre-empt the outcome of the vote, as we have seen today with spike higher in the British pound (GBP/USD). Meanwhile those who have existing positions on sterling may decide to take profit, further exacerbating GBP’s stability. The potential for increased volatility is not necessarily a bad thing, especially for scalpers and short-term term trading strategies, but speculators who like to take longer-term directional views on the pound may be better off waiting for the outcome of the vote before deciding on a trade. On the other end of scale, aggressive traders may wish to buy as close to support or sell as close to resistance if they want to be in the market in the lead up to the vote, although we don’t recommend this strategy as it can be very risky.

Among the pound crosses, the GBP/JPY is among the most volatile pairs in normal times, but will be more frothy should the outcome of Tuesday’s vote trigger a risk-off response in the markets. So, the GBP/JPY has the potential to drop sharply if May’s Brexit deal is rejected by the parliament.

However, if the vote somehow passes then this pair could absolutely surge, as May’s Brexit vision is seen as being a market-friendly deal. In other words, her deal, if approved, would represent a “soft” exit from the EU, which could limit the damage the UK economy might face in the short to medium term, compared to say, a no-deal Brexit. This would encourage the Bank of England to hike interest rates to combat inflation, thus sending yield-seeking investors into the pound.

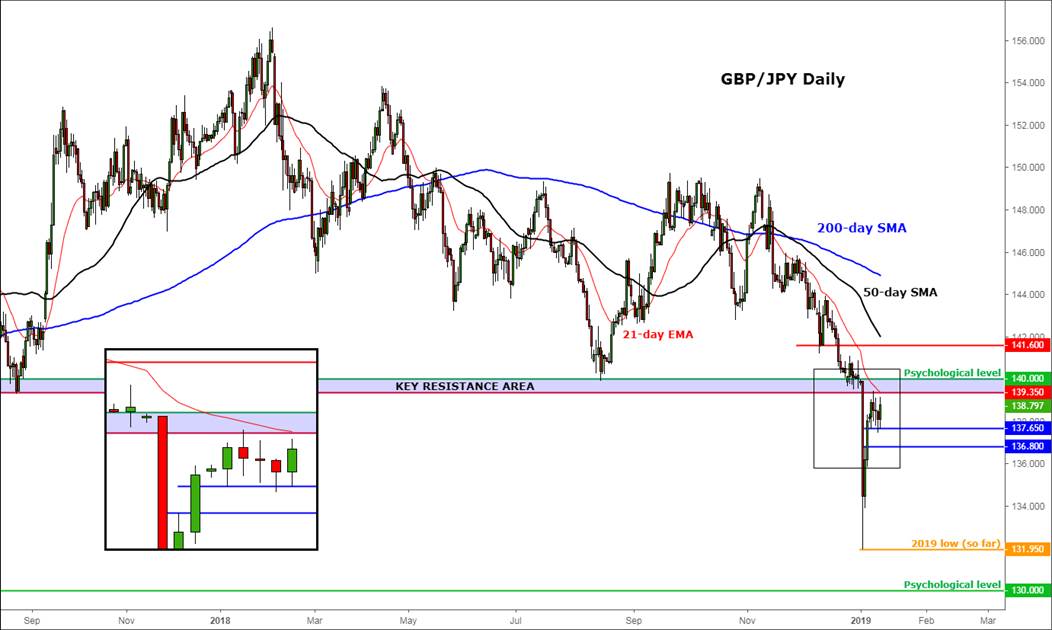

Source: TradingView and FOREX.com

The GBP/JPY has staged an impressive rally off its 2019 low at 131.95, which it hit on Jan. 2 (see chart above). Ahead of the Brexit vote, it has now reached the pivotal technical area between 139.35 and 140.00. This range was the last support prior to the latest breakdown. Once support, this level could turn into resistance going forward. But if the bulls reclaim this resistance zone then rates could push higher in the short-term, with the next potential resistance coming in at 141.60. Meanwhile, the next support levels come in at 137.65 and 136.80 respectively. If the latter breaks, say, on the back of the Brexit vote on Tuesday, then we wouldn’t rule out a potential drop towards the next psychological level around 130.00. In any case, traders need to be extra vigilant to the prospects of price spikes, flash crashes, and indeed flash melt ups, and take appropriate measures to minimize these risks. Good traders are, above all, good risk managers.