The CFTC’s Commitments of Traders (COT) is a valuable tool for traders explains Andy Waldock who will be discussing the COT Report and seasonal tendencies at the TradersEXPO Chicago this weekend

The partial government shutdown continues to halt the Commodity Futures Trading Commission’s production of the Commitments of Traders report.

In addition to the COT, other government produced reports relevant to markets have been disrupted. The U.S. Department of Agriculture stated: “Due to a lapse in Federal funding, work on National Agricultural Statistics Service (NASS) and Office of the Chief Economist – World Agricultural Outlook Board (OCE-WAOB) reports have been suspended since Dec. 22, 2018 and remain suspended. Given the lead time required for the analysis and compilation of Crop Production, Crop Production-Annual, World Agricultural Supply and Demand Estimates (WASDE), Grain Stocks, Rice Stocks, Winter Wheat and Canola Seedings, and Cotton Ginnings reports, those reports will not be released on Jan. 11, 2019 as originally scheduled even if funding is restored before that date. The date of all NASS and OCE-WAOB releases will be determined and made public once funding has been restored.”

Since we have no new data, let’s take a brief look at the historical way the COT report has been used versus our current treatment of the data and the trading opportunities it provides.

Historically, the COT report was viewed by the masses through Steve Briese’s COT Index. The COT index provided a long-term trend following indicator. Part of this was a necessity since the COT data was initially published monthly and then, bi-weekly prior to the current, weekly reports. The COT Index approach created two problems for retail traders. First, the risk on a weekly or, bi-weekly timeframe along with the monetary swings it produced was just too significant for new traders to trade objectively. Secondly, the holding period was so long that it made recapitalization and money management a much longer-term proposition. Retail traders must be comfortable with the initial risk, and be able to trade frequently enough to re-capitalize, learn, and remain divorced from emotional attachment to any given position.

Our approach focuses on potential market turning points or, reversals. The data suggests the battle between the trend-following large speculators and the net commercial traders’ position is the key to determining a market’s next move. Will the market breach recent levels and develop a new trend? Will the speculative efforts find, “this time is not different,” and reverse course as the speculators scramble to limit their losses?

Market trends are impossible to pinpoint. However, markets are rarely in trending mode, and their general meanderings between trends can be reasonably easy to spot using the commercial traders’ business plans to determine levels of commodity supply and demand.

We distill the data down to a daily level in our hunt for overextended markets on the verge of reverting to their previously traded levels. The multi-timeframe analysis allows us to define the boundaries of our trade in terms that a retail trader can get their head around. Every strategy requires a built-in stop-loss order. Since this is a reversal methodology, the protective stops are always placed at the most recent extreme price. The ability to call the potential reversal within a day allows us to define the risk more tightly than the previous week’s range.

Finally, the broadening appeal of our treatment of the COT reports lies in the 3 to 5 period holding windows. We will spot some of the more significant turns on the weekly data and extrapolate them to your favorite commodity-based exchange traded fund. Using less leverage may be more comfortable over a month’s holding period. Meanwhile, futures traders actively watching the markets can move in and out at some of the most critical moments as the battle between commercial price discovery and speculative trend following rages.

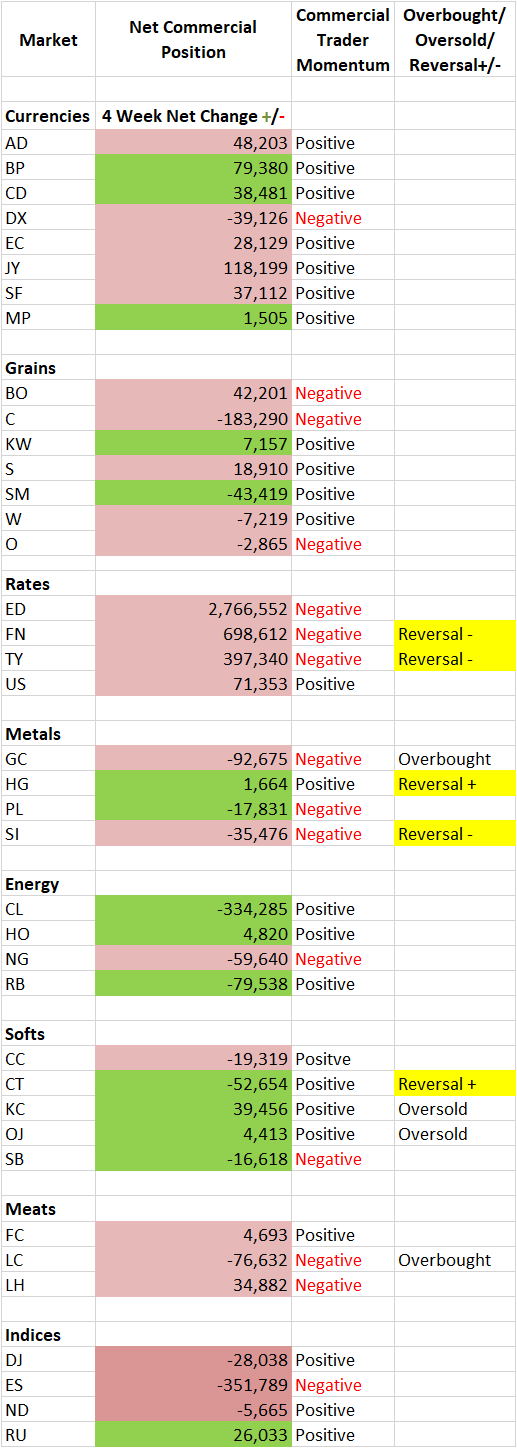

Table shows net commercial position, recent movement, positive/negative momentum and whether the data shows a market is overbought, oversold or anticipates a reversal. (Note: Data based on last COT report from before government shutdown).

Join Andy at the TradersEXPO Chicago next week where he will discuss: Swing Trading Futures & Commodity ETFs with the COT Report & Exploiting Seasonal Tendencies in Futures & Commodity ETFs.

Here is a preview: Understanding the COT Report & Seasonality and the COT