CHL is trading near annual highs, but the stock is barreling into formidable technical resistance, says Elizabeth Harrow, Director of Digital Content Schaeffer's Investment Research, Inc.

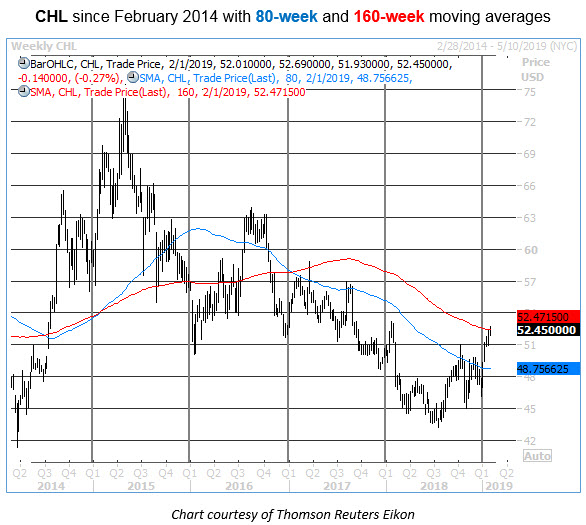

The U.S.-traded shares of Hong Kong-based China Mobile (CHL) have rebounded impressively from their July 2018 low of $43.25 and started 2019 by breaking out above stubborn resistance at their 80-week moving average. CHL is now trading near annual highs, but the stock's breakout rally has now brought it barreling into a historically formidable level of technical resistance -- and a rejection here could create a compelling opportunity for traders to bet on a quick leg lower for CHL in the weeks ahead.

Specifically, CHL is trading within one standard deviation of its 160-week moving average, after having spent nearly all of its time below this trendline since late 2016. Looking back at the past 15 years' worth of data, Schaeffer's Senior Quantitative Analyst Rocky White found nine prior examples of CHL testing resistance at its 160-week moving average in this manner. Following those previous signals, the stock was higher four weeks later just 22% of the time, with the equity's return over this time frame averaging out to a loss of 3.12%.

The last time CHL traded above its 160-week was a brief pop back in March 2017 that lasted less than a week. The shares retraced all of their gains to end lower for the five-day period, and on the south side again of both their 80-week and 160-week moving averages. As of this writing, CHL is trading just about its 160-week, so traders will want to wait for a weekly close below this moving average as "confirmation" of this bearish technical signal.

From a sentiment perspective, there's not much pessimism priced into CHL, despite the stock's longer-term downtrend (see chart below). Short interest has increased by nearly five times from its January 2018 lows, but still accounts for only 0.22% of China Mobile's float. And from here, the number of shorted shares could roughly double before matching the 2014 calendar year high. A continued increase in bearish speculation could keep the stock under pressure, providing an additional headwind on the charts.

Meanwhile, China Mobile isn't expected to report earnings until the end of March, which means financial results shouldn't be an event-related risk for short-term traders in this name. That said, headlines related to U.S.-China trade negotiations remain a wild card, so traders may wish to hedge risk by making a bearish trade on CHL alongside a call play on an outperforming trade-sensitive stock, like Boeing (BA).