“It doesn’t get any better than when the data and the central bank policy all point strongly in the same direction as they do now for gold assets,” writes Landon Whaley. He's presenting at MoneyShow Orlando Feb. 9.

Our newest Macro Theme, “Goldfinger”, is driven by the three-headed hydra of slowing U.S. growth, falling U.S. yields and a declining U.S. dollar. The recent U.S. growth data and the January price action in both yields and the greenback are confirming this macro theme is beginning to pick up steam. More importantly, no matter what action the Fed takes (or doesn’t take) in March, this theme will thrive. From a trading perspective, it doesn’t get any better than when the data and the central bank policy all point strongly in the same direction as they do now for gold assets.

The Big Fundamental

As we discussed when we launched the Goldfinger macro theme on Jan. 7, there is no better environment for gold. In these growth-slowing regimes, gold averages a quarterly gain of +3.5% and has positive returns 72% of the time. And the VanEck Vectors Gold Miners exchange trade fund (GDX), which is just a leveraged play on gold, gains an average of 4.6% and is positive in 76% of all growth-slowing calendar quarters.

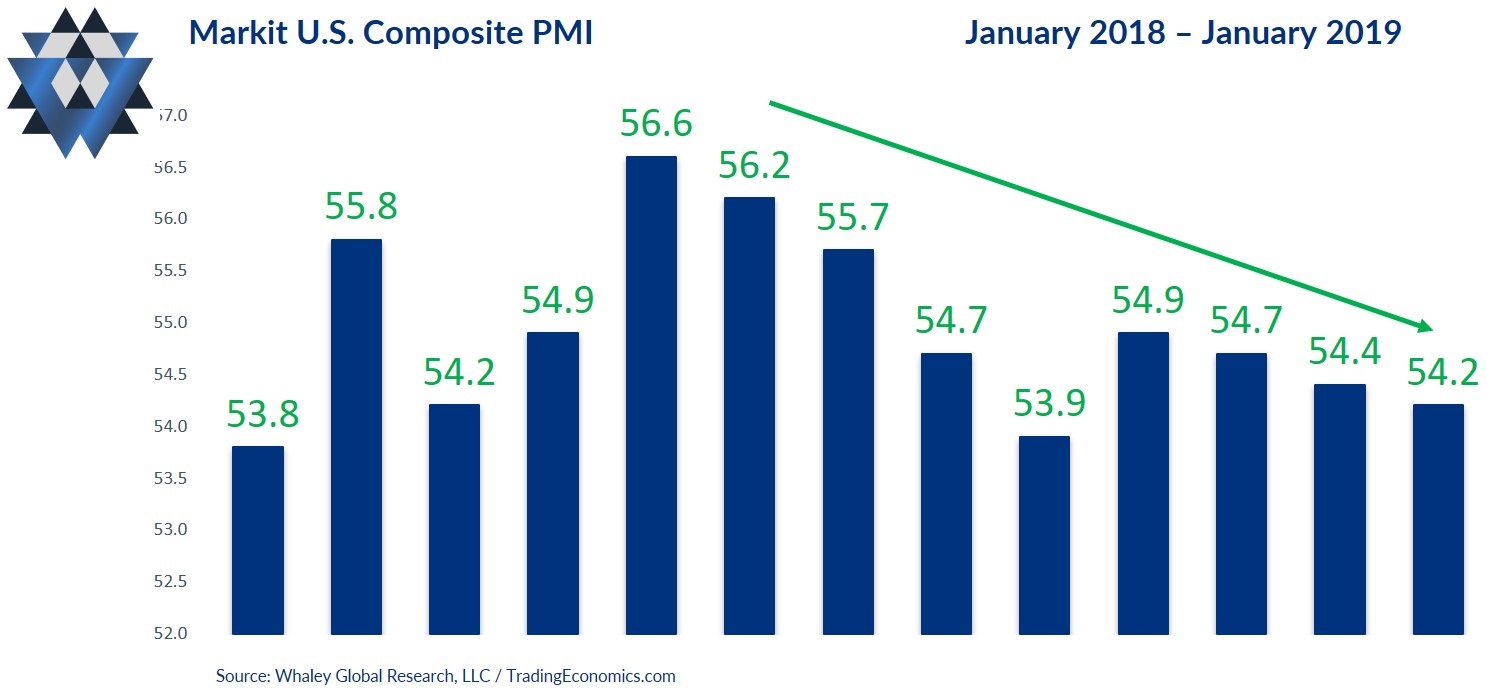

Economic data from the final three months of 2018 are confirming this growth-slowing environment, and the price action in two critical markets to begin the year is also confirming that Goldfinger is alive and well.

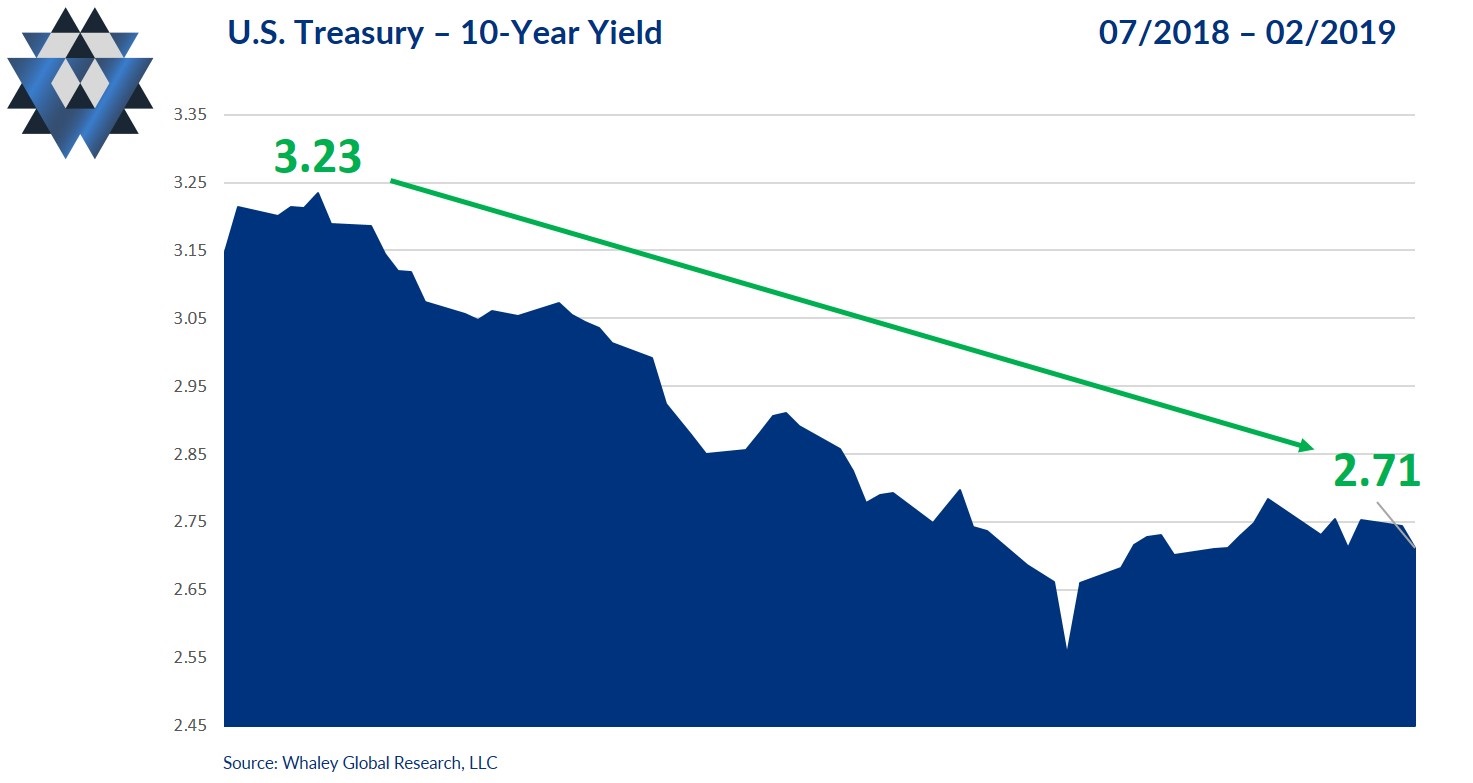

U.S. 10-year yields have been making a series of lower highs since peaking on Nov. 8, and 30-year yields have been in their own downtrend since peaking on Nov. 2. Both yields bounced off their Jan. 3 low, but only modestly so before consolidating in a fairly tight range for the last month. Gold has been moving higher despite the fact that yields haven’t fallen back to their early January levels. If yields break the low end of their range, gold (and gold miners) will trade like they were shot out of a cannon.

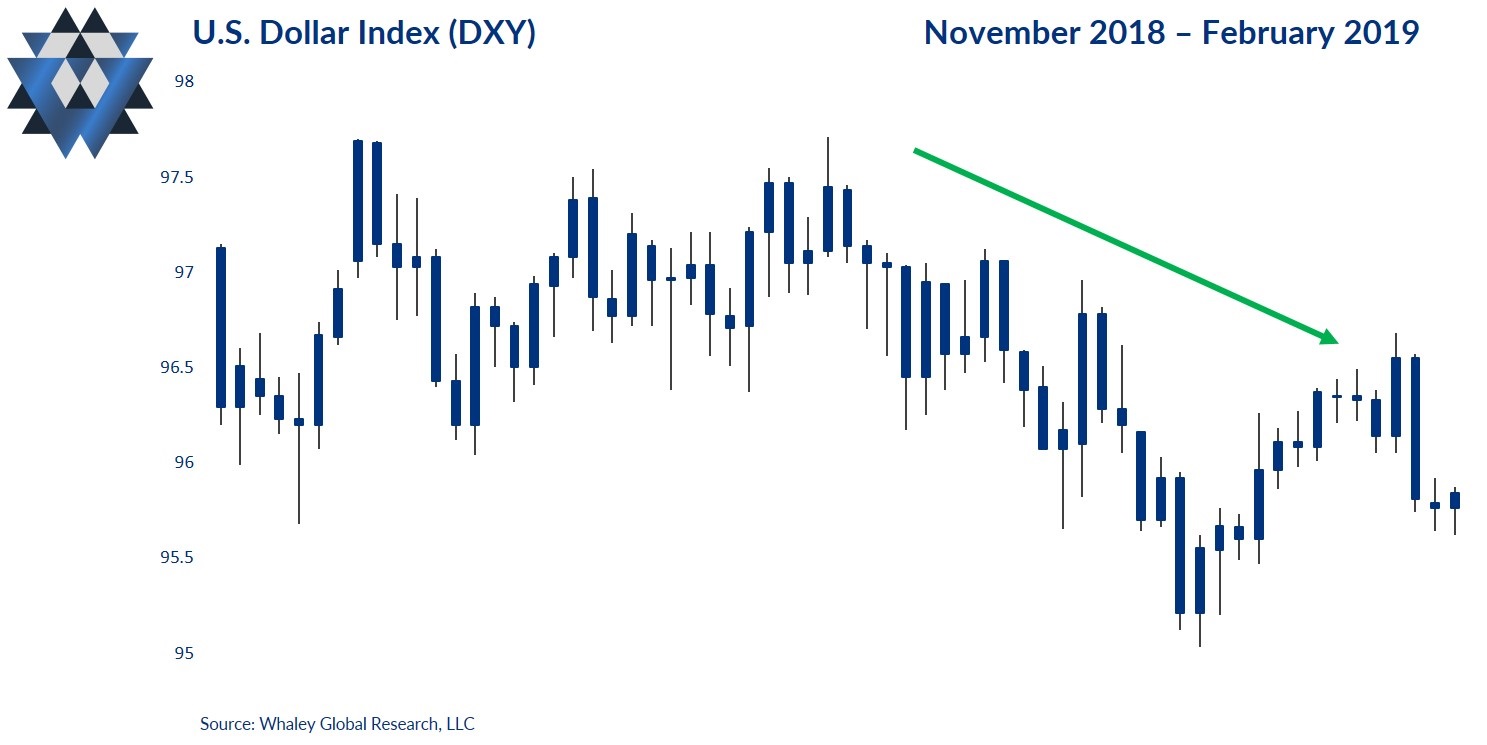

However, slowing U.S. growth and declining yields are only two of the three heads of the hydra that will propel gold higher. The accelerant that would get the Goldfinger macro theme working in spades is continued weakness in the U.S. dollar.

The greenback peaked on Dec. 14 and has been making a series of lower highs ever since. In a similar manner to yields, we don’t need a cascade in the dollar to get gold moving higher; we simply need a lack of strength. Based on Friday’s close, strength would be defined as a rally above $96.70. Unless the dollar can claw its way above that level, then at a minimum it’s not an impediment to further upside in gold. On the downside, should it break below $95.25, it becomes a massive tailwind to this macro theme.

If the trading gods are on our side, and both yields and the dollar break lower together, then hold on to your hats because gold is going to rip higher like a volleyball released from underwater.

Right Said Fed

The Fundamental Gravity and market-related factors are all tilted in bullish favor of gold, but we can’t ignore the most critical aspect of trading: central bank policy.

As we discussed this past Saturday, we got the full dovish tilt last Wednesday when Powell said, “Goldfinger lives!” OK, OK, he didn’t say exactly that, but the Fed did say, “… the Committee will be patient as it determines what future adjustments to the target range for the federal funds rate may be appropriate …", which, roughly translated, means “Goldfinger lives!”

The Bottom Line

Every aspect of the current Fundamental Gravity, from the data to Fed policy, is conducive to being long gold and gold miners. We continue to believe these markets will be among the best performers through the first six months of the year. After a slow start, both markets have been picking up steam over the last eight trading days and look poised to break even higher. We’ve got our foot in the door with starter positions in the Gravitational 15 and will look to add whenever The Mongoose gives us the green light.

Landon Whaley is the CEO of Whaley Capital Group and the editor of Gravitational Edge.