Suddenly the U.S. dollar and others currencies reversed direction. Jeff Greenblatt, who is speaking at the TradersEXPO New York on March 10, explains why.

I’m sure you’ve noticed the sudden change in fortune for gold, the U.S. Dollar Index, the euro and the Aussie dollar. Do you know why? Was there an advance indication this could happen? Let me put it to you this way, I had a Kairos level indication on three of these charts something like this could happen.

If you are wondering why this is happening, it’s simple but it’s not easy. I mentioned these conditions to clients and it has gone beyond what I anticipated or expected. Sometimes you have to trust your own instincts, methods and what brought you to the party in the first place. Here’s the most high-profile reading.

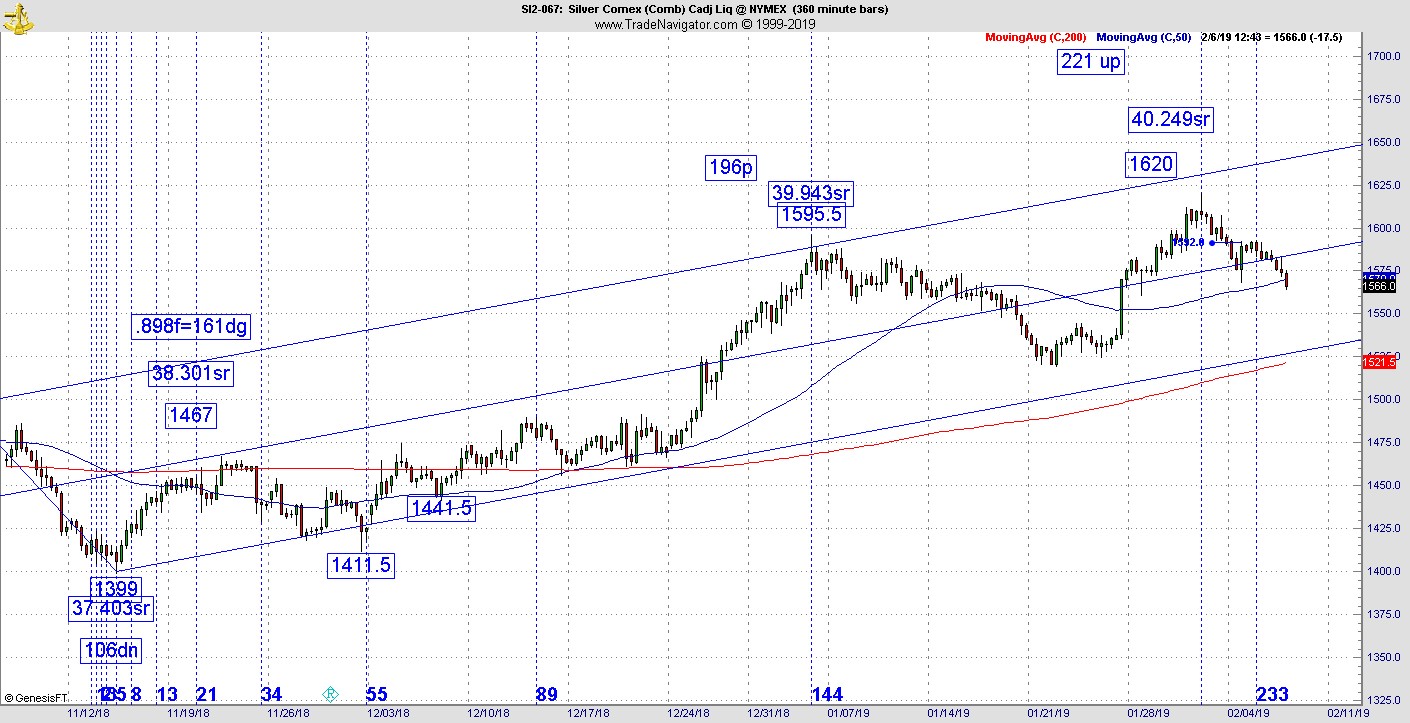

My Kairos indications caught the last two highs in silver. Briefly, you see the high is 196.50 points up at 1595.50, which is a margin for error of one (see chart below). That led to a drop from Jan. 3 to Jan. 22. It was only 4.7% which is benign considering it’s a pullback in a bull phase. For those of you looking for swing type trades Kairos works great.

Now we have something a little different, which is part of my new revelations. The first leg up back in November had a square of 9 reading of 161dg. In the square of 9 we convert the movement of prices from point A to point B to degrees in a circle. The vibration worked when the high matched at 1620, which Fibonacci aficionados will recognize as being right near 1618, which is the vibration of 1.618. That Kairos vibration identified the high. As it turns out, what I’m showing you is also 55 days up on a daily chart. How low will it go? That’s anyone’s guess but what I’m looking at without the benefit of some Kairos indication showing up earlier is the rising Andrews channel lines. (The QuantCycle oscillator is also showing weakness.)

Why is this so significant? It’s because suddenly the U.S. dollar and the others currencies mentioned above are going in the opposite direction from less than a week ago. What is likely to happen? They should extend in this new direction. What I can tell you about the Aussie dollar is right after the turn roughly a month ago in this space I told you about a very good turn on a longer-term chart. The problem is they got a moderate retest of the bottom and this could be a shakeout of the weaker hands. It’s a real shakeout given its even stronger than I thought it would be.

What about the stock market?

Last Wednesday the SPX and other indexes violated a good reading for a high in its first real test to top out. I also talked about sentiment on the business channels as they started getting euphoric for the first time. Being euphoric isn’t a sell signal in and of itself and we know from experience markets can stay euphoric for a season. How long is a season? It could be a day, week or a month. In 1999-2000 it went on for months. In this case, we had a bout of euphoria after the Fed meeting. Euphoria is fleeting but the markets also violated good readings. So, it’s a week later and Wednesday is the first day they stalled. The readings at this point are few and far between. It will take more to top this market out. The SPX even took out its 89-90-day window off the top. There is one last chance for a high this week and it comes Friday as the NDX hits its 89-day window off the top. They could be waiting for that given some of these markets stalled today at a 62% retracement and some are retesting the 200-day moving average. The 62% retracement is no guarantee of anything. However, it does work better when there is a Kairos vibration attached as you see on the silver chart. As of Wednesday, that condition doesn’t exist. Here’s what I can tell you; if the stock market hangs on through this 62% level at 89 days coming at the end of the week, there is a good chance they will come close to retesting the highs.

Should you turn long-term bullish? I know some of you have, but that’s investing and not trading. Traders take this one step at a time. There’s an adage in this business that you can make money or you can be a hero, but chances are you won’t do both. How high will it go? Nobody has the answer but what I can tell you is conditions don’t support it. Yes, the interest rate environment changed and many of the geopolitical/domestic issues everyone was so concerned about in the fourth quarter have gone into remission. But next week the border wall/government shut down wild card rises back to the surface. By the end of the month President Trump is scheduled to meet with Kim Jong Un again. There is at least a half dozen issues circulating below the surface as well. The risk factor is still out there but the Kairos readings are just not there right now. If you are looking for a behavioral, sentiment issue, that could be why the dollar is up right now.

One other condition is noteworthy and this comes right out of the Prechter Socionomics way of thinking. As the new Congress came into session, we heard lots of talk about investigations and impeachment. It’s the classic chicken and the egg. Many wondered if President Trump would get impeached. I liked their answer. In a declining social mood, this President has a much better chance of getting impeached. In a rising social mood not so much. Which way is the market going? You have your answer.