The ECB’s reinvestment of proceeds from maturing securities and expansion of the ECB’s balance sheet is clearly not working, notes Landon Whaley.

European Central Bank (ECB) President Mario Draghi’s Dilemma was one of our most profitable macro themes during 2018. The combo platter of a continued deterioration in growth data alongside a massive policy mistake by the ECB is providing us with even more opportunity from this theme in 2019.

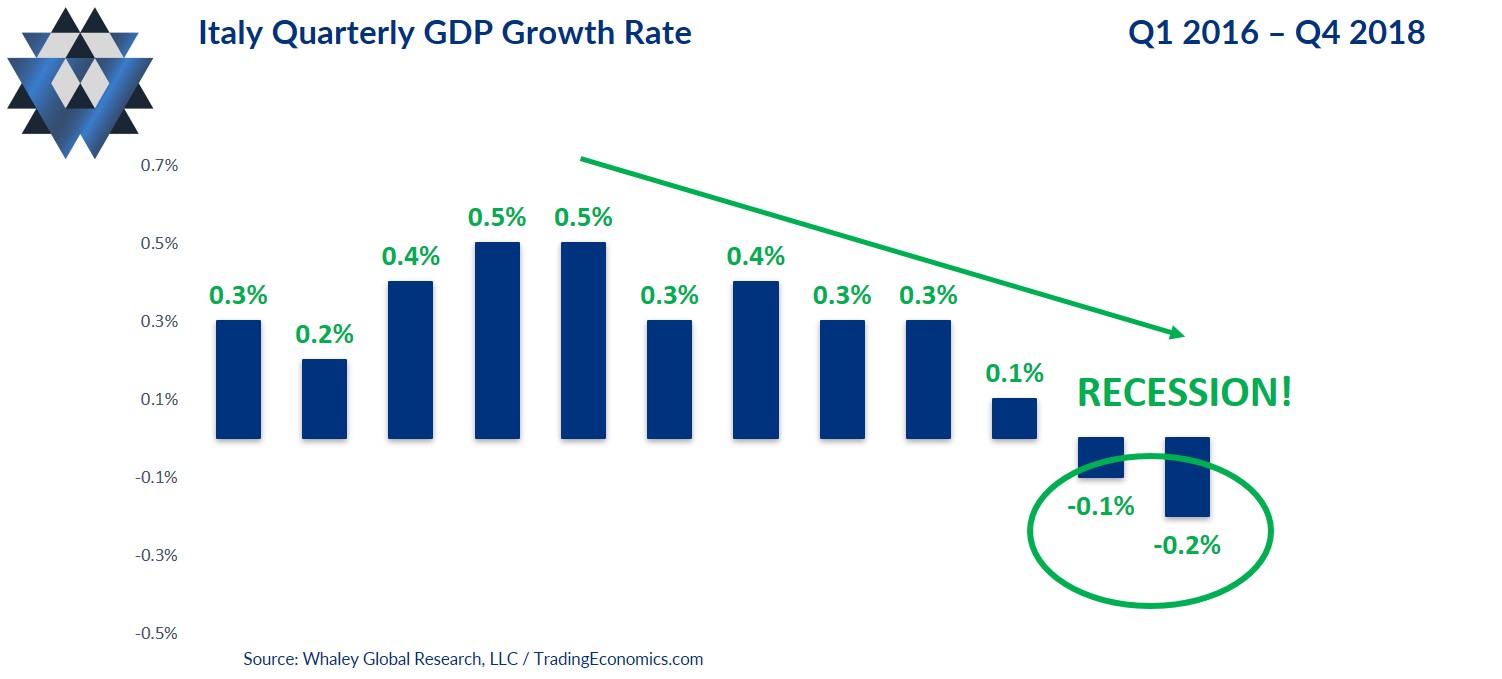

While Draghi and the ECB continue to reinvest proceeds from maturing securities and expand the ECB’s balance sheet, it’s clearly not enough. We’ve been updating this macro theme for almost 12 months, and just when you think the data can’t deteriorate any further — it does. We are now seeing levels and rates of change like we haven’t seen since the Credit Crisis, and Italy is officially in a recession. As long as the ECB stands aside, there will be an opportunity on the short side of German equity markets, and a very real possibility that the euro trades back down to $1.10.

Just the Data, Ma’am

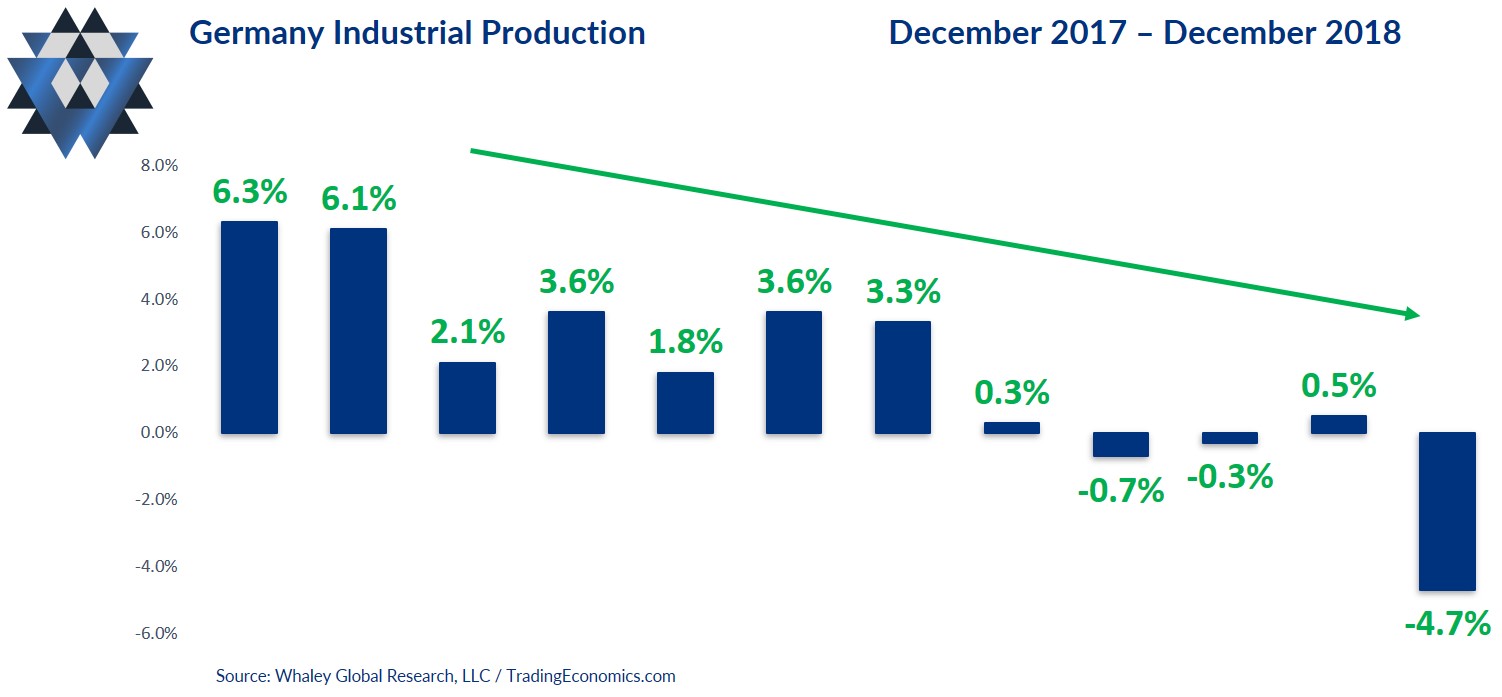

We’ve been updating this macro theme since last March, and just when you think the data can’t possibly deteriorate further, it does. This last month was no exception, as the Eurozone’s economic locomotive led the way lower:

- German retail sales contracted at the fastest monthly pace since the Crisis and have now contracted in annual terms for the second time in the last four months.

- Germany’s Manufacturing Purchasing Managers Index (PMI) declined for the sixth consecutive month in January, falling into contraction for the first time in over four years. New orders declined at the fastest pace in six years.

- Germany’s ZEW economic sentiment index flashed a negative reading for the tenth consecutive month. The “assessment of current conditions” portion of the survey fell to the lowest level since 2015.

- The Ifo Business Climate Index for Germany fell for the fifth consecutive month and the tenth month in the last 12.

- Spain’s industrial production growth rate slowed dramatically and has now contracted in two of the last three months.

- Italy’s Manufacturing PMI slowed yet again (for the ninth month in the last 12) and has now been in contraction for the last four months.

No Eurozone data dump would be complete without acknowledging that Italy is now in an official recession, its quarterly GDP growth having contracted for two consecutive quarters.

Data sets from the core and periphery have been slowing for 12 months and counting — surely the ECB will start to take notice?

That’s What He Said

In December when Draghi said “... the balance of risks [to the growth outlook] is moving to the downside ...”

Fast forward six weeks, and apparently someone shared the January 2019 Monthly Gravitational Edge with Super Mario, because he’s now saying “The risks surrounding the euro area growth outlook have moved to the downside ..."

It only took the data deteriorating nearly every month for over a year, and to levels we haven’t seen since the Crisis (along with Italy being in recession), for Draghi to finally acknowledge the Fundamental Gravity #4 environment engulfing the Eurozone.

It’s worth pointing out that the ECB is taking completely the opposite approach to the Fed.

The Fed is talking dovish, but still tightening conditions via the balance sheet. The ECB refuses to talk dovish but is still reinvesting principal payments from maturing securities, and this has just pushed its balance sheet to a brand new all-time high of €4,703.4 billion ($5,315.25 billion), approximately 42% of Eurozone GDP.

The Bottom Line

Unlike our Slowing Dragon theme, which was killed off by Peoples Bank of China’s intervention, the ECB seems content to stand aside while the dumpster fire that is Eurozone growth builds larger and hotter. As long as this is the case, and the data continues to reveal slowing growth across the core and periphery, there will be an opportunity to short the German equity market, which has had a 10% bounce off its December lows, and the euro, which is likely headed back down to $1.10.

That said, the Fed massively pivoted in just five weeks, so keep your head on a swivel for a similar pivot out of Super Mario. In addition, by the time a technical recession has hit, like it has in Italy, it’s generally time to start buying stocks, not shorting them. Any short positions should be kept on a tight leash.

Please click here and sign up if you’d like to receive February 4 edition of Gravitational Edge, which contains an update for all five macro themes as well as full breakdown for all 14 markets we believe are providing the best opportunities right now, bullish and bearish. By signing up, you will also receive the latest edition our research reports as well as to participate in a four-week free trial of our research offering, which consists of three weekly reports: Gravitational Edge, The 358 and The Weekender.