Bitcoin may be returning to its alternative money roots, notes Bob Savage.

Waiting for something to happen in Bitcoin beyond momentum has been hard. The price action Tuesday - near $4,000 is encouraging for Bitcoin holders or HODL types. It’s a sign of Bitcoin returning to alternative money catching up to gold. But there are cracks in the price action.

The scariest story over the last three weeks has nothing directly to do with this space but it is tangential and meaningful to the entire zeitgeist of technology changing the world. If there is one thing that matters to the blockchain, bitcoin, alternative money and processed induced trust – its technology. So when I read that China is tracking nearly 2.6 million people in Xinjiang using artificial intelligence and facial recognition technology, and that the 17,000 Android apps have been collecting information– it becomes clear that technology is amoral and can be dangerous in the hands of the state.

Perhaps this is the reason for hope that the libertarian constructs of the crypto currency world matter most in nations where freedom is hardest to find. Of course, there is a downside to picking on China in the headline as the same technology is being used by the police in the United States, UK and EU. Now the effect of ugly cyber technology ruling over us all via an all-powerful State is developing from the Science Fiction of Orwell to something more tangible.

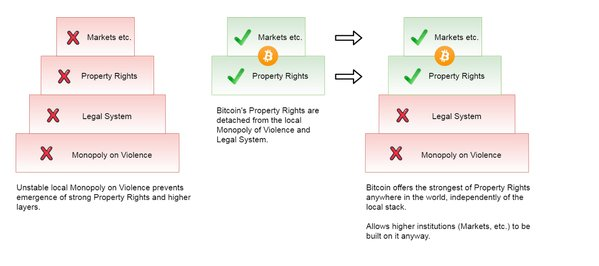

Observations matter and that is the lesson of the week as markets in crypto land are stuck waiting for reasons to see more money flow – beyond the return of China from its holidays, the tired hope that the U.S.-China trade talks are making progress or the collapse of Venezuela and the surge in Bitcoin trading there. What matters to this space is money, and the flow of it to pay for the infrastructures built up when Bitcoin was above $15,000. The point is that Bitcoin is trying to build its own independent set of rules for trust in the global marketplace. This is not a simple process – something that seems obvious in the United States but maybe less so in emerging markets.

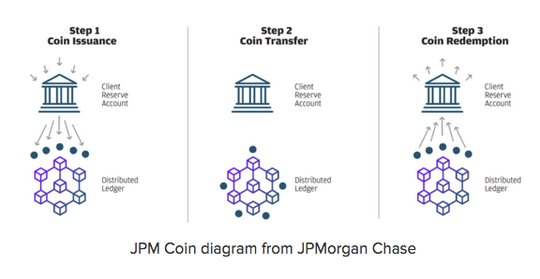

The most upbeat headline in the last month goes to JPMorgan where its new coin has jump-started the push for more payment linked distributed ledger technology work. This relates back to the Bitcoin independence push and contrasts to it. The problem for Bitcoin - as many haters will note – is that the JP Morgan coin is a private one fully linked to the dollar. In fact, to the non-cyber world, the JPM coin is really just a bank IOU or commercial paper by another name.

The bank is not paying out money and shifting its balance sheet but rather retaining the money in the settlement process with clear and obvious on-and-off ramps into the fiat dollar for those that doubt its bank credit. The heart and soul of cryptocurrencies rests in not having to prove your credit but merely to live within the confines of process protocol in a distributed ledger. The problem is that requires a lot of time, energy and effort to prove and settle as fast as currency. The obvious competitor to JPM Coin is XRP and that will be the one to watch in the months ahead to see if this gains or loses ground. The obvious loser is the Fedwire and Swift – both are used by governments to monitor capital flows – so expect some warning shots to be fired over AML/KYC and more macro-prudential pressures on those that decide to use either JPM Coin or XRP.

The most notorious story of the last month is how Canada’s QuadrigaCX – with the reported death of Gerald Cotton – leads to $190 million in frozen accounts. By cryptocurrency standards, QuadrigaCX was a relatively well-known exchange. Co-founded by Canadian Gerald Cotten in 2013, the exchange appeared to be a safe bet. By last fall QuadrigaCX users were complaining that it was taking longer than usual to withdraw funds. After the Dec. 9 death of the CEO, the company confirmed 115,000 users were owed another $70 million, much of which remains tied up in bank drafts held by third-party payment processors. The Nova Scotia Supreme Court granted QuadrigaCX temporary protection from its creditors on Feb. 5. A court-appointed monitor is searching for the missing money. Court documents show that in January 2018, CIBC froze the accounts for a third-party payment processor known as Costodian, preventing QuadrigaCX from getting at more than $25 million. That matter has yet to be resolved.

What Happened? The markets in Crypto were fixated on the bounce up in prices post the return of China from its Lunar New Year Holidays. The stories above were interesting in that they shifted the meandering search for cause and effect in the space away from momentum to something more fundamental – like the demand for new technology.

Despite all of the problems, there has been an uptick of recent stories on cryptocurrencies:

POSITIVE:

- Cambridge Associates– a pension and endowment consultant - believes “it is worthwhile for investors to begin exploring the cryptoasset area today, with an eye toward the long term

- Japan Rakuten likely to set up cryptocurrency integration – the Japanese Amazon – e-commerce giant – will soon have all payment solutions embedded on its platform.

- Germany researches its blockchain options. Reuters sources claim companies and industry groups have been asked for recommendations and may become “stakeholders in a blockchain deployment process.

- The most notable delay – ETH Constantinople – with the fork expected a month ago delayed but now expected to be delivered in 2 weeks.

Negative:

- Argo terminates mining services. The UK mining-as-a-service company blamed the bear market.

- Hackers use PUBG– online video game – to steal $2.5mn in crypto. The Istanbul firm reported the theft and Turkish authorities detained some alleged hackers.

- Coinmama data breach. The crypto broker reported a data breach of 450,000 emails and hashed passwords.

What will move money into the blockchain space?

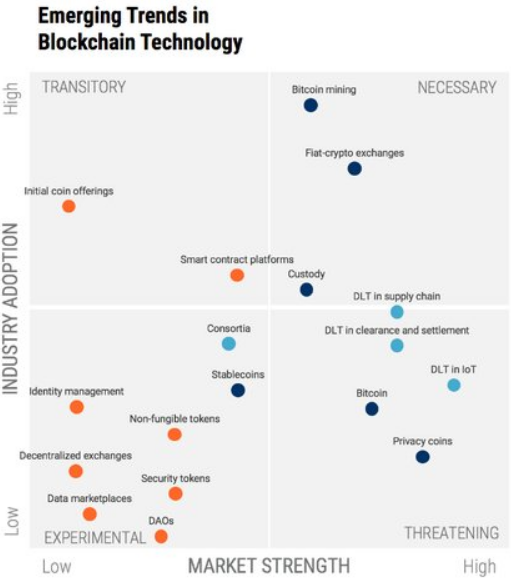

The crypto space is shifting its focus. The money that looks sustainable is being put into technology, particularly that which is disruptive to present business models – which means DLT is clearly in the focus as shown by JPM. The problem is that the more exciting and likely truly different research is in data and decentralized applications. This chart from CB Insights is worth considering.

The obvious loser in money flows in 2019 and beyond is the ICO. The breakdown of trust stands out. The fraud and deceit from the $20 billion thrown into the crypto space via ICOs means years of bad press and scared investors. This puts all other investments on call to prove that they are different. Expect one trend in the months ahead to be that venture capital money is back in vogue and the phrase “disruptive technology” returns as a code for new ideas in the blockchain space.