Emerging markets may be the canaries in the coal mine, warns Joe Duarte, Editor Joe Duarte in the Money Options.

This remains a bull market for now, but with the emergence of softer economic data in the United States and the world, the character of trading is changing and only those traders who change with the times will profit.

With two “First World” countries – Italy and Canada – recently reporting two consecutive negative GDP quarters in a row, the call for central bank easing is about to rise. Moreover, when you consider that U.S. ISM numbers are starting to roll over and that China’s economy is flat at best, logic dictates that it’s all but a matter of time before the next round of lower interest rates/quantitative easing rolls off of the central bank printing presses. The big question isn’t if or when the central banks ease, but how will global markets react to any easing of monetary policy by the big central banks.

For its part, the Federal Reserve sees a slowing economy in the U.S. and has made it clear that rate increases are on hold. The People’s Bank of China is already in easing mode, albeit through back channels instead of an outright lowering of interest rates. But in Australia where there is weakness in housing, and in Europe where there is weakness everywhere, the central banks are still waffling. We’ll see what the ECB says this week and how Canada reacts to its own slowing, which could be made worse if there is an extension of what could be a political crisis.

So the take home message is how quickly the central banks start easing if the data continues to slow and how the markets respond. And this week’s U.S. employment data along with numerous Fed speeches and the release of the Beige book along with housing data could well be the catalysts. Also data on U.S. home sales, Chinese trade data, and the ECB meeting are on tap.

Emerging Markets, Central Banks and the Future of Stocks

Regular readers of this column are aware that I’ve been positive on the emerging markets for some time. Indeed, until recently positive action in Brazil (EWZ), Malaysia (EWM), Singapore (EWS) and Australia (EWA), four countries that given their trade agreements should benefit from easing of monetary policy in China had been leading the way. Yet that has changed recently, as these former leaders have rolled over and entered a consolidation pattern which has the potential to deteriorate into outright selling if things don’t turn around in the next few days to weeks. Emerging markets may be the canaries in the coal mine, watch their price action in the short to intermediate term very closely.

Flying Bullets

- Calendar: Big data releases this week: employment report, U.S. housing data, the Fed’s Beige Book, China trade data.

- Big Picture: The third year of the Presidential Cycle (2019) is traditionally bullish for stocks. So far so good. But the short term could see some slowing of the recent gains in stocks.

- Monetary Policy: Central banks are no longer raising interest rates but markets may become impatient if economic data continues to show weakness and the big three: the Federal Reserve, the ECB, and the People’s Bank of China don’t start easing aggressively soon.

- Risk: Headline risks persist. Think U.S.-China trade war, slowing economic data, politics.

- Market Behavior: Short term volatility. Look for swift corrections and price dip buying over the next few weeks.

- Stocks: Think sector rotation: new leadership in sectors and within sectors is emerging

Market Breadth Says Consolidation and Rotation

The New York Stock Exchange Advance Decline line, the most accurate indicator of the market’s trend since the 2016 presidential election made a new high last week but seems to be thinking about entering a consolidation pattern. As this unfolds, we can expect a leadership rotation perhaps away from some, but not all technology stocks (XLK) and into other areas of the market. Already we are seeing money flowing more aggressively into biotech (BIB).

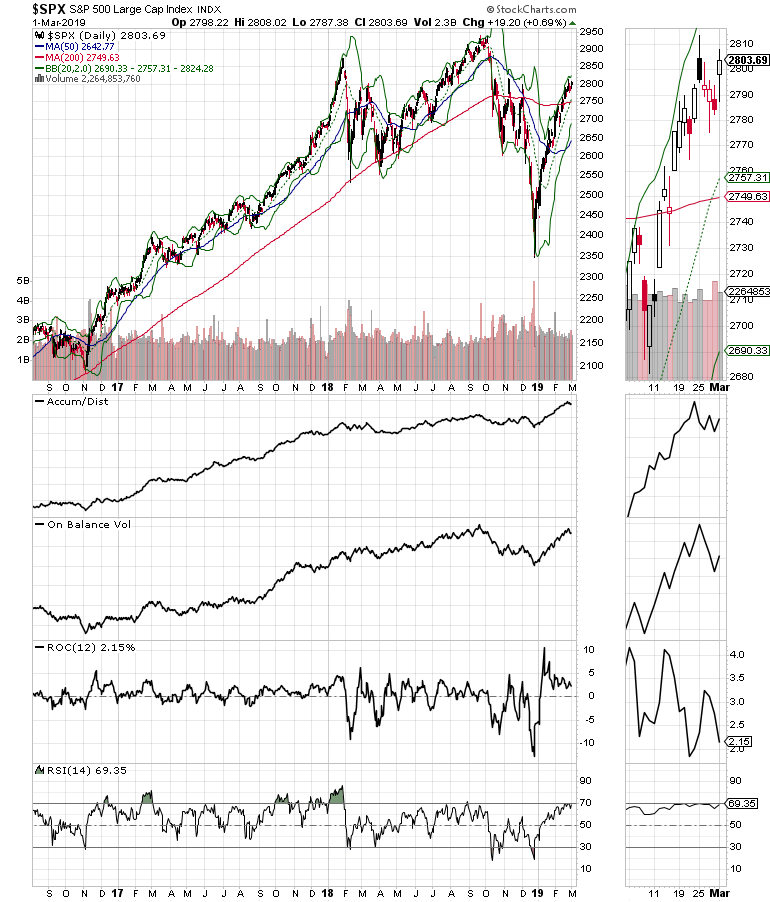

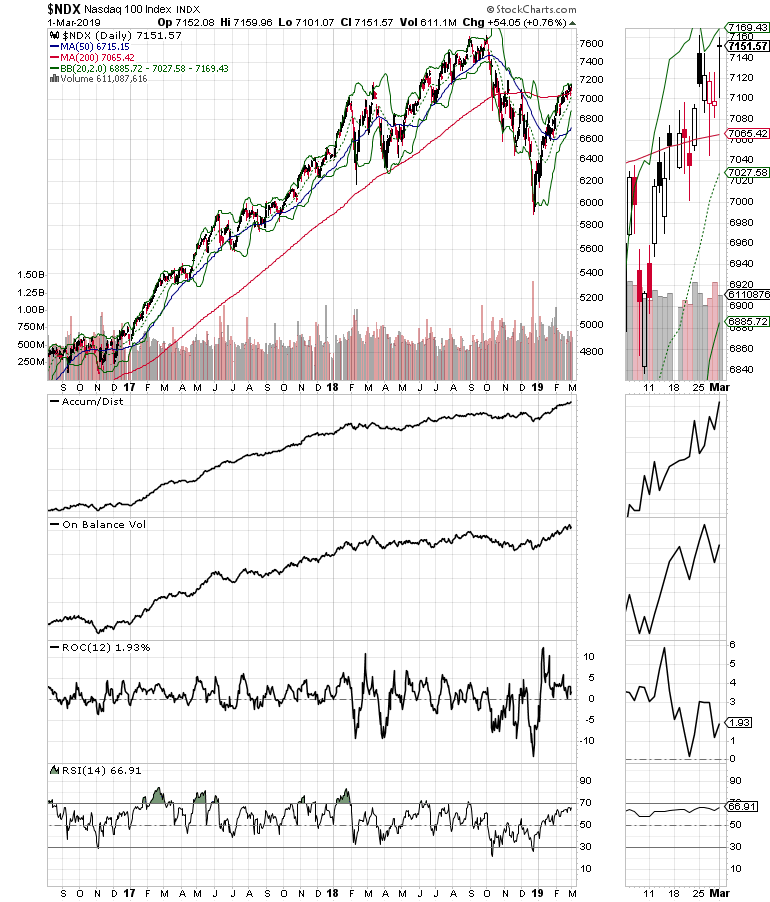

The S & P 500 (SPX) and the Nasdaq 100 (NDX) indexes failed to rise above their Q4 highs but have remained above their respective 200-day moving averages. SPX did close above 2800, which is a positive.

There are three key chart support and resistance points which are likely to define the next market trend:

- Support at the 200-day moving averages on SPX and NDX

- Resistance at 2900 on SPX

- Resistance at 7200 on NDX

The key is to watch for breaches of key support and resistance and how trading evolves from there.

Take Some Profits: Look for New Leaders: Hedge: Use Options

At this point, given the potential for either a consolidation or a correction of some sort, it makes sense to take some profits off the table and look for new sectors and individual stocks that are starting to move. It also makes good trading sense to use options when looking to trade in high price stocks. Hedging is still cheap and so are puts on stocks that have come a long way over the last six weeks. Finally, stay with what’s working and look at stocks individually as some are more likely to outperform others as this market evolves.

Joe Duarte has been an active trader and widely recognized stock market analyst since 1987. He is author of Trading Options for Dummies