Slowing growth is almost assured, no matter what the Fed does, writes Landon Whaley.

Almost all of the data points so far in 2019 are confirming that U.S. growth is slowing. For the next three quarters, U.S. GDP growth rates are up against very difficult comparisons given that Q3 2018 marked the end of nine consecutive quarters of accelerating growth. Slowing growth is almost assured, no matter what the Fed does, because it’s hard to outpace the second-longest expansion in U.S. history. Despite bear market rallies across U.S. asset classes to start the year, it’s critical to stick to the playbook and not be sucked into growthy sectors because of eight weeks of price action.

Just the Data, Ma’am

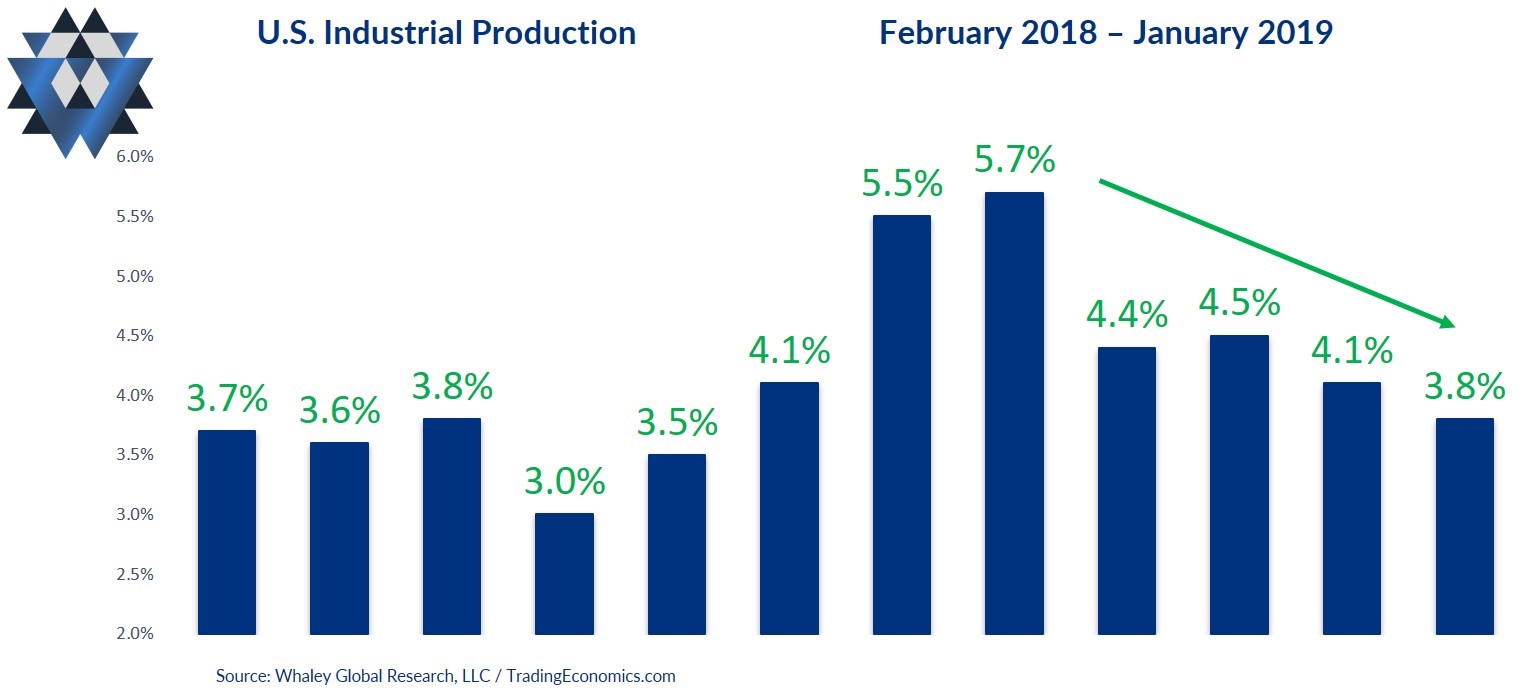

On the industrial side, the December Durable Goods report showed that capital expenditures declined for the third consecutive month, which is its longest below-zero streak in more than three years. This was followed by the latest Philly Fed manufacturing index falling off a proverbial cliff, dropping from 17 in December to -4.1 in January. This is the first negative reading in more than two years and the lowest reading since May 2016. January’s report also marks the biggest drop in points (-21.1) since August 2011. The Markit Manufacturing PMI added a third factor of deterioration, declining from 54.9 in January to 53.7 in February. And finally, industrial production growth slowed for the third time in the last five months, hitting the weakest growth rate since last June.

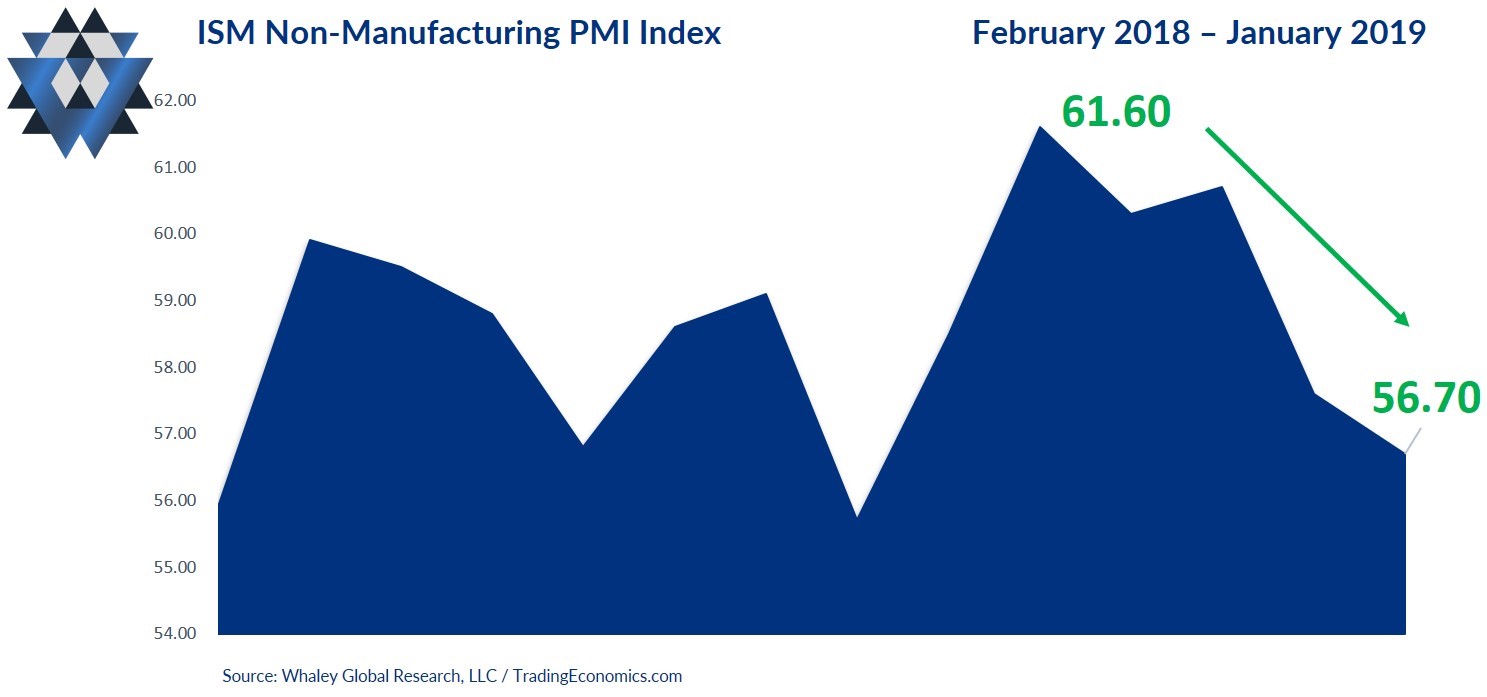

On the service side of the economy, Markit's US Services PMI slumped to 56.2 in February from January’s 54.2 reading. Prior to February, this measure of the service sector had slowed in seven of the previous eight months and for four months in a row. This is probably a one-off given the downtrend and the fact that the ISM's own Non-Manufacturing Index didn’t confirm the Markit survey, declining for the second straight month to the lowest reading since December 2017.

And lastly, we like to measure various sentiment indicators to get a feel across both consumers and businesses. The University of Michigan’s consumer sentiment index jumped in February after declining in the prior four months. Here again, time will tell if this is a one-off, but this index has been in a solid downtrend since it peaked in March 2018. The Small Business Optimism Index declined for the fifth consecutive month, hitting a fresh low, which doesn’t bode well given the impact that small businesses have on the U.S. economy.

The Fundamental Gravity bottom line is that we are in the early stages of a growth-slowing regime (no matter what the initial Q4 GDP report says) in the United States that is highly likely to last throughout the remainder of this year, no matter what the Fed does or does not do.

We pointed out in last week that despite two dovish statements in the last six weeks, the Fed continues to tighten financial conditions through its balance sheet policy. Every $200 billion in bonds the Fed allows to roll off its balance sheet has the same tightening consequences as if it actively raised rates by 0.25%. As of the end of last week, $34.2 billion worth of Treasuries had been allowed to roll off this year, and the Fed had allowed another $23.3 billion to mature without re-investment. That gives us a balance sheet that’s already shrunk by $57.5 billion from Treasuries alone this year, which equates to another Fed hike of 8 basis points. As we’ve covered before, central bank tightening in a growth-slowing environment is a recessionary no-no.

The Bottom Line

I’ll be the first to admit that markets have completely ignored the prevailing U.S. Fundamental Gravity in the first two months of 2019. This is not the first time that markets have disconnected from their Fundamental Gravities, and it certainly won’t be the last. What time has taught me is that no matter what the price action may be, trading a market in a manner that runs counter to the underlying Fundamental Gravity is how you get your portfolio body bagged.

U.S. growth is slowing and the Fed is continuing to tighten anyway, which means the playbook remains the same. On the long side, we like U.S. Treasuries of all durations, REITs and homebuilders. On the short side of this macro theme, you can continue to short financials and basic material stocks on bounces, but make sure to keep any trades on a tight leash until the broader market realigns with the current reality.