Ag market specs may have gone too far in reaction to fundamental news, says Andy Waldock.

Speculators may have pushed the obvious bullish fundamentals in the meat sector, focused of the loss of roughly one millions hogs in China, too far. Likewise, corn bears may have gotten ahead of themselves as the planting season gets under way.

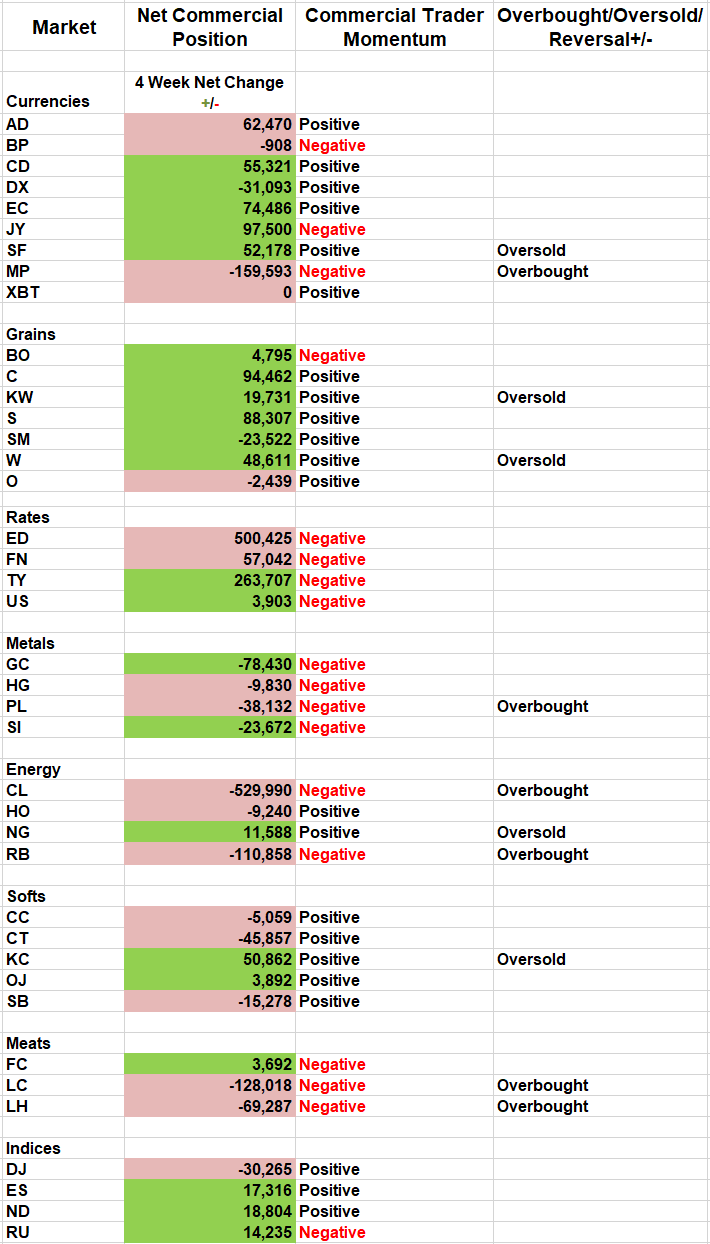

Meats

African swine fever in China continues to dominate the headlines with information coming out of China sketchy at best. Situations that call the fundamentals of a market into question halfway around the world in a country dominated by the government’s news agency are a great place to put the Commitments of Traders (COT) report to work.

I’ve discussed at length the arm’s length relationship among many of the top commodity producing and processing companies via the interlocking webs of the boards of directors. While I’m not suggesting collusion, I am stating that the directors from ADM, Monsanto, Mondelez, etc., have coffee together four times a year. Their information is just better than ours. And when it comes to the economic numbers produced by a socialist government, versus boots on the street intelligence, it’s no big surprise that the Fortune 500 commodity companies might share information resources and have a leg up on the general public.

Fortunately, we get to track the actions of the trading decisions made by those firms and use it to help separate Chinese propaganda from a potentially legit production chain disruption within the hog industry. This is why the reporting of commercial producer and processors’ actions here on U.S. exchanges is so vital. Their actions tell us that speculators are the only ones putting new money to work on the long side of the hog market. In fact, the commercial traders have been net sellers of roughly 80k contracts over the last couple of weeks. This has not only pushed the speculator vs. commercial battle to record levels, but it has also doubled the size of the total commercial position over the last few weeks. We’ll continue to watch this market for signs of a reversal as we feel it could be dramatic.

Corn

This is a bad time of year for the corn market, and the speculators just set a new net short record position, doubling down on their bearish bets. The corn market has been stuck in roughly a 10% range as it has ground lower. The total speculative position has doubled in size on the short side within a 20¢ range. This feels a bit ambitious on the speculators’ behalf, and we’re left wondering where additional selling might be found. While I expect the corn market to make new lows, they will likely be short-lived. Look for a buying opportunity ahead of the typical mid-May low and hold on for weather-related planting concern rally.

Euro Currency: Commercial traders in the euro FX futures switched to the sell side over the last week. This action is contrary to their expected purchases through this seasonally strong period for the euro. This is still the most bullish commercial traders have been since late 2016. We’ll continue to hold the trade with our measured protective sell stop in place.

Live Cattle: The live cattle market remains primed for a significant top. Both the commercial and speculative traders have set net and total position records. To put this in perspective, speculators are now long three times their average position size, while the net short commercial position is a whopping 5.6 times its average.

Remember that the sellers are the ones with the cattle on their farms, and whether they’re selling them to feedlots who are buying more cattle because of the spread between the low price of corn feed and the high price of finished cattle or, just talking about farmers selling directly to processors, those with cattle on hand are selling.

Seasonally speaking, the June cattle contract tends to peak towards mid-May. I’m wondering how much higher we can climb between now and, then. Currently, there are very few fundamental factors to support cattle trading at these prices.

While the market tried to reverse lower, it clawed back most of its losses last week. We’ll be stopped out of this position at a loss if the recent high at $124.90 is breached. However, keep an eye out for short selling reversal situations as we wait on the bigger picture to materialize.

We offer more specific instructions in our Weekly COT newsletter.

Andy described how traders can exploit the Commitments of Traders report in an interview with Dan Collins at the TradersEXPO New York: Understanding the COT Report.