There is a bullish Harmonic Pattern in U.S. Dollar Index futures, which may portend a huge breakout, writes Suri Duddella.

The U.S. Dollar Index futures are a measure of the value of the U.S. dollar relative to the majority of its most significant trading partners. This index is similar to other trade-weighted indexes, which also use the exchange rates from the same major currencies. As a financial commodities contract, the U.S. Dollar Index is the most-used currency in international transactions and as other many countries’ official currency.

Furthermore, the dollar is also the world’s reserve currencies. Today, the dollar is the standard unit of currency in many commodity markets, such as gold and oil, all over the world.

H.M. Gartley established the concept of Harmonic Patterns in 1932. Gartley wrote about a five-point pattern (known as Gartley) in his book Profits in the Stock Market. The primary theory behind harmonic patterns is based on price/time movements which adhere to Fibonacci ratio relationships and its symmetry in markets.

Fibonacci ratio analysis works well with any market and on any timeframe. The basic idea of using these ratios is to identify key turning points, retracements, and extensions along with a series of the swing high and the swing low points. The derived projections and retracements using these swing points (Highs and Lows) will give key price levels for Targets or Stops.

Harmonic patterns construct geometric pattern structures (retracement and projection swings/legs) using Fibonacci sequences. These harmonic structures identified as specified (harmonic) patterns provide unique opportunities for traders, such as potential price movements and key turning or trend reversal points. This factor adds an edge for traders as harmonic patterns attempt to provide highly trustworthy information on price entries, stops and targets information. This may be a key differentiation with other indicators/oscillators and how they work.

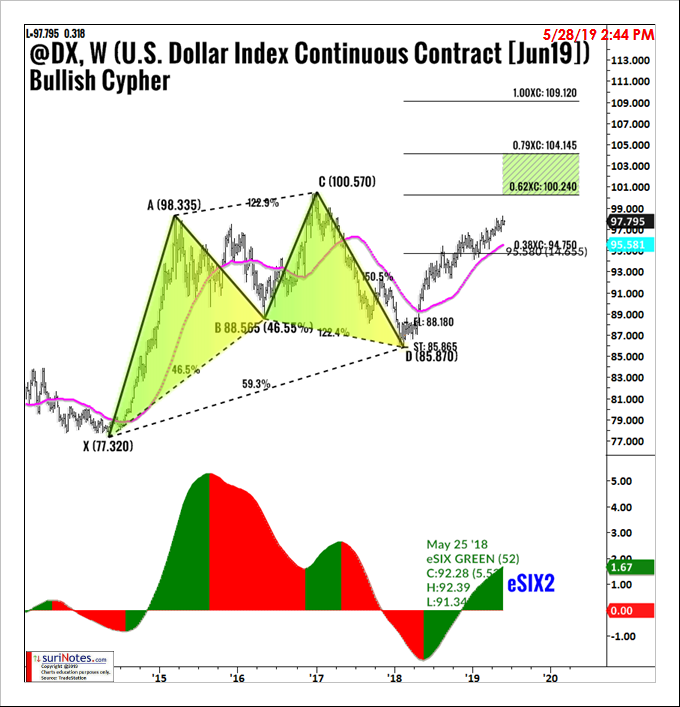

Since May 2014, from a low of 77.3210, U.S. Dollar Index futures are trading in a five-point harmonic pattern (Bullish Cypher, a variation of Gartley pattern). In March 2018, the fifth point in the pattern was initiated and gave an entry signal when dollar futures closed above 88.18. The initial stop was placed at 85.870, with the first target set at 94.75, and the next target range set at 100.24 to 104.145. The underlying trend (eSIX) is also strongly bullish since 2018 to confirm the long entry and continued momentum.