Could the US-China trade war lead to stagflation? Ashraf Laidi raises this specter in his analysis of gold.

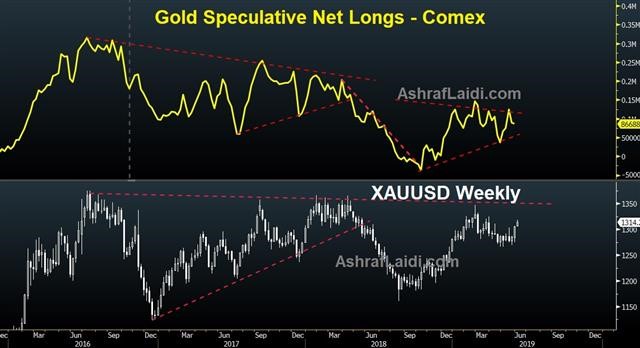

Is the ascent in gold another example of its many unsustainable rallies? Or will the current rally last for some time? Gold rose 1.7% in May, posting its biggest monthly gain since January, thanks to a helpful combination of safe-haven investment flows from tumbling global equities and a broadening rally in metals at the expense of energy. We won't go through the powerful textbook technicals justifying the yellow gold as we have mentioned this numerous times over the past six weeks, but there are other dynamics.

Resurfacing market expectations of a U.S. Federal Reserve Fed funds rate cut this year (86% chance of a rate cut by September and according to Fed funds futures and perhaps as many as two rate cuts from the Eurodollar futures) have provided gold bulls with an essential source of confidence, especially as the U.S. Dollar Index has faltered.

USD Recurring Failures & Stagflation Risks

The recurring failures of various USD pairs to retest and break recent highs have served as a vital stimulus for gold's recurring support near $1,266. Whether it is Dollar/yuan (USDCNY) failure to break 6.0, the euro holding above 1.10 or Japanese yen’s cap at 112, the FX message is loud and clear.

Today's release of U.S. May manufacturing ISM hitting 2.5- year lows and the prices paid edging higher could be the start of stagflationary consequences of the US-China trade war.

Last week, the PMI version of manufacturing hit a 10-year low. Perhaps "stagflation" is a little of an exaggeration, but slowing growth and price burden on consumers is the inevitable result of the trade war.

Silver's striking signal?

What about silver? Is it time for gold's cheaper cousin to finally wake up? One striking aspect is that despite having fallen for four straight months, silver preserved its multi-year trend of higher lows.

All these fundamentals factors are well and good. You probably have read a similar narrative six months or two years ago. The key here is to figure out whether the price action will enter a new wave of momentum and how to build a trade around it.

And that's what I'll cover in tonight's Premium Video.

You can see Ashraf’s daily analysis at www.AshrafLaidi.com and sign up for the Premium Insights.

Ashraf Laidi recently talked about the Dollar, gold and the Chinese yuan Triangularity at TradersEXPO New York.