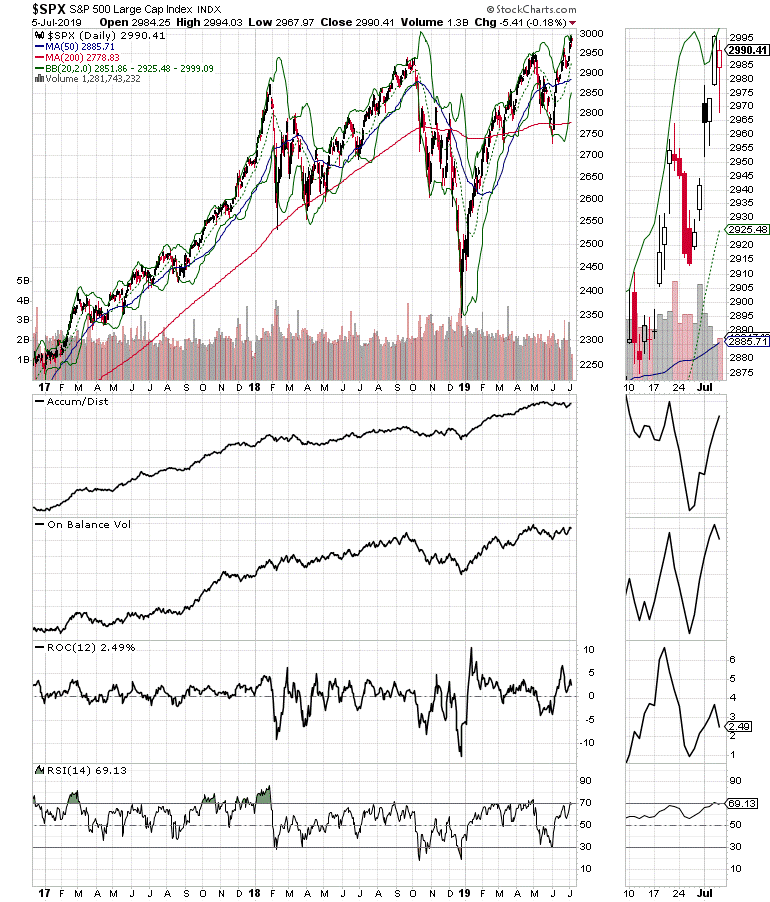

The stock market made a joyless new high last week, but it still counts, despite signs of weakness, writes Joe Duarte.

The stock market made a joyless new high last week, but it still counts, even though it may be short lived due to whatever emerges from the bond market and the Federal Reserve over the next couple of weeks. Nevertheless, and highly important, investors got a useful glimpse into the bond market’s psyche as the sellers came out in force July 5 due to a stronger than expected jobs report.

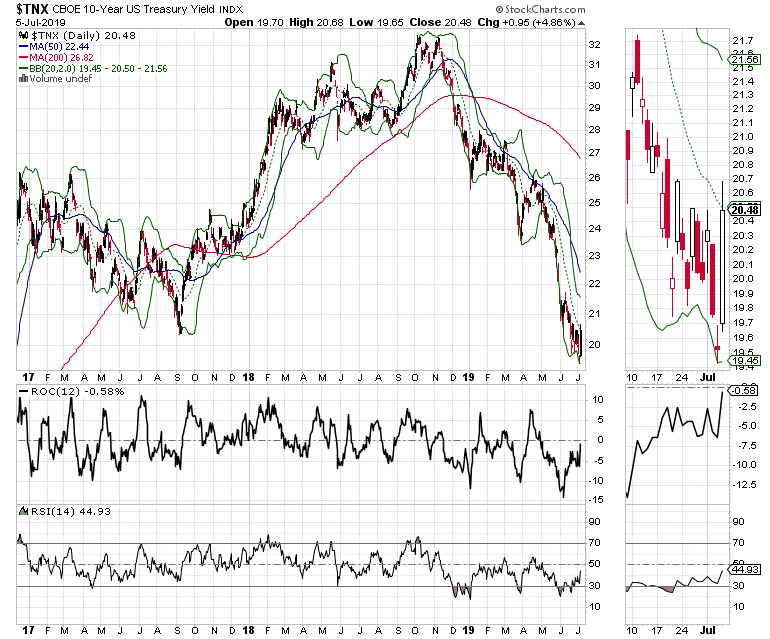

Still, the stock market recovered and should hang on to most of its recent gains in the short term as long as the U.S. Ten Year Treasury note Yield (TNX) stays below 2.1%, barring extraordinary circumstances. This, of course is why Fed Chairman Powell’s upcoming Congressional testimony matters in the daily grind of the Markets-Economy- everyday life system.

When Stock Traders are talking about Bonds

It’s never good when stock traders talk about bonds more than stocks. Yet given recent trading patterns in both markets, especially in the context of shifting economic data, it’s likely this will continue in the near future.

Certainly, the truth is that nothing is settled at the moment, especially when you factor in the velocity with which the Market-Economy-Life system (MEL) reacts to the flow of information. Moreover, the net effect of this system is that every day people make life changing personal and business related financial decisions at the speed of light; influenced by the market’s effects on social media and the total interconnectedness of modern life through mobile devices. Thus, economic trends that would in the past take months could now occur in the space of days to weeks.

Furthermore, this phenomenon means that through this feedback loop that connects all economic things, everyday people and the markets are now intertwined as never before. Thus, the rapid ebb and flow of economic data influences behavior at all points simultaneously and the cycle becomes a perpetual feedback loop which affects the entire system rapidly and constantly.

Bonds & Housing are MEL’s Heartbeat

MEL may be a new concept to the uninitiated, but anyone who takes the time to look around with a keen eye could spot it if they know what to look for. For example, in my own neighborhood over the last three months, there were about six homes for sale in a space of two blocks. These homes came online in the early spring and did not sell for months. However, as soon as the Fed suggested it would lower rates and the bond market moved yields below 2.1%, they all sold within a period of two weeks with one of them fetching well-above the average market price.

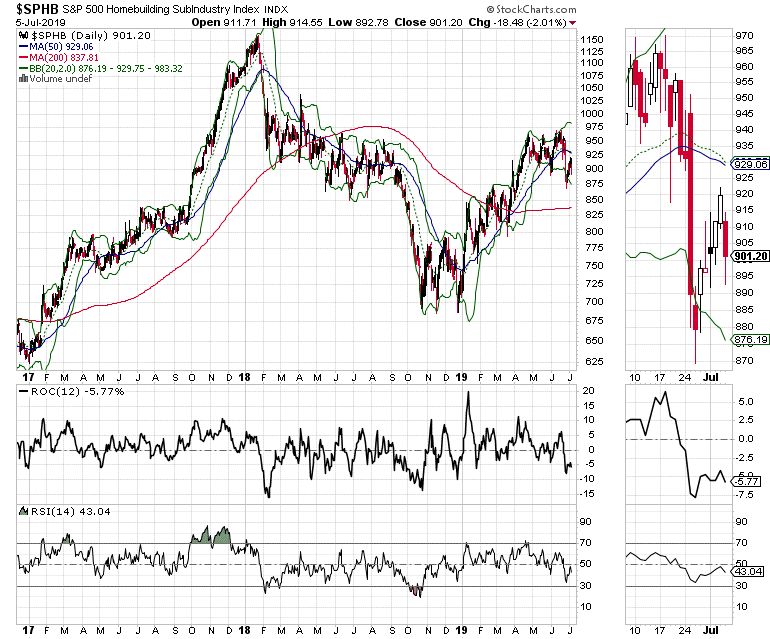

Indeed, the interaction between key components of MEL is equally visible in price charts such as that of the U.S. 10 Year Bond Yield (TNX) and the S&P Homebuilders Index (SPHB).

Notice that as TNX reasserted its decline in March and April 2019, SPHB moved decidedly higher as investors began to factor in a potential rise in demand for housing secondary to lower interest rates (see charts below). This positive money flow into housing stocks was also partially fueled by somewhat better than expected results and guidance from homebuilders who have recently reported earnings.

Note also that when TNX moved back above 2%, SPHB took a tumble. This market event also coincided with a rapid decline in demand for mortgages, highlighting the MEL effect. The key chart area to watch is the 2.1% to 2.15% range on TNX. If yields rise above this range decisively the next target is 2.2% to 2.25%. Thus, it is it plausible that if yields surge above these key chart points all bets for this bull market in stocks and the generally positive tone of the U.S. economy are off, unless the Fed moves aggressively, which may not be enough as it may come too late.

How things Could Unravel if the Fed Doesn’t Ease in July

Times have changed. Before President Trump, when globalization was in vogue, weak international data led to all central banks easing in tandem. So, if that was still the case, the Fed would likely be not just talking about easing, but actually doing so along with other global central banks since the global economy, especially China, Asia and Europe are weakening rapidly.

Just last week Samsung Electronics (XKRX) announced expectations for a significant slowing in its mobile chip orders. Meanwhile Germany’s economy is teetering while their government bonds are offering investors negative yields.

But here is where things could get dicey. Globalization has given way to national interests these days. And since the U.S. economy seems to be holding up better than other global economies, the Fed may decide that it doesn’t have to ease in July, although this is not likely given the fact that the central bank does not want to be blamed for the MEL meltdown that is likely to follow such a decision.

Still, if the Fed doesn’t ease at least a quarter point, I suspect MEL will move into hyper drive and the U.S. could fall into a psychology induced fear-driven recession with bond yields falling deeply below 2% accompanied by a severe and rapid drop in stocks as the U.S. economy grinds to a halt.

Joyless New Highs are Still New Highs

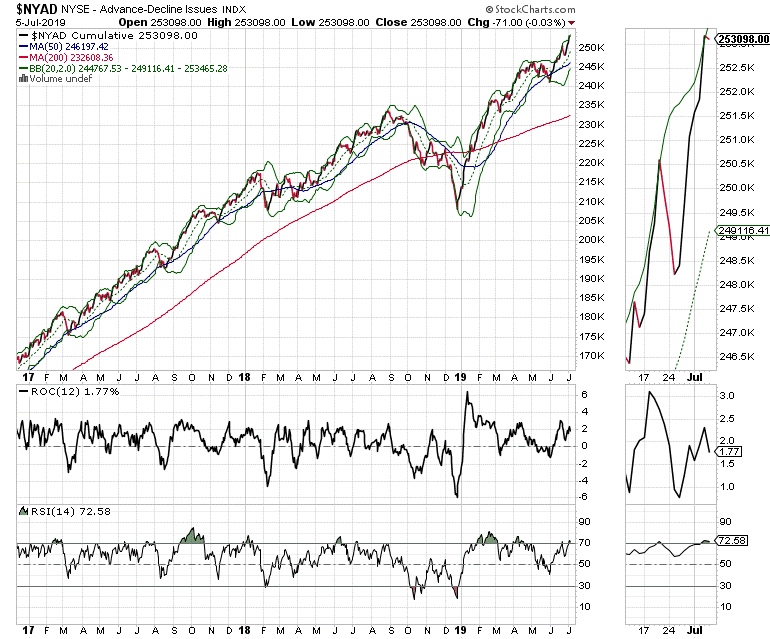

If we lived in an algo vacuum, I would be betting that stock prices are going to go through the roof. That’s because New York Stock Exchange Advance Decline line (NYAD) made a new high on July 3 and held its own after the 4th of July Holiday despite a bond market selloff on July 5.

And, as I’ve noted repeatedly, since this has been the most accurate indicator of the market’s trend since the 2016 presidential election, the bulls once more ended the week on top and the odds favor a continuation of the stock rally, barring a nasty surprise from the Federal Reserve, the bond market or both.

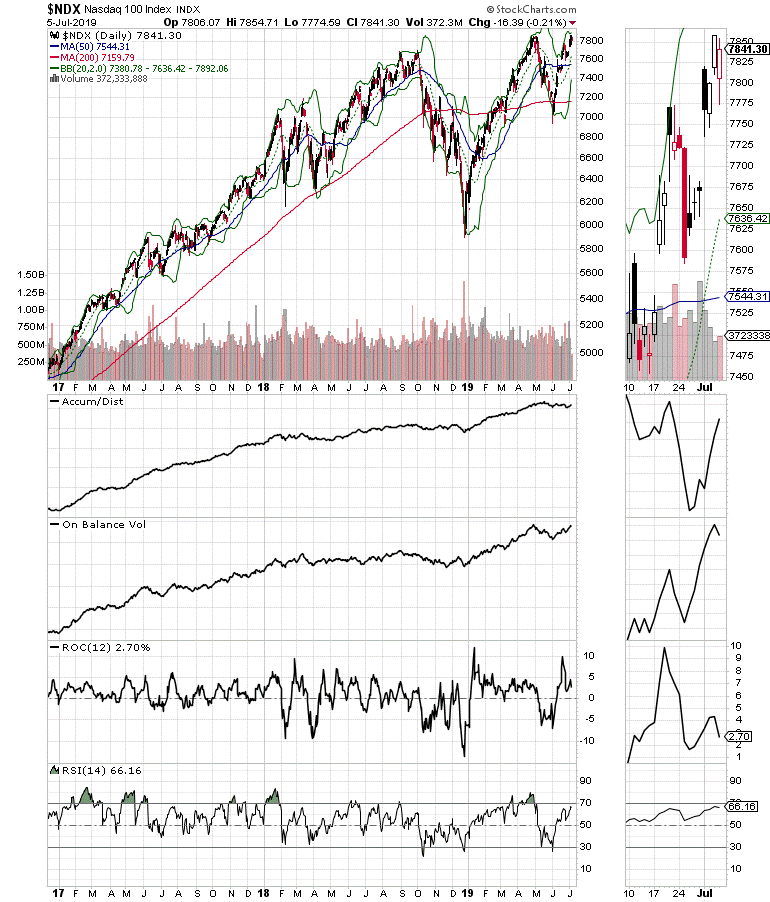

In fact, both the S&P 500 (SPX) and the Nasdaq 100 (NDX) indexes confirmed the new high in NYAD, which is a bullish confirmation of the still in place up trend.

The bottom line is that the algorithmic trading systems are ready to rumble higher and that if the Fed and bond market cooperate, we could see a blow off scenario.

Trade Cautiously with the Algo Trend

Risk is not low, and the major internal force in the markets, the robot algo traders are on the bull’s side for now. Of course, algos turn on a dime, which means anything is possible. Nevertheless, at the moment, the best strategy remains to trade cautiously with the trend and that means the algos. My, how times have changed.

Thus, I will repeat the five pillars of the trade:

- Trade with the trend

- Be aware that the trend could turn against you at any moment

- Hedge as needed via raising cash, using inverse ETFs and options, consider bonds as long as TNX yields remain below 2.1%.

- Use sell stops in the 5% range and

- Let your winners ride while cutting losses early.

Finally, stay awake because even though the Fed should ease in July, there is no guarantee that it will. If they don’t, things are likely to get ugly very quickly as the algos reverse course and MEL goes into a tailspin

Joe Duarte has been an active trader and widely recognized stock market analyst since 1987. He is author of Trading Options for Dummies, and The Everything Guide to Investing in your 20s & 30s at Amazon. To receive Joe’s exclusive stock, option, and ETF recommendations, in your mailbox every week visit here.