While the housing sector has generally been a bright spot, there is a growing divergence that investors should follow, warns Joe Duarte.

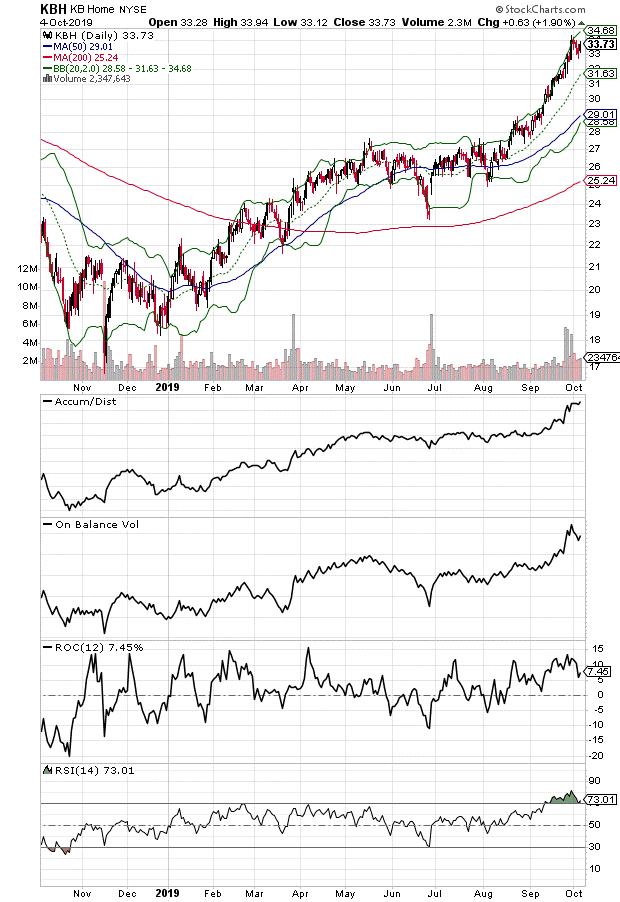

The latest ISM manufacturing sector data checked in at 47, a number that shows a rapid and accelerating contraction of the U.S. economy. Meanwhile a major component of the country’s manufacturing sector, homebuilders such as KB Homes (KBH) are reporting robust numbers and giving optimistic guidance with the unspoken asterisk being that new homes are selling well and are likely to continue to do so as long as the economy holds up.

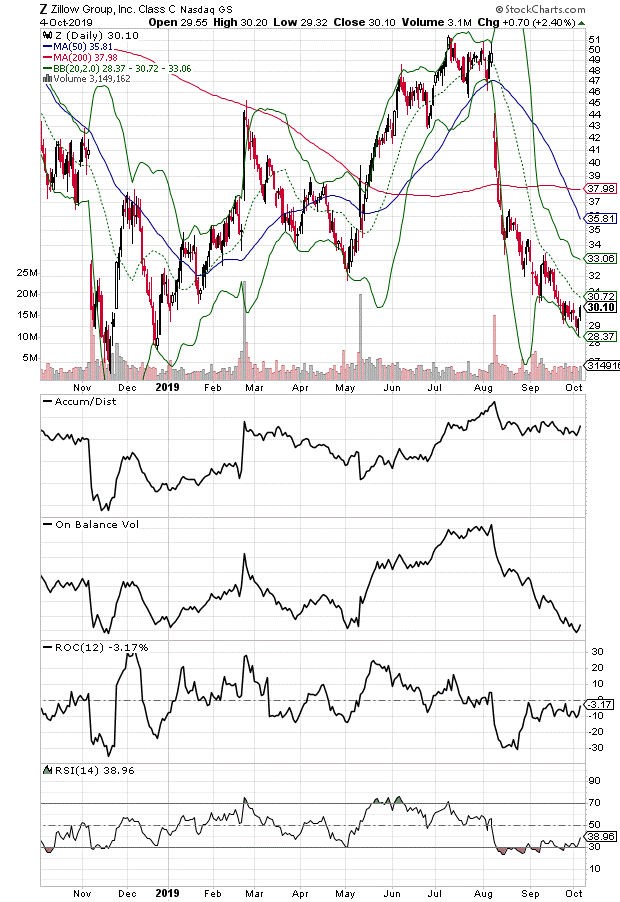

As a result of this divergence between new and existing homes the housing sector is far from simple these days. Consider that even though new home sales may still have some upside left, likely boosted by low interest rates, the existing home market is in dire straits as prices for older homes especially many in need of remodeling remain too high.

More important, there are now emerging signs of what could become a seller’s panic attack. Familiar readers may recall that I’ve been following the travails of two existing homes in the up an up and coming young professional neighborhood over the last few months. Not surprisingly, even as I see new housing developments selling out rapidly in other parts of town, both of these homes remain on the market with one of them now dropping its price to $690,000. That’s $100,000 below its original offering price after being on the market for 194 days. The other one, which is next door to the one listed above has now cut its offering price to $760,000 from its original listing price of $796,000 after 196 days on the market.

The stock market is certainly voting with its money, as shares of new homebuilders are near their recent highs while shares of online home listing and marketing Zillow.com (Z), a proxy for existing home sales are near their 52-week lows. Of course, it doesn’t help that Zillow’s most recent earnings report was a huge disappointment due to higher than anticipated marketing costs.

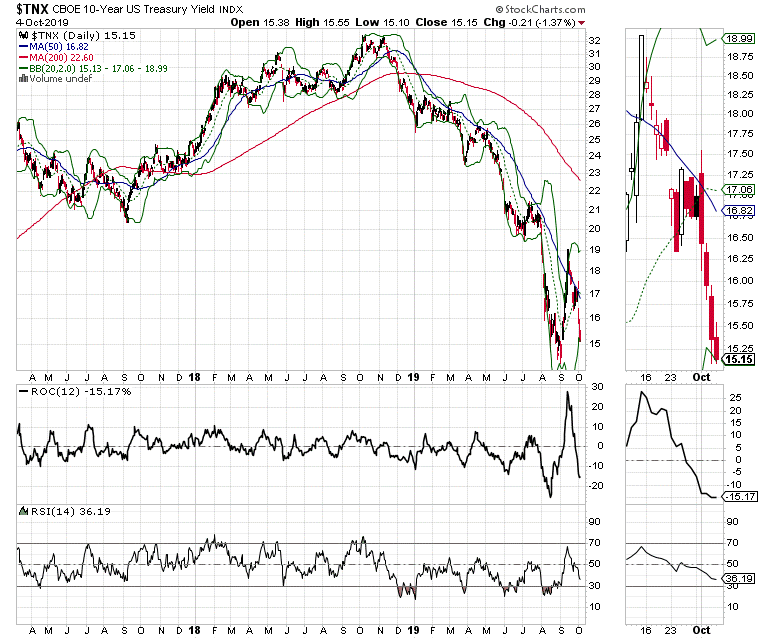

Certainly the bond market is doing all it can to help the housing market, given last week’s return of the U.S. Ten Year note yield (TNX) to 1.5%, a decline which should help mortgage rates over the next week or two and could move buyers off the sidelines.

The bottom line is that the Markets-Economy-Life (MEL) complex adaptive system is nearing a major point of emergence, a decision point. In other words it is clear that price point and convenience are the keys to success in the housing market and that new home buyers, empty nesters, and move up buyers, the largest combined segment of home buyers, is currently willing to take the financial risk on more affordable new homes with amenities and prime locations than pricey older homes with a pending backlog of expensive repairs or features that need changing.

Now the big question is whether the economy will hold up well enough to keep the homebuilders in the money and if the Federal Reserve and the bond market will cooperate. A second question, which must also be entertained is what may happen to homebuilder stocks if existing home prices fall to a point where these current wallflowers become price competitive.

Joe Duarte has been an active trader and widely recognized stock market analyst since 1987. He is author of Trading Options for Dummies, and The Everything Guide to Investing in your 20s & 30s at Amazon. To receive Joe’s exclusive stock, option, and ETF recommendations, in your mailbox every week visit here.