There are some misconceptions regarding Federal Reserve rate cuts and the stock markets reaction, points out Landon Whaley.

With the Federal Reserve’s Open Markets Committee (FOMC) solidly behind the rate cut eight-ball and central bankers around the world cutting more than Jason Vorhees during a weekend getaway at Camp Crystal Lake, I thought it was a good time to debunk a few myths.

Rate Cuts Are Bearish

The one trade that people believe is reasonably straight forward when the Fed cuts rates is that the U.S. dollar weakens. But a weak dollar is not a guaranteed outcome in the immediate aftermath of a cut.

Back when the Fed cut rates on July 25, 2003, the dollar rallied 5.8% over the next two months before starting a multi-month downtrend. On the flip side, the dollar was already declining when the Fed cut rates for the first time (after a hiking cycle) on Sept. 18, 2007. The dollar tacked on 10.7% of additional losses before bottoming on March 21, 2008.

Fast forward to today, we are two cuts into what was initially called a mid-cycle correction by Fed Chair Jay Powell but appears to have become an all-out rate cut cycle. The dollar weakened for three trading days in the immediate aftermath of the first cut on July 31 but then rallied 2.6% over the ensuing two months.

Despite the recent two-week correction, a materially weaker greenback from here is not a foregone conclusion. Especially if you consider the bullish dollar factors in play right now like slowing global growth, the U.S. Winter Fundamental Gravity, and easing central bank policy from every other central bank on Earth, save a few. The combo platter of these factors means it becomes even more challenging to discern the direction of the dollar based solely on rate cuts.

Rate Cuts Are Bullish

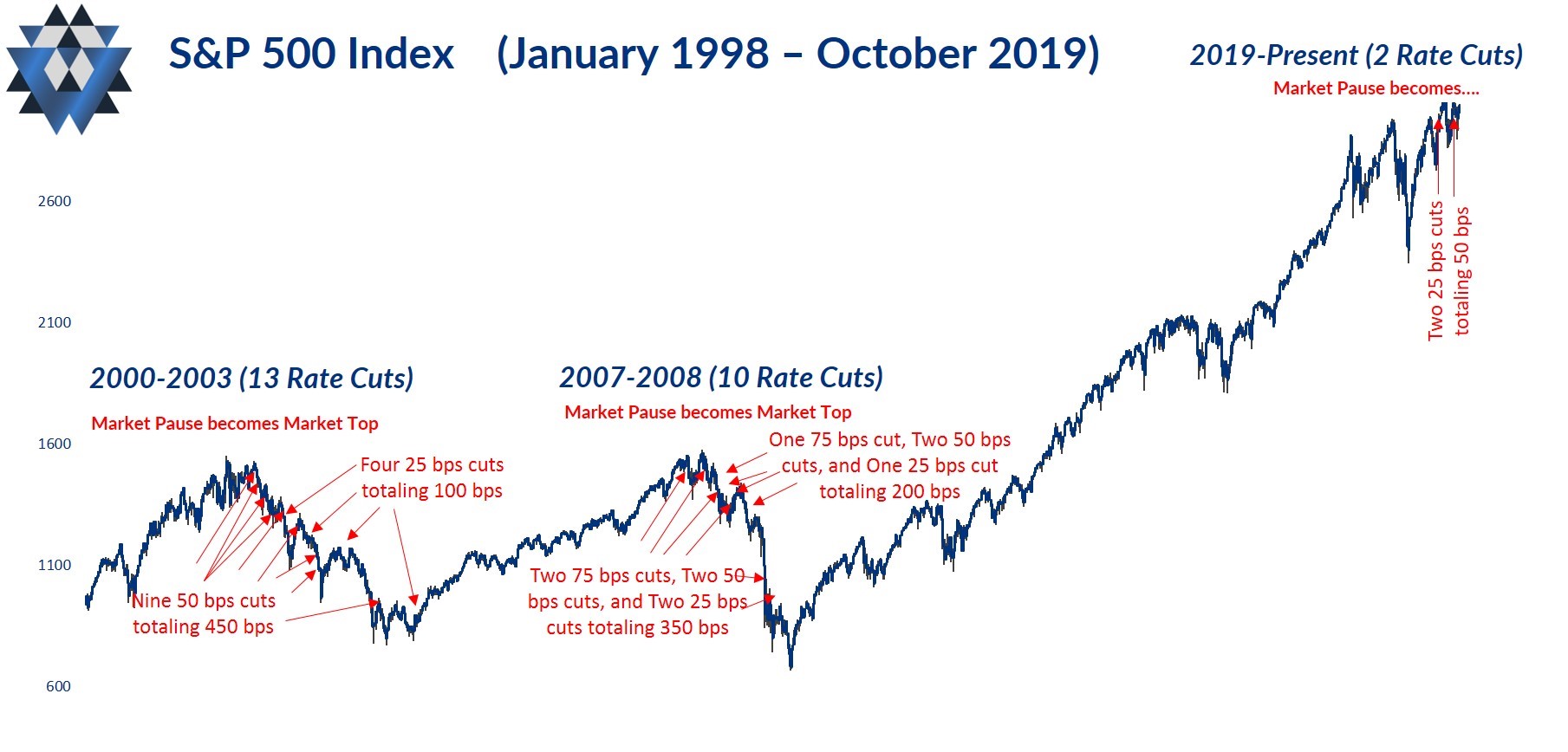

Another commonly held misconception is that an FOMC rate cut is unequivocally bullish for stocks. Remember, in saner times, the Fed typically raises rates to combat inflation, which is often accompanied by a rising stock market, i.e. irrational exuberance; and cut rates when they fear the economy is slowing and at risk of recession, which is often accompanied by a falling stock market.

I’m going to appeal to those of you who share my own preference to be a “visual” learner. They say a picture is worth 1,000 words. I say this picture (click to enlarge), like Shakira’s hips, doesn’t lie.

Please click here and sign up to receive the latest edition our research reports as well as to participate in a four-week free trial of our research offering, which consists of two weekly reports: Gravitational Edge and The Weekender.