Dan Keegan describes option straddles and one way to trade the upcoming FB earnings release.

On Wednesday, Oct.30 Facebook (FB) releases its earnings at 4:05 pm EDT. The closest expiration cycle to the earnings release is Nov. 1. The time value that is embedded in options premium rises during the march towards the earnings release. The yardstick for time value is implied volatility. Historic volatility measures past movement. The historic volatility for FB is 24.77%.

Implied volatility is determined through a reverse engineering process. Look at the FB Nov. 1 185 (at-the-money) straddle with FB trading at $185 (straddles involve buying or selling the same strike put and call). The point of trading a straddle is that you are not making a directional bet, or more precisely betting on a specific direction, you are trading volatility. If you go long a straddle, you are betting on an increase in volatility, typically that the market will make a significant move in either direction. If you sell (go short) a straddle it is making a bet that the market will stay within a relatively narrow range. Both the calls and puts are trading at $5.80. Together that’s $11.60 of time value. The upside breakeven point is $196.60 and the downside breakeven point is $173.40.

Options traders are collectively, but not in concert with one another, implying that the range between Oct. 23 and Nov. 1 will be $23.20. If you think that the range will be lower you can sell the straddle and if you think the range will be higher you can buy the straddle. The implied volatility for the FB Nov. 1 185 straddle is 50.3%, while the Oct. 25 185 line is 31.1%. and the Nov. 22 line is 34.2%. The driver of time value is uncertainty. Uncertainty breeds fear and sometimes panic. Panic that you are going to suffer massive losses or that you’re missing out on something.

It stands to reason that the options expiring on Oct. 25 would have the least demand. The options will expire before the big event (earnings) occurs. The greater demand for the Nov. 1 options vs. the Nov. 22 options also makes sense. If you’re betting on a big move, then paying the lowest price makes sense. If it does make a big move, then you’ll be holding deep in the money options with little time value anyways.

A long straddle is a good strategy to employ in front of important events, like earnings, elections or anything that has the likelihood to create volatility where the outcome is unknown and the event could create a large move in either direction. With a short straddle, you would be betting that the event (or lack of a market moving event) will not produce much movement.

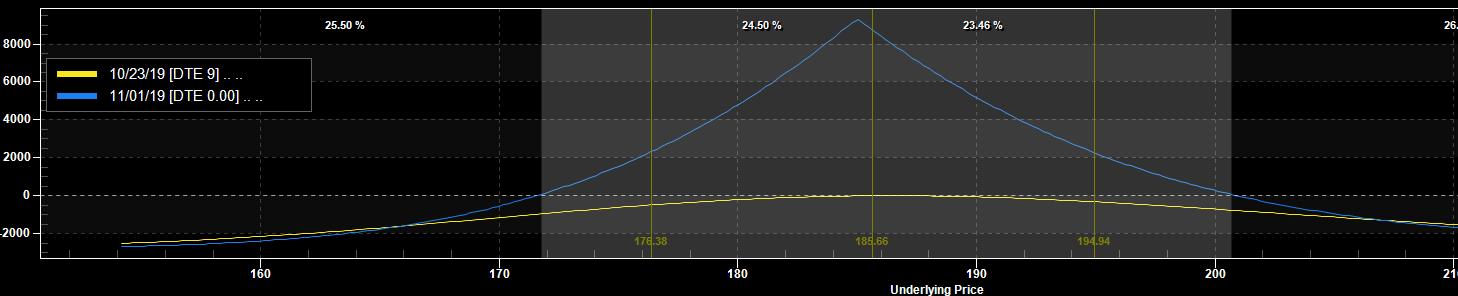

Oct. 23/24, you can buy the Nov. 1 185 straddle. The options won’t decay much with a probable increase in implied volatility. If you keep the long straddle through earnings, you’ll need a big move in the stock in order to make money. If there’s a small move the position can be a catastrophe. The converse is true for a short straddle. A less risky strategy than the short straddle that also takes advantage of the elevated implied volatility is the long, time value spread. You buy the closest at the at-the-money Nov. 22 options and sell an equal number of the at-the-money Nov. 1 options. The 185 spread now can be bought for $1.45. The premium is the most that you can lose. I believe that you should pull the trigger on a spread like this if the front cycle implied volatility is 2.5x the implied volatility of the back cycle (see chart).

That’s not currently the case but it might be on the afternoon of Oct. 30. If there is little movement then it’s a big payday and you have a defined loss if there’s a big movement.

Hear Dan Keegan talk about harvesting volatility and the many facets of options. You can reach Dan keegan at dan@optionthinker.com