Understanding the intricacies of options exercise is important. Alan Ellman explains the distinction so you don’t get surprised by an assignment.

When we sell covered call options or cash-secured puts, the expiration date of our monthly option contracts is usually the third Friday of the month at 4 p.m. EST. However, this is not to be confused with the expiration time of these contracts. The latter is the date and time when the contract is rendered null and void.

Expiration date: This date and time is our main concern— 4 p.m. EST on the third Friday of the month. This is the deadline for the option sellers to close our short positions.

Expiration time: This is the date and time when the option contracts no longer exist. It is always at a later time than the expiration date, currently at 11:59 p.m. EST on the expiration date (usually Friday). In the past, options technically expired on Saturday.

Exercise decisions

Options holders (buyers) generally have about 30 minutes to 60 minutes after 4 PM EST to instruct their brokers to exercise an out-of-the-money strike. If positive news comes out immediately after market close, an out-of-the-money strike may become ripe for exercise if a price gap-up is anticipated on Monday morning.

How is the “moneyness” of options determined?

The markets close at 4 p.m. on expiration Friday but the published stock prices can and usually will change after 4 p.m. for exercise by exception purposes, moneyness is determined by the last traded price on a national exchange on expiration day. There is an “Early Prices” report that is generally available about an hour after close. However, there could be a revised report that is published a bit later with any adjustments or corrections that need to be made. It is impossible to place a time on the latter report. These reports are used if the option holders do not communicate with their firm.

What is the latest time a clearing member can submit an exercise notice to the Options Clearing Corporation (OCC)? It is 5:30 p.m. EST on expiration day.

Can out-of-the-money options be exercised?

Yes, the option holder can exercise for any reason up until their firm’s cutoff time. Also, after-hours news events can motivate exercise notices for options that expire OTM if that new information appears to influence price opening on Monday.

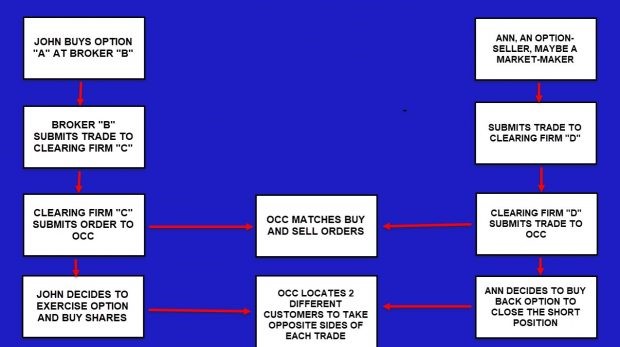

See OCC flow chart below.

OCC MANAGING OUR TRADES

Discussion

Expiration date and expiration time are not the same. The former represents the last time option traders can take action on their positions. The latter is when options contracts are rendered null and void. If share price is near the strike as expiration approaches, we must factor in that the moneyness of the option may flip after hours.

Use the multiple tab of the Ellman Calculator to calculate initial option returns (ROO), upside potential (for out-of-the-money strikes) and downside protection (for in-the-money strikes). The breakeven price point is also calculated. FREE Beginner’s Corner Tutorial for Covered Call Writing has Been Enhanced and Updated here: