There are ways to enhance our covered call strategy to add protection in bear markets are exploit opportunities in bull markets, shares Alan Ellman.

Combining in-the-money strikes and stock dividends can provide protection in bear markets and exploit bull markets to enhance the returns in a covered call strategy.

When establishing our covered call writing trades, we must factor in current market conditions to either add protection in bear and volatile environments or to take advantage of normal to bull market scenarios. On May 17, 2019, Mauricio sent me a diagrammatic strategy proposal that would lower the breakeven using an in-the-money (ITM) strike as well as a stock dividend for Exxon Mobil Corp. (XOM).

The background setting for these trades involved a play on a U.S.-China trade war with both countries raising tariffs causing economic and corporate concerns. Let’s breakdown Mauricio’s strategy.

Summary of trades

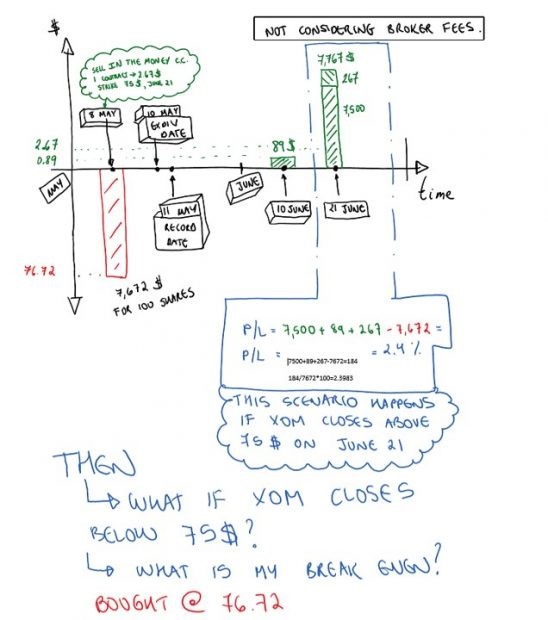

- May 8, 2019: Buy XOM at $76.72, sell the ITM June 21, 2019 $75.00 call at $2.67

- May 10, 2019: XOM ex-dividend date for a dividend of $0.89 paid on 6/10/2019

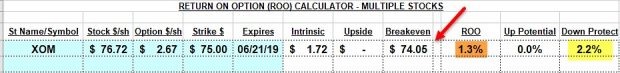

XOM initial calculations with the Ellman Calculator

XOM Calculations Using the Ellman Calculator

Here is a Diagram Mauricio created of his trade

Takeaways

- The initial six-week time value return (ROO) is 1.3% (about 11% annualized- brown cell) with downside protection of that time value profit of 2.2% (yellow cell)

- The breakeven is lowered from $76.72 to $74.05 (red arrow) assisted by the intrinsic value component of the ITM strike

The ex-dividend date factor

Shareholders on May 10 will be entitled to receive the 89¢ per-share dividend on June 10. This will lower the breakeven to $73.16 or 4.64% lower than the purchase price.

Advantages of the strategy: In a troubling market environment, the breakeven is lowered by a combination of premium time value plus intrinsic value as well as a potential dividend distribution.

Disadvantages of the strategy: The strategy returns a modest initial time value return which annualizes to 11% which may or may not meet the goals of the call writer. It is also dependent on receiving the dividend which is not guaranteed as early exercise is a possibility.

Discussion/response to Mauricio

This is a sound and appropriate strategy for bear and volatile market conditions. As you know, I am a huge proponent of ITM strikes when additional downside protection is indicated. Now, adding a dividend component will offer potential additional downside but also additional considerations:

1. Enhanced possibility of early exercise the day prior to the ex-date. This is more likely when the strike is ITM and the time value component of the premium is less than the dividend about to be distributed. This may or may not be a factor depending on how important share retention is to the investor. If this occurs, the dividend goes to the option holder, not us.

2. Stock price will drop by the dividend amount on the ex-date. This makes it more likely for share price to drop below the strike than had there not been an ex-date. Also, the premium for calls is lower when there is an ex-date involved because call buyers are not willing to pay “full price” when they know share price will decline by 89¢.

That said, your math is perfect, I love the drawing and the strategy is solid.

Use the multiple tab of the Ellman Calculator to calculate initial option returns (ROO), upside potential (for out-of-the-money strikes) and downside protection (for in-the-money strikes). The breakeven price point is also calculated. For more information on the PCP strategy and put-selling trade management click here and here.