Landon Whaley exposes the myth of market timing. It actually works!

“I've been walking the streets at night, just trying to get it right. A little patience, yeah, it’s hard to see with so many around, you know I don't like being stuck in the crowd …”

--Axl Rose

I start this week’s “Playbook” with lyrics from “Patience” by Guns-N-Roses. Don’t count out a Playbook that begins “Welcome to the Jungle; we’ve got fun and games.” Both are appropriate springboards for a conversation about financial markets.

Just a Little Patience

The hardest thing for most investors to do is absolutely nothing. If markets are open, they tinker with their portfolio or take positions simply because they can. The Old Institution and their media counterparts have led generations of investors to believe that markets are chock-full of opportunities 24/7. The reality is that markets are far more noise than signal, which is why to be a consistently successful investor, you must learn to have a little patience.

Being patient in markets means waiting for the fat pitch across the middle of the plate before putting capital at risk. It means you don’t buy and hold; you enter positions when they are poised to move in your anticipated direction, and you close the position when that price momentum fades.

Yes, folks, being patient means you must time the market. I know, “market timing” is a four-letter word, and most believe you can’t do it. Most people are dead wrong—besides its unavoidable as every entry comes at a certain point in time. During 2019, we clipped 77.9% winners of all closed trades (long and short), and we’ve improved the odds with 86.2% winners over the last 29 closed trades. Last year’s market timing accuracy was far from an anomaly; it aligns perfectly with the 79.5% win rate we’ve achieved since the inception of the Gravitational 15 portfolio. Market time that!

The jumping-off point for successfully timing the market is a conversation with a man named Vilfredo Federico Damaso Pareto.

Pareto’s Principle

Pareto discovered a principle known today as the 80/20 rule. Pareto’s Principle states that, for many events, roughly 80% of the effects come from 20% of the causes. This same principle can be applied to understand the natural price movement of markets better because approximately 80% (and often more) of a market’s return over any duration occurs in only 20% to 35% of the time being studied. This reality means that 65% to 80% of the time, markets are bobbing around rudderless, emanating pure noise within a trading range.

Case Studies

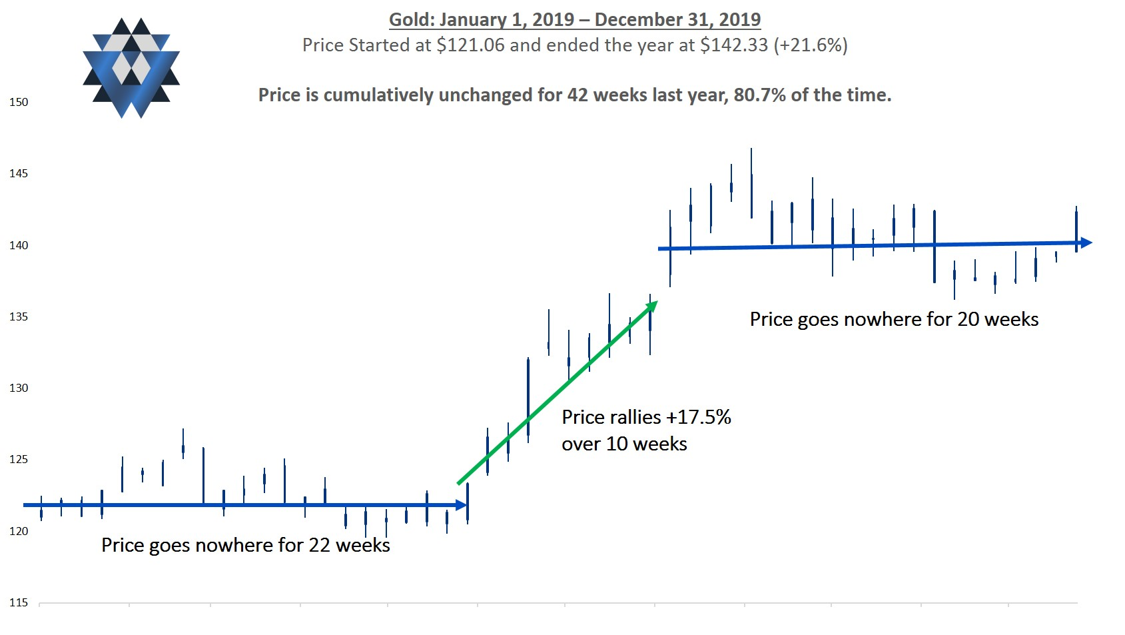

For 2019, gold gained 21.6% but only moved directionally for 10 weeks, or just 20% of the year (see chart below). You can see there was only one-directional move last year, which roughly accounted for gold’s entire calendar year return.

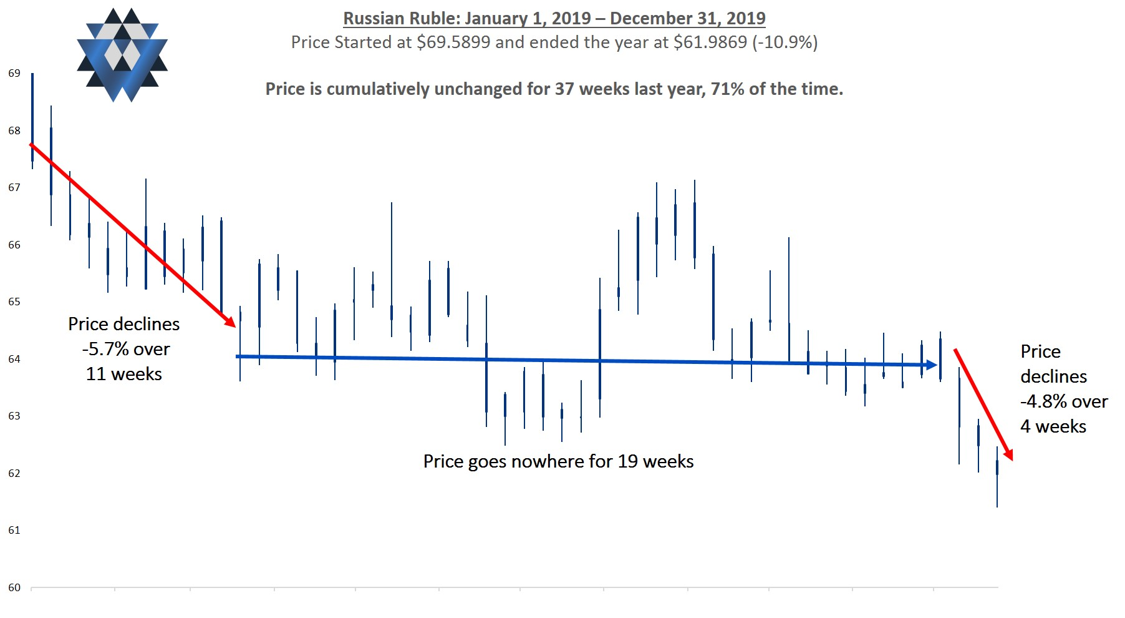

We can also see Pareto’s Principle at play when we evaluate the U.S. dollar/Russian ruble currency pair. The FX pair declined 10.9% during 2019 but only moved directionally for 15 weeks (29% of the time). You can see from the ruble’s weekly chart (below) that there were two directional moves (one 11 weeks long and another lasting four) that accounted for the entirety of its 2019 price action.

I grabbed these market examples to highlight Pareto’s Principle, but I’m not cherry-picking. Feel free to run your own case study: pick any market over any time frame, and given a reasonable margin of error from the 80/20 rule (think 65/35 or 75/25) you’ll see that markets spend most of their time chopping around making no cumulative progress, and any directional movements occur in just a fraction of the total time under study.

The Bottom Line

Markets spend very little time in a directional posture, and therefore a true investing edge comes from the willingness to do nothing, sit in cash and wait for real opportunities to materialize. This is why the Mongoose is such an integral part of our process.

The Gravitational Framework does a lot of the heavy lifting, and it’s critical to know which directional bias to carry on a market, if any. But it’s the Mongoose who makes sure we are efficient with our capital by alerting us to the potential for a directional move. He also makes sure we are risk-conscious by keeping us on the sidelines if the probability of a directional move is low, and the likelihood of market chop is high.

Stick with your process and wait for opportunities skewed in your favor to present themselves, and the low-risk, high-reward returns will follow. As Axel Rose would say, “… take it slow; it’ll work itself out fine. All we need is just a little patience.”

Please click here and sign up to receive the latest edition our research reports as well as to participate in a four-week free trial of our research offering, which consists of two weekly reports: Gravitational Edge and The Weekender.