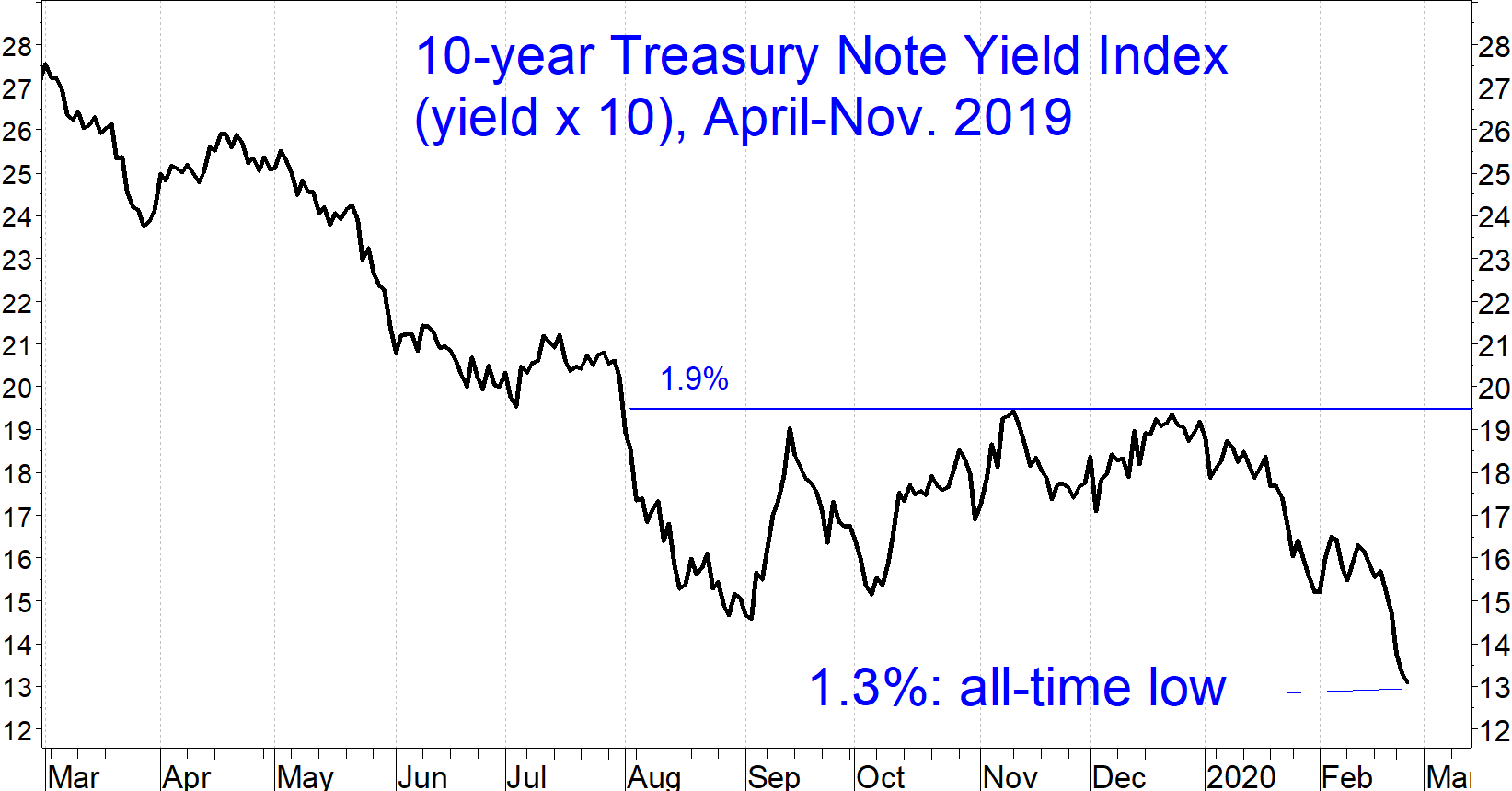

With 10-year Treasury yields hitting an all-time low below 1.3%, cash is king, writes Marvin Appel.

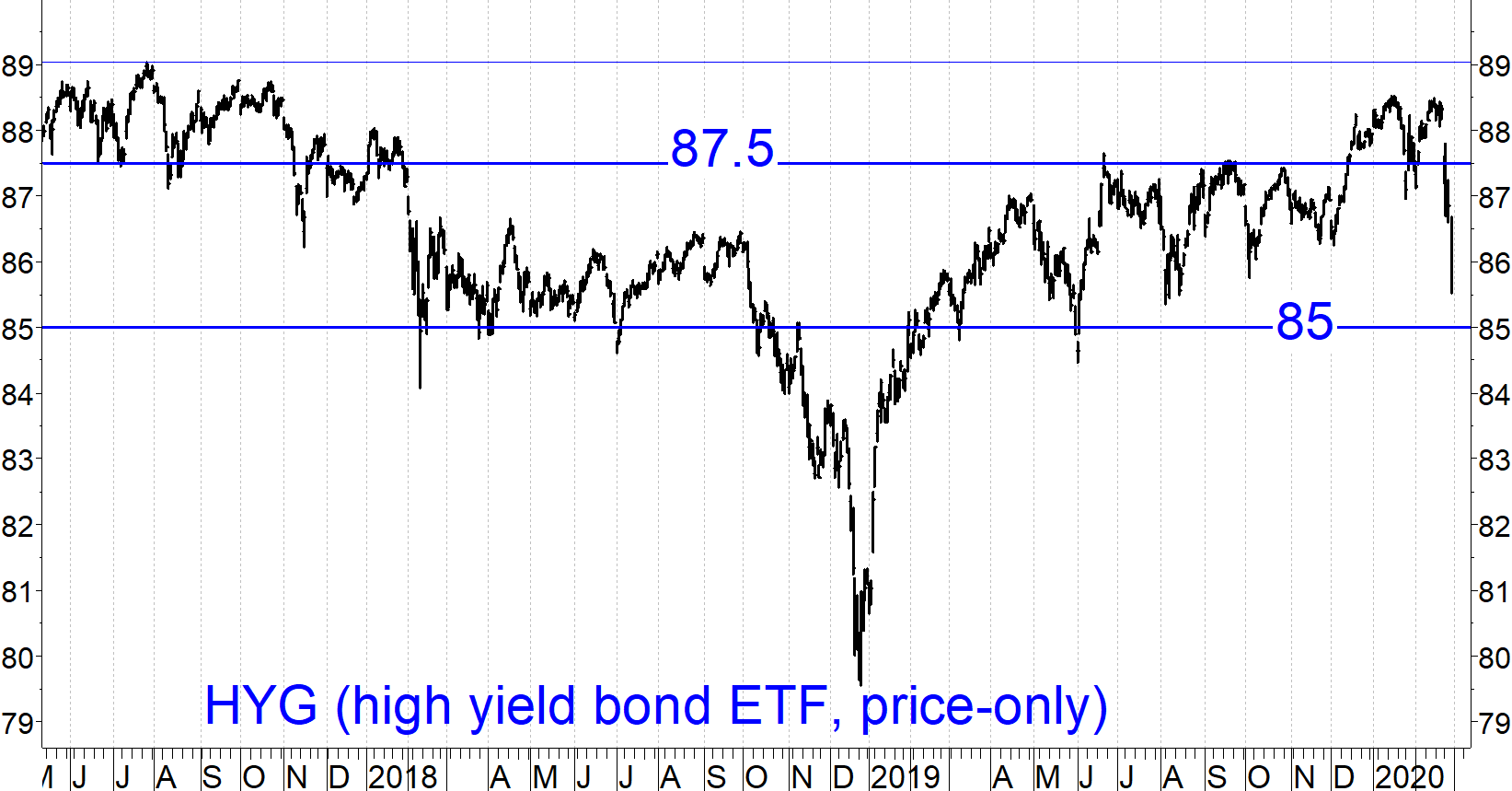

Corporate high yield bonds have joined stocks in their sell-off. As of this writing, the iShares Corporate High Yield Bond ETF (HYG) is almost 3% below its Feb. 20 peak, now back within its 2018-2019 trading range of 85-87.5 (see chart). This raises the possibility that the high yield bond funds that we track might soon generate sell signals.

Note that two of the funds we track in the hotline, the Transamerica High Yield Bond; I (TDHIX) and the TCW High Yield Bond Fund;N (TGHNX) are scheduled to pay monthly distributions of approximately 4¢ and 2¢, respectively. These might occur on Feb. 28 or March 2. Pay close attention because these distributions will cause a drop in the share price that will reduce the sell stops by the amount of the distribution. Pre-distribution, the sell stops for TDHIX is 8.96 and for TGHNX, 6.44. (TGHNX has held up very well compared to other high yield bond funds and is therefore further from a sell signal.) If in doubt, take the sell, but do make every effort to account for distributions. (NNHIX, which we also follow, is not due to make a distribution in the coming week.)

Ten-year Treasury note yields closed at 1.3% on Feb. 27, an all-time low. That yield is so low that investment-grade bonds are no longer productive enough for individual investors (except as a stock market hedge). It may be a while before interest rates recover, and the two-year yield being at 1.2%, well below the Fed Funds rate, suggests that Fed easing is priced into the market already.

The bond strategy that we will use for our clients is to be patient, waiting in cash for the high yield market to stabilize. There is a good chance that eventually, as in early 2019, we will get a re-entry into high yield bonds at very attractive yields.

Sign up here for a free three-month subscription to Dr. Marvin Appel’s Systems and Forecasts newsletter, published every other week with hotline access to the most current commentary. No further obligation.