Market have been rebounding this week as quickly as they dropped last week. Has a bottom been set, asks Jeff Greenblatt.

Do you realize the Dow Jones Industrial Index lost seven to eight months’ worth of gains in roughly five days? Just when the crowd started getting conditioned to the bear, the environment changed yet again. To make matters even more interesting the Federal Reserve dropped rates 50 basis points on Tuesday and markets tumbled after the event.

The bottom line is on Friday the Dow Jones Futures (YM) had a nice reading for a low. It was supported by the Cboe Volatility Index (VIX) that rose to nearly 50. That roughly matches its high from previous volatility spikes (and conversely lows in stocks), so perhaps it’s a sign a bottom was reached. The fact the market had a major retest of the low on Tuesday also helps.

Here’s a secret hiding in full view. Did anyone consider the market was up on Wednesday because Bernie Sanders didn’t sweep through Super Tuesday? Sanders was expected to make major gains, but instead lost ground to Joe Biden. That fact was not lost on various business networks. The thinking goes that the markets fear a Sanders nomination, but it is hard to quantify that in actual Dow points. As is the Coronavirus.

The challenge is at least part of the Coronavirus is now baked in the cake. But how much? Certainly not the chance it expands to a major pandemic, as the market would still be dropping. Nobody knows the complete implications of how it can impact the economy. I’ve seen reports the Port of Long Beach has seen a 10% drop in supply chain deliveries coming from China in February. I’ve heard there are contingency plans in place for the NBA, NHL, Major League Baseball and the NCAA Tournament that include playing games in empty arenas or ballparks.

I did some digging and found the average gate receipt for an NHL game averages around $1.6 million (Vegas Golden Knights) and roughly $2 million for the Chicago Blackhawks based on arena capacity and average price per ticket. Let’s use the lower amount. On an average Saturday night, the NHL plays at least 10 games, that would be a loss of $16 million and during the week perhaps a loss of $6.4 million a night. With teams near the salary cap, this loss of revenue could potentially destroy the competitive balance of the league. All I’ve mentioned is two variables. The worst-case scenario, should it materialize, would be catastrophic. Looking at it in those terms, its hard to get bullish in the larger perspective. It is, after all, a rolling black swan (more light grey as we have known about for months).

Many conferences overseas and in the United States have been canceled. The Housewares Conference in Chicago, which was expecting 60,000 guests who would be staying at hotels and eating at restaurants, was canceled. The Futures Industry Association canceled its annual conference in Boca Raton Fl. While much smaller, it has a large international contingent, which is probably a major contributing factor.

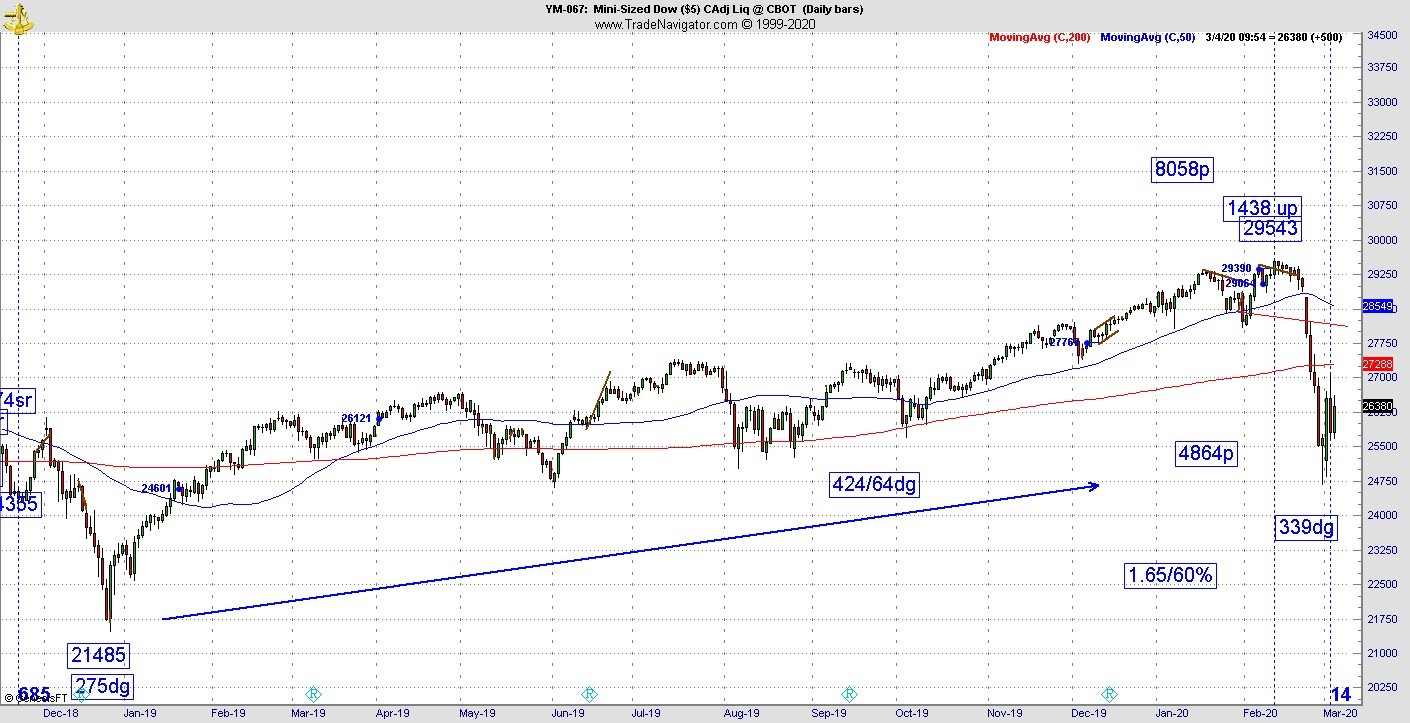

For right now, the technicals looks decent. From my experience, bear phases are more complex when it comes to smoking out the Kairos readings. This one is no different. From the low on Dec. 26 to last Friday is a difference of 275 dg to 339 dg in terms of the Gann calendar. At 4864 points down against 8058 up, we have a slash line of 1.65 with a 60% retracement (see chart below). But wait, that low was on Dec. 26 was in 2018, not 2019. That’s why we have a dual reading of 64dg and 424dg. What I’m looking at is a 64 vibration in terms of the slash line at 1.65, 4864 and the pure dates at the 64 dg difference. Right now, we have short sellers covering positions and after yesterday’s retest there is likely some institutions dipping their toes in the water.

Due to the speed of the correction, many may be fooled into thinking there should be more right now, but when you consider the amount of territory covered, which is a 60% retracement and near 50 for the VIX, they are right there. What is confusing is the quickness but what still can’t be good is the Fed action. If you were planning on going to a restaurant, ballgame or a movie theatre, if you fear catching the virus, all the interest rate cuts in the world aren’t going to impact your decision of whether to stay home or not. Lower rates open a whole new can of worms because once the Fed uses all its powder, that’s it. The only thing left will be negative rates and we’ve already seen how investors have been chasing yield in asset backed securities, which involved the subprime auto market which currently has the highest rate of default since the financial crisis years.

The higher probability now is the drop from last week is over. That doesn’t mean we have a long-term bottom but what started this week should continue. Stay safe and let’s hope the worst-case scenario never materializes.