Here’s how you can create a dividend on a non-dividend stock from Alan Ellman.

Covered call writing can be beneficial to us in a variety of circumstances. Here we highlight how this strategy can be implemented to create a dividend-like cash flow for stocks that currently offer no dividend income. This can be particularly useful for those who will only purchase dividend stocks and miss out on other great stock opportunities.

On August 30, 2019, Paycom Software Inc. (PAYC) boasted elite fundamentals and technicals but generated no dividend income. Let’s see how we can create a dividend-like cash flow using covered call writing.

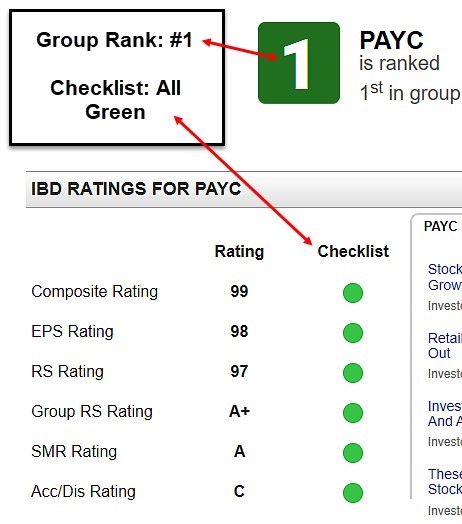

Fundamental review using IBD’s SmartSelect screen: Elite results (below).

PAYC: Elite SmartSelect Rankings

Technical analysis for PAYC: Bullish price chart

PAYC: Price Chart as of 8/30/2019

Achieving an annualized 4% dividend-like return

With PAYC trading at $254.10, a 4% annualized dividend yield would generate $10.16 per-share. This would calculate to four quarterly cash-flows of $2.54 per-share. We would select out-of-the-money strikes on months when earnings are not due out.

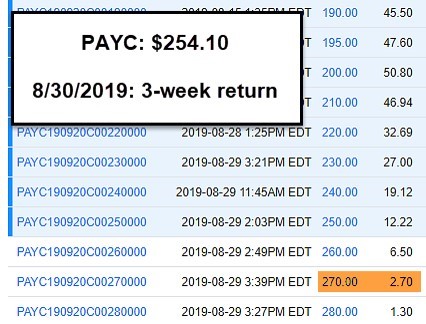

Option chain (3-week expiration) for PAYC on Aug. 30, 2019 (below).

At this point in time, selecting the $270.00 strike for a three-week return and still allowing share appreciation from $254.10 to $270.00 will meet our goal. Three more similar trades per year would meet our target of a 4% annualized return.

Discussion

Covered call writing can be crafted to generate a dividend-like cash-flow. It involves making only four out-of-the-money trades per year in months when earnings reports are not due for publication. This allows investors to purchase stocks they may have otherwise avoided because of the lack of a dividend distribution.

Use the multiple tab of the Ellman Calculator to calculate initial option returns (ROO), upside potential (for out-of-the-money strikes) and downside protection (for in-the-money strikes). The breakeven price point is also calculated. For more information on the PCP strategy and put-selling trade management click here and here.