Micron may be at the head of the post-Coronavirus winners, writes Joe Duarte.

The recent rally in the shares of Micron Technology (MU) may have been a shot across the bow of the next technology revolution.

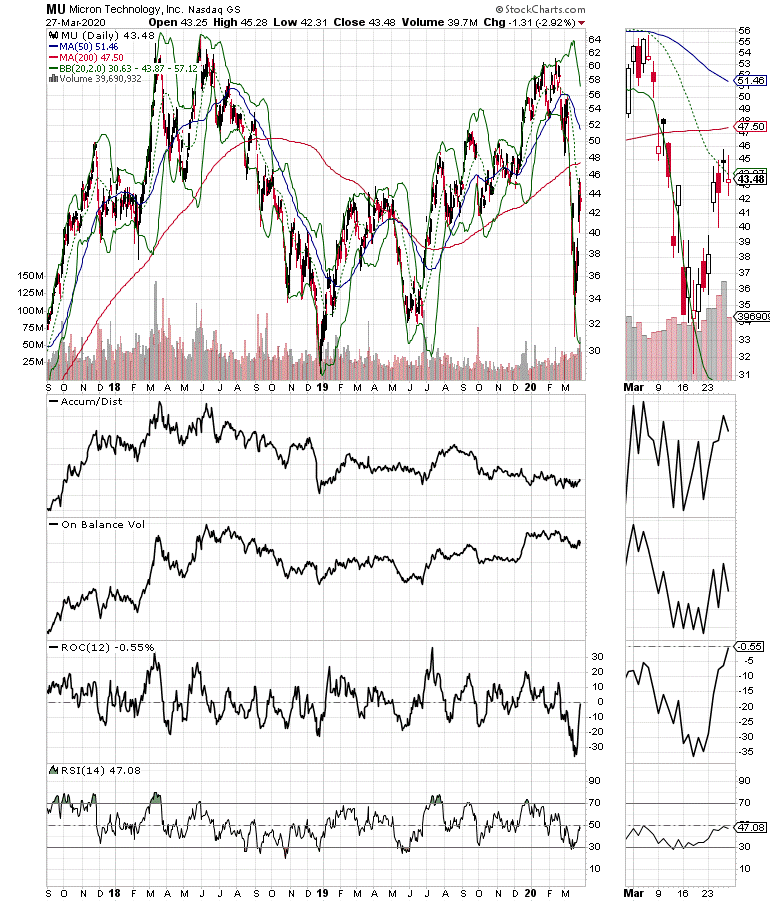

Indeed as Wall Street analysts scramble to cut future earnings expectations and economists argue about the depths of the contraction in GDP due to the Coronavirus, Micron the global leader in flash memory recently delivered a huge earnings beat, which took the stock nicely higher in response (see chart below).

Moreover, in its conference call, Micron actually gave positive guidance, citing increased demand for its chips due to the increase in online meetings.

What it means for investors is that the next big wave of technology may be about to gather steam. Certainly 5G, the buzzword before all this started will be involved. But, as a betting man, I would suggest looking for companies in the United States and Europe to take over from China’s domination of that market from Huawei with Micron in the mix.

Micron’s guidance suggests that we are already seeing a critical pivot by companies and individuals to the next big wave of technology and that over time this will be accompanied by an acceleration of the already significant move of production capacity away from China. And while the Coronavirus situation will likely resolve at some point in the future, those new developments which have made people’s lives easier during this difficult time will remain and likely flourish over time.

We are already seeing Micron benefit from apps such as telemedicine, which I expect will increase as the population ages. This is also visible in the rise of online meetings for banking, deal making, and other routine things which have up to now been done in person.

Complex adaptive systems emerge and evolve. Thus, over time, thanks to the Coronavirus, we are likely to see a rapid transformation of what we do and how we do it. Moreover, it will likely involve the Internet and private online meetings and subsequent technology offshoots that evolve from this dynamic. It seems as if Micron is already there.

Joe Duarte is a former money manager, an active trader and a widely recognized independent stock market analyst since 1987. He is author of eight investment books, including the bestselling Trading Options for Dummies. To learn more about how Chaos and Complexity move the markets, and how to adapt this information into your daily trading routine check out my presentation, “ Trading at the Edge of Chaos” and take me up on a FREE 30-day trial offer.