Crude currency straddling correlation between crude oil and the U.S. dollar, reports Joe Perry.

Yesterday, the Norwegian Health Minister, Bent Hoeie, said that the Coronavirus is “under control” in Norway and that “a person carrying the novel coronavirus in Norway contaminates now on average 0.7 other individuals.” Before lockdown restrictions were implemented, the average was 2.5 to other individuals. Good news for the Norwegian krone, however this isn’t the only reason it has been so strong as of late.

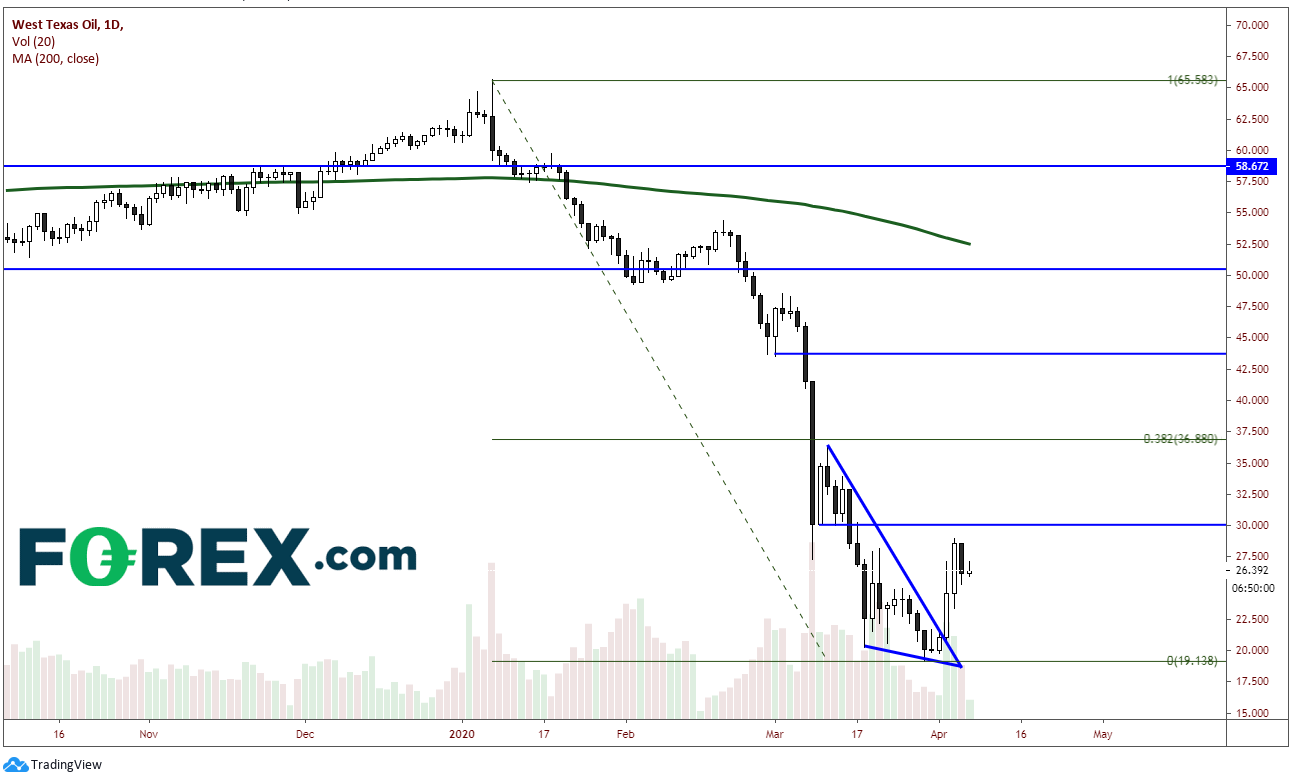

The U.S. dollar Norwegian krone currency pair (USD/NOK) is inversely correlated with the price of crude oil, as Norway is an oil export led economy. As we have seen over the course of the last month, the price of crude has been selling off aggressively since March 9. Only recently has price began to bounce as Russia and OPEC+ have agreed to meet to discuss oil production cutbacks.

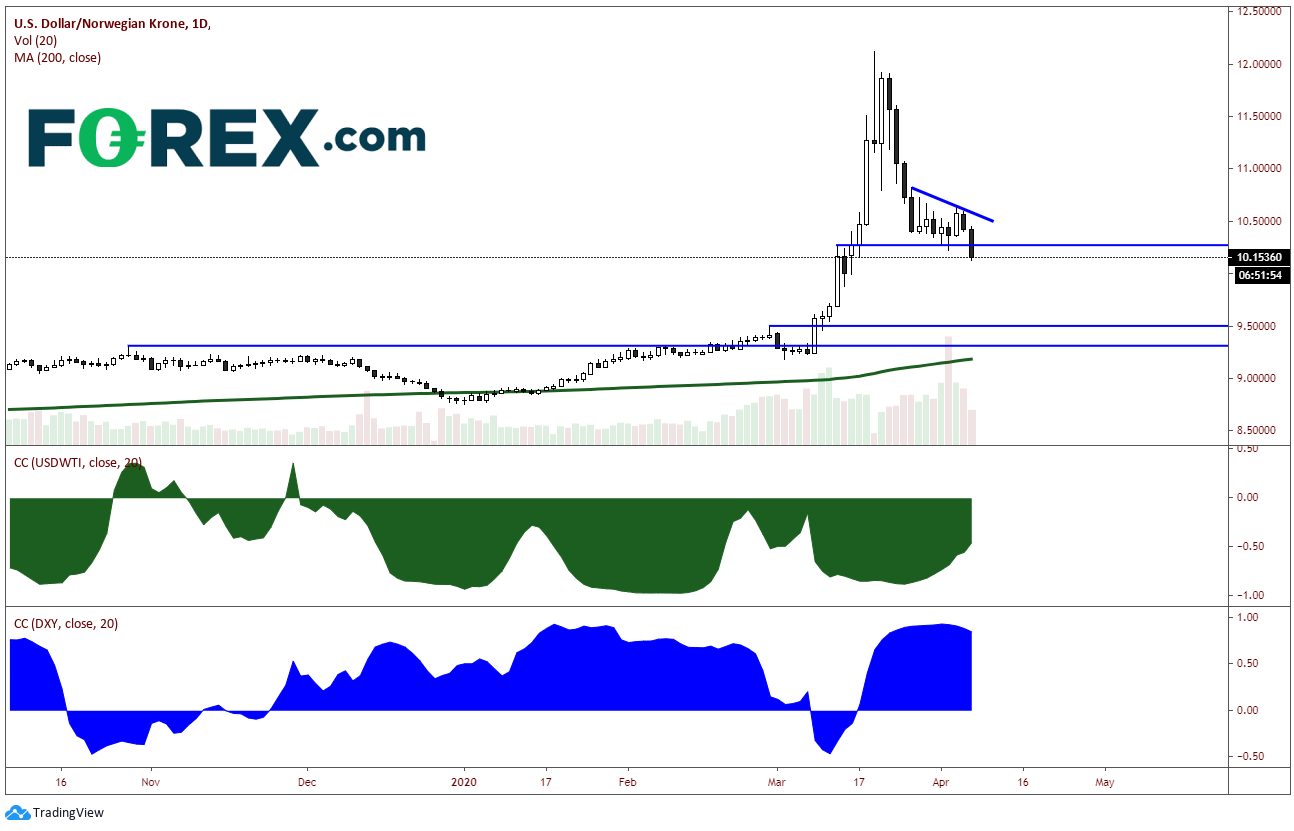

Source: Tradingview, FOREX.com

As crude oil began selling off on March 9, USD/NOK has rallied from then until March 19 from 9.2412 up to 12.1224. However, as crude oil continued to sell off an additional 10% and began forming a near term bottom, USD/NOK sold off as well and consolidated at the 61.8% Fibonacci retracement level off over the same time period near 10.33695. Between March 27 and yesterday, the pair tried to meagerly bounce, only to push lower today through the 61.8% level and horizontal support.

Why would USD/NOK come off as crude was bottoming you ask? Because USD/NOK also has a strong positive correlation with the U.S. Dollar Index (DXY). As the DXY began pulling back on March 23, USD/NOK followed it lower. The bottom of the chart below shows the correlation coefficients for USD/NOK with both the WTI (green) and DXY (blue). Notice how on the move higher in USD/NOK, the correlation was more correlated with WTI (negatively). On its move lower, USD/NOK was more correlated with DXY (positively).

Source: Tradingview, FOREX.com

If crude oil does bounce above 30, USD/NOK could move back above the 61.8% Fibonacci retracement level and trendline resistance near 10.56. However, it appears for the time being, the pair is following DXY. If price closes today below support at 10.27, the next support isn’t until 9.6056 and then 9.4935. WTI crude oil will move on headlines relating to the upcoming meeting between OPEC and Russia.

Pay close attention to both the headlines and the correlations. These will indicate which direction USD/NOK will move next!

Joe Perry holds the Chartered Market Technician (CMT) designation and has 20 years of experience in the FX and commodities arenas. Perry uses a combination of technical, macro, and fundamental analysis to provide market insights. He traded spot market FX and commodity futures for 17 years at SAC Capital Advisors and Point 72 Asset Management. Don’t forget that you can now follow Forex.com’s research team on Twitter: http://twitter.com/FOREXcom and you can find more of FOREX.com’s research at https://www.forex.com/en-us/market-analysis/latest-research/.