The technology sector and a few megacap stocks are propping up the entire market, reports Mike Larson.

With my apologies to Charles Dickens, this is the best of times, the season of light, and the spring of hope — for a select few stocks and sectors.

For everyone else, it’s the worst of times, the season of darkness, and the winter of despair.

If you own technology stocks, you’re as happy as can be. Especially the group I call the “S&P five” that includes mega-cap names like Apple (AAPL) and Microsoft (MSFT).

If you own financials, transports, energy, small caps and many other groups — you’re wallowing in a pit of despair.

The year 2020 is truly a “Tale of Two Markets.” That creates both enormous opportunities and sizable risks.

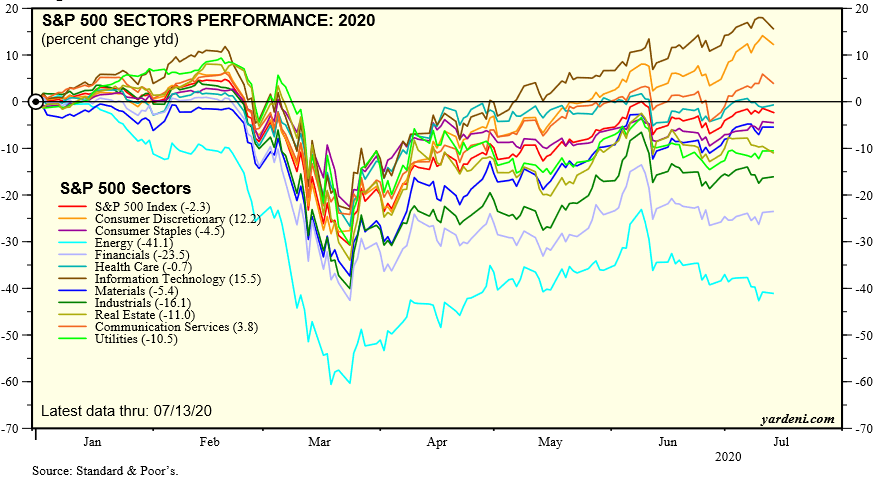

Just consider the following: The S&P 500 is down about 2% year-to-date. Not terrible. Yet if you look at the performance of the 11 S&P 500 sectors, you see an unbelievable dispersion of returns (see chart below).

Technology is rocking and rolling. It’s up more than 15%!

Consumer discretionary is up more than 12% — skewed by Amazon (AMZN), which accounts for a whopping 25% of the sector’s weighting.

Communications services are up 4%. Again, that’s skewed by a handful of tech stocks. Facebook (FB) and the two classes of Alphabet (GOOGL and GOOG) shares account for 45% of the sector.

Meanwhile, every sector that is not heavily influenced by a handful of mega-cap tech stocks is in the red for the year.

Materials are off 5%. Real estate is down 11%. Industrials are losing 16%. Financials are shedding 23%. And energy? It’s down 41%. Yikes!

Frankly, this isn’t the kind of broad-based, rising tide, wide-ranging advance you see during powerful bull markets.

It’s much narrower, more worrisome behavior that I’ve seen a handful of times in my career — most notably around the peak of the Dot-Com Bubble in 1999-2000.

Does that guarantee we’re on the cusp of a mega wipeout in equities? No. But it does confirm you want to keep treading more carefully, using the “Safe Money” approach.

As you know, it’s focused on income-producing investments, alternative assets like precious metals and mining shares, higher levels of cash and other important, prudent steps to control your risk. Stick with it and I’m confident your portfolio will meet a better fate than some of Dickens’ characters!

I’m about to roll out my June issue of the Safe Money Report with new ideas and new recommendations designed to ensure you do. Subscribe to Weiss ratings' Safe Money Report here… You can check the Ratings on your investments using the search tool at the top of our website here.