Alan Ellman breaks down the components of the collar trade using the Silver ETF SLV.

The collar strategy is a covered call writing-like strategy where a protective put is added to the covered call trade.

Here, we will highlight the initial structuring of a collar trade using the iShares Silver Trust (SLV), an eligible exchange-traded fund in our Premium ETF Report in August 2020.

The 3-legs of a collar trade

- STOCK: We buy shares (in 100 share increments) of a security that meets our system criteria

- CALL OPTION: We sell an out-of-the-money (OTM) call to generate premium. This represents the ceiling of the trade.

- PUT OPTION: We buy an OTM put to protect to the downside. This represents the floor to the trade.

Rationale behind structuring a collar trade

Simply stated, we want to generate cash flow. The stock is leveraged to generate option premium. Since we have a credit on the call side and a debit on the put side, we want call premium to be greater than put cost. As a guideline, we define our initial time-value return goal range for covered call writing and then reduce that amount due to the put debit.

Let’s say our covered call writing stated goal is 2% to 4% per month and up to 6% in a bull market. For a collar trade, that would translate to 1% to 2% per month and up to 3% a bull market. We must establish a strategy goal prior to entering our trades whether it’s the one I am using here, or another. It should be based on our personal risk-tolerance.

Real-life example with SLV

- Aug. 5, 2020: SLV trading at $24.99 (long stock position)

- Aug. 5 OTM $25 call (Aug. 21 expiration) generates $1.34 (ceiling); OTM $23 protective put costs 48¢ (floor)

SLV bullish chart in July – August 2020 (red arrow shows trade entry)

SLV Chart: Trade Entry Point

The BCI Collar Calculator

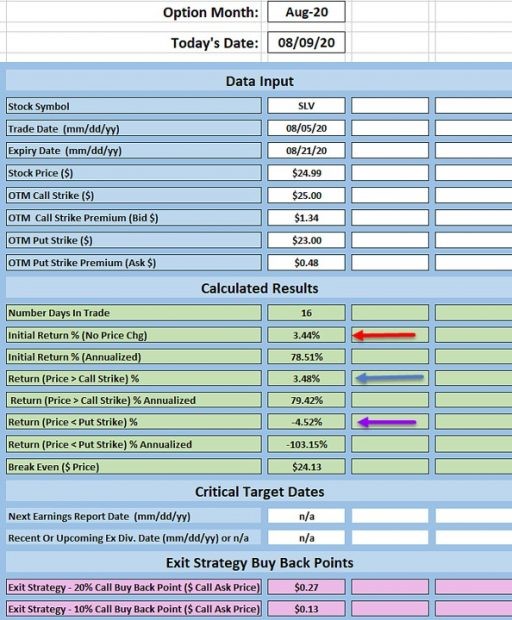

Collar Calculations with the BCI Collar Calculator

Initial calculation results:

- Initial 16-day time-value return is 3.44% (red arrow in above chart)

- Maximum return if SLV moves to, or above, the $25 call strike (can be called an at-the-money strike, 1¢ above current market value) is 3.48%

- Maximum loss if SLV moves to, or below, the $23 put strike is 4.52%

- These results do not reflect potential exit strategy opportunities. They are initial structuring calculations

Discussion

Collar trades should be structured to generate cash flow. This means a net option credit. The initial time-value return goal range will be lower than that of traditional covered call writing due to the cost of the protective put. A guideline for our trade expectations is to generate at least one half of our traditional covered call writing initial time-value return goal range.

Use the multiple tab of the Ellman Calculator to calculate initial option returns, upside potential (for out-of-the-money strikes) and downside protection (for in-the-money strikes). All the different covered call strategies listed above are explained in full on the Blue Collar Investor Website.