A lot will be at stake in this week’s virtual Jackson Hole symposium, reports Adam Button.

Will Thursday's speech from Federal Reserve Chair Jerome Powell at the Fed's Jackson Hole virtual symposium be the watershed towards a new type of monetary policymaking? Will it re-write the rules on inflation targeting?

Commodity Futures Trading Commission (CFTC) Commitments of Trader (COT) data was little changed last week but continued to show euro longs near a record.

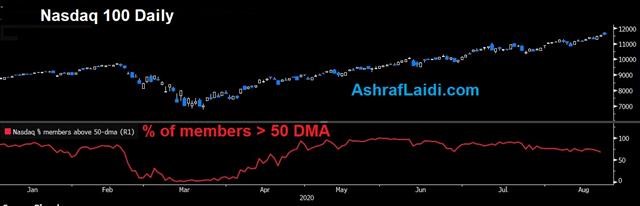

Monday’s SPX session showed 76% members advancing, which is twice more than last week. The chart below shows the percentage of Nasdaq 100 members above their 50-day moving average fell from 90% to 70% over the last four weeks (see chart below).

The Jackson Hole symposium will be held virtually this year but it will be no less of an event for market participants. Fed Chair Powell's topic will be the Fed's long-run framework and specifically, shifting towards average inflation targeting.

Currently, the Fed aims to hit 2% inflation, and if it undershoots, it tries again. A new regime could see the central bank overshoot to make up for lost ground.

The hope is that it will act as a natural stabilizer that signals easier policy for longer, without all the complications of forward guidance.

It's fraught with pitfalls. At the heart of the Fed's thinking is that it believes it can control inflation if/when it returns. It's as simple as raising rates and when appropriate, the Fed doesn't see the risks of rising prices.

Yet officials don't need to look any further than the U.S. housing market for an inflationary jump that few saw coming.

“The housing market is past the recovery phase and is now in a booming stage,” said Lawrence Yun, the chief economist of the U.S. National Association of Realtors on Friday after a record jump in existing home sales.

The Fed is right that it has the tools but the Fed has always had the tools to curb inflation and it's arrived many times. Why? Political risk is big. It's simply hard to raise rates and demand that all borrowers pay more. With Wall Street firmly in control of the Fed and increasing politicization at the Fed (and everywhere else), we would argue that long-term risks are higher than they've been in a generation.

CFTC Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.

EUR +197K vs +200K prior

GBP +7K vs -3K prior

JPY +21K vs +27K prior

CHF +15K vs +17K prior

CAD -34K vs -30K prior

AUD -3K vs -1K prior

NZD +4K vs 0K prior

The recent rally in the British pound appears to have caught the speculative market by surprise and that leaves plenty of fuel for the fire. Expect a slow burn with the never-ending Brexit saga as a constant headwind.