Dan Keegan suggest making a safer long QQQ play through a ratio spread.

The Invesco QQQ Trust (QQQ), the exchange traded fund based on the Nasdaq 100 traded as low as $251.32 on July 24 and as high as $282.34 on Aug. 21. During that time there were only a couple of times that the ETF gapped more than two points on an overnight move. The four-week move was $30.02.

The Nasdaq 100 is near its all-time high so the first instinct is to believe that it will give back a chunk of its upward move. It does seem counterintuitive that stocks should so quickly regain their pre-Coronavirus footing with the economy in mothballs for a couple of months. The absolute explosion in the money supply with never ending near zero interest rates and Federal Reserve stimulus has something to do with it. Every bubble always ends with a frothy spasm.

One way to take advantage of a continuing upward trajectory is to purchase the QQQ. If you buy 100 shares at $282.34 you need to come up with $28,234 in cash or you could margin the trade and come up with $14,117.

The good part of this trade is that you are profitable as soon as it trades above 282.34, but if QQQ declines you need to simply take your loss or throw extra money at it.

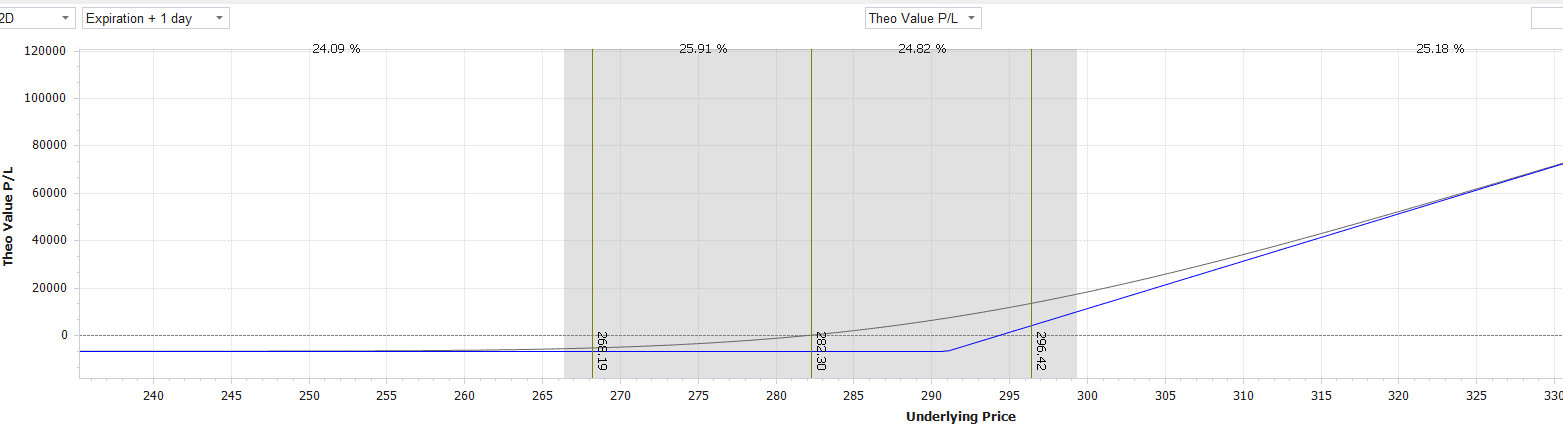

A better alternative is to buy 20 weekly Sept. 18 291 calls at $3.28. That is a commitment $6,560, which is also the maximum loss for the trade. You control 20 times the number of potential shares at only 23.2% of the cost. You have 86 times the leverage. If the QQQ sells off by 35% that results in a loss of $9,881.90. The breakeven point for the call purchase is $294.28. At that point, the shares would have been in the black for $1,194 (see chart below).

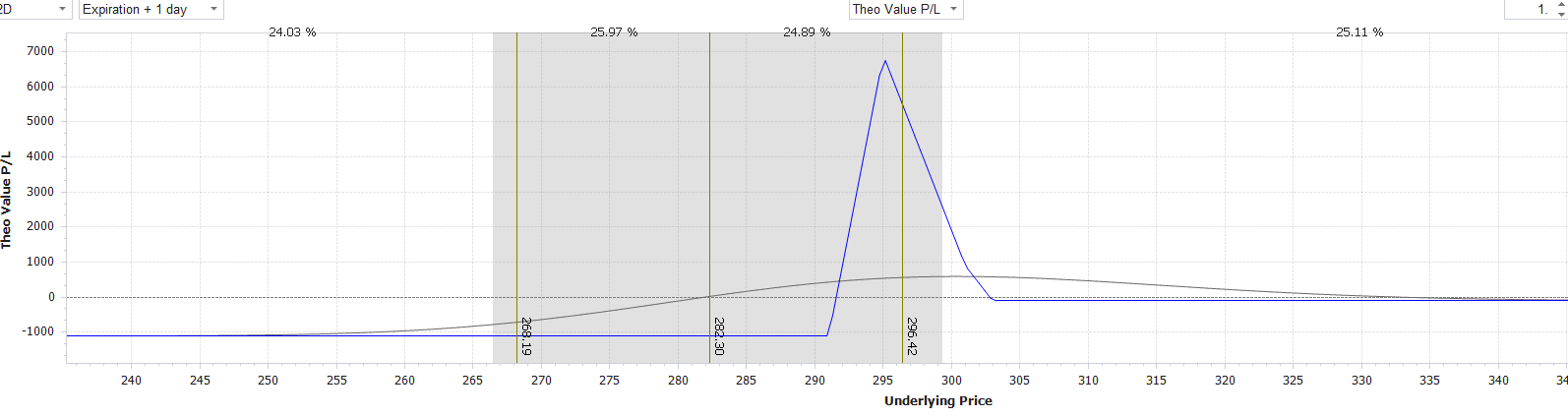

A third alternative is to construct a ratio spread where the upside profits are not unlimited, but the downside risk is much lower. This spread would consist of buying 20 QQQ Sept. 18 291 calls and selling 30 Sept. 18 295 calls.

To protect the upside and to keep the pesky margin department at bay, you buy 5 Sept. 18 301 calls and 5 Sept. 18 303 calls. The delta for the 291 calls is 31, the delta for the 295 calls is 23, the delta for the 301 calls is 13 and the delta for the 303 calls is 11. The grand total is positive 50 deltas. The maximum loss for the trade at expiration is $1,105 (if it settles below $291 and $105, if it settles above $303. The max loss for the spread is about one-sixth the amount that it is for the long calls. If the ETF blows past $295 you can adjust with a positive delta trade like a bullish Vertical spread. If it never moves up, then you could sell the 296-292 call spread seven times. Spreading gives you many more options (pun intended).

Equity markets are extremely volatile and unpredictable these days. Adding to the unpredictability is the economic uncertainty of the Coronavirus pandemic, upcoming presidential election and the unprecedented level of Fed intervention in the markets. For these reasons, it is important to make as precise of a trade as possible. Options in general—and the above example of a ration spread in particular— allows you to dial the risk and opportunity in any position more precisely, which is an important risk management strategy.

Dan Keegan, founder of optionthinker.com, operates a six-month one-on-one mentoring program, which brings expertise to new options traders. You can reach Dan at dan@optionthinker.com