For some people, the Forex market might seem like a complicated place full of unknown terms and strategies. However, the reality of the matter is that one does not need an advanced degree in finance in order to understand the basic mechanics of this market and eventually start trading as well.

The term ‘Forex’ itself, represents a shortened version of the ‘Foreign Exchange’ market. As the naming suggests, the main purpose of this market is the purchase and sale of currencies in order to earn some payouts.

Now, obviously one does not need to be a client of the brokerage company in order to exchange currencies. An individual can do so by visiting a bank or currency exchange bureau. In fact, some financial institutions also offer their clients multi-currency accounts, where they can convert their savings into different currencies by online or mobile banking, without having to visit the branch.

However, the Forex brokerage accounts differ from those bank products in the sense that it involves borrowing in one currency in order to invest in another currency. Therefore, if the purchased currency rises in value, then the trader can make a profit. Now let us go through the basic mechanics of the Forex market in greater detail.

Basics of Currency Pair

It is worth noting that in the Forex market, instead of buying or selling some individual currencies, the trader traders currency pair. A currency pair is the main trading instrument in the Forex market. As the name suggests it involves two individual currencies.

For example, the EUR/USD currency pair is the most frequently traded currency pair. It consists of the Euro, with the EUR used as an abbreviation, and the USD, which stands for the US dollar. In the trading platforms, the currency pairs are typically accompanied by the exchange rate. For example, the EUR/USD pair shows how many US dollars one can get for 1 Euro.

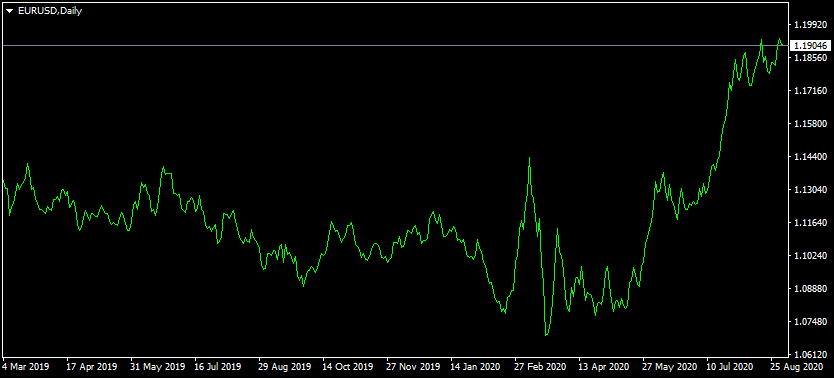

In order to understand those basic dynamics better, let us take a look at this daily EUR/USD chart:

This is the most basic diagram, also known as the line chart. It displays the recent movements of the EUR/USD exchange rate. The main principle in this diagram is quite simple: if the pair moves lower, it means that the Euro losses value against the US dollar. In this case, one can say that the Euro depreciates. On the other hand, if the pair moves higher, it means that the European currency gains value against the USD. This is also known as appreciation.

As we can see from the above image, the Euro was in a downward trend, eventually depreciating from $1.13 level in March 2019 to $1.07 by April 2020. However, there was a major reversal in May, as a result of which the Euro erased all of its recent losses and even reached $1.19 by August 2020.

Here it is worth noting that the depreciation and devaluation might seem the same for some traders, but there are some differences between those. Depreciation is the process when the currency losses its value due to market forces. On the other hand, the devaluation is the event when the government or the central bank devalues the currency due to economic, political, or other reasons.

As we can see from the chart above, the latest exchange rate, shown in the diagram is 1.19046. This means that at the current exchange rate of EUR/USD, 1 Euro is worth $1.19046. If we round this up to the nearest pip, that will be 1.1905. The pip essentially is the smallest unit of the currency exchange rate and represents the fourth decimal point. For example, if the EUR/USD rises from 1.1905 to 1.1910, then one can say that the pair has gained 5 pips, or alternatively the Euro has appreciated by 5 pips.

When it comes to every single currency pair, traders have two options: they can either buy or sell the pair. Returning to our EUR/USD example, if the market participants decide to buy the pair, then it means that they borrow in US dollars in order to buy Euros. The opposite is also true, if traders decide to sell this pair, it means to borrow in Euros in order to buy the US dollars.

Now, the fact that the chart shows the current market exchange rate of EUR/USD at 1.1905 does not mean that the trader will necessarily be able to buy or sell the currency pair at that rate. The fact of the matter is that in order to make their business model sustainable, the brokerage companies have to earn some revenues in the process. They do this by applying the spreads to each currency pair.

This means that on the trading platforms the buying price of the given currency pair is typically slightly higher than the current market price. This is also known as the ‘Ask’ price. At the same time, the selling price of the given currency pair is usually slightly lower than the current market exchange rate. This is also known as the ‘Bid’ price.

Here it is worth noting that there is no standardized policy on spreads. Every brokerage company has its own policies when it comes to pricing the currency pairs. Some of them might offer tighter and consequently, more competitive spreads, compared to others. This is why it is so important to do proper due diligence before choosing a brokerage company to trade with.

So, returning to our previous example, if the bid price for the EUR/USD pair is 1.1903 and the asking price is at 1.1907, then the size of the spread will be 4 pips.

Major, Minor, and Exotic Currency Pairs

When it comes to the currency pairs, there are indeed more than a hundred of them in the Forex market. However, not all of them are popular to the same extent. Some of them are so popular that they drive huge volumes on a daily basis, while some others are only traded by a small number of market participants.

This is why the currency pairs are generally divided into 3 categories:

Firstly, we have so-called ‘Majors’. Those are 7 some of the most liquid currency pairs, those are:

EUR/USD (Euro / US dollar)

GBP/USD (British pound / US dollar)

USD/JPY (US dollar / Japanese yen)

USD/CHF (US dollar / Swiss Franc)

USD/CAD (US dollar / Canadian dollar)

AUD/USD (Australian dollar / US dollar)

NZD/USD (New Zealand dollar / US dollar)

As we can see from the above list, all those 7 currency pairs include the US dollar. This is because the USD is the world’s most traded reserve currency. Therefore, it is not surprising that those pairs have some of the highest volumes in the market.

Due to their popularity, a significant number of brokerage firms try to apply very tight and competitive spreads to major currency pairs in order to increase their market share and attract more clients in the process.

It is also worth noting that some beginner Forex traders prefer to trade only with the major currency pairs. This is meant to avoid confusion and gather some much-needed experience, before moving on to other trading instruments.

The second category of currency pairs is called ‘Minors’. It includes all currencies from the Majors category, except for the US dollar. Consequently, there are 21 pairs in total, including EUR/GBP, EUR/AUD, AUD/NZD, and GBP/JPY.

In general, those 8 currencies involved with major and minor pairs do represent stable economies. Therefore, relatively speaking, they tend to be less volatile and more predictable than other currency pairs.

This is why even some professional Forex traders might prefer to stick to the major and minor currency pairs in trading. It is generally regarded as less risky and there is no lack of variety of choices since there are 28 currency pairs in those 2 categories.

Finally, we have the so-called ‘Exotic’ currency pairs. This essentially includes all currency pairs which are not included in the Majors and Minors. This includes the currencies of developed economies outside those 8 currencies mentioned above. For example, the USD/SEK (US dollar / Swedish Krona), EUR/NOK (Euro / Norwegian Krone), GBP/DKK (British pound / Danish Krone) are all included in this category.

Here it is also worth noting that all currencies of developing countries are also part of Exotic currency pairs. Some examples of this include USD/RUB (US dollar / Russian ruble), EUR/MXN (Euro / Mexican Peso), GBP/ZAR (British pound / South African rand), and USD/TRY (US dollar / Turkish lira).

It is useful to point out here that in general, those currency pairs tend to be more volatile and unpredictable than in the case of major and minor currency pairs. Exotic pairs also tend to be less liquid as well.

However, this category still attracts a large number of traders. After all, for some market participants look at more volatility as an opportunity to earn even higher payouts. In addition to that many emerging markets, currencies tend to have higher interest rates, compared to developed countries, something which some traders might find quite attractive.

Earning Payouts

At this point, one might ask a very logical question: so how can traders earn payouts in the Forex market? Well, there are essentially two ways a market participant can earn some money in the market.

The first and most common way to do so is to make a profitable trade. Returning to our previous example, let us suppose that the market participant buys the EUR/USD pair at 1.1907. The purchase of the currency pair is also referred to as opening a long position.

After some hours of trading, let us further suppose that the Euro has appreciated to a certain degree and reached 1.1942 level. In this case, if the trader closes the position, the total gain, in this case, will be 35 pips.

Here it is worth noting that the exact amount of earnings depends on the size of the position. The smallest size of the position in the Forex market is called the ‘mini lot’. This is represented by 10,000 units of currency. For example, if the currency of the trading account is the US dollar, then one mini lot will be $10,000.

At the same time, the standard lot is the equivalent of 100,000 units of currency. Consequently, in our example, this will be $100,000.

It goes without saying that traders can also earn some payouts by selling the currency pair. This is also known as opening a short position. For example, if the trader sells the EUR/USD pair at 1.1903 and the exchange rate drops all the way down to 1.1883, then the market participant will earn a payout worth of 20 pips.

Carry Trades

At this point, it is important to note that closing positions profitably is not the only way to earn some money with Forex trading. There is also another method, known as the ‘carry trades’. This essentially involves borrowing in a lower-yielding currency in order to buy higher-yielding currency and earning a daily income from the interest rate differentials.

Now, this definition might sound confusing, but the main principle here is quite simple. The fact of the matter is that nearly every currency in the world is managed by the central bank. The policymakers in those institutions get to set their interest rates for the currency. This essentially defines the rate at which borrowers can borrow money. It also influences the rates on the savings accounts and certificates of deposit (CDs).

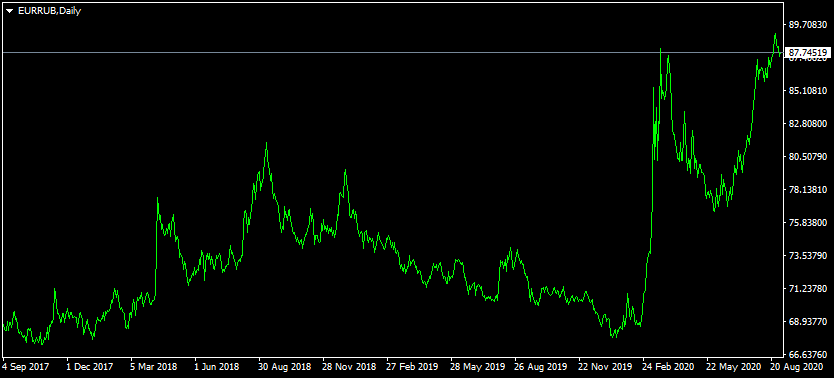

What happens with the Forex market is there can be interest rate differentials with many currency pairs. To illustrate one example here, let us take a look at this daily EUR/RUB chart:

As we can see from the above chart, the EUR/RUB pair mostly moved sideways from late 2017 until early 2020. However, the outbreak of the COVID-19 pandemic has altered the exchange rate dynamics significantly, with the Euro making some rapid gains eventually reaching 87 level. This was followed by the major correction, with the pair briefly dropping all the way down to 76 mark.

This development turned out to be short-lived. As the Bank of Russia authorized several rate cuts, the EUR/RUB once more returned to the upward trend, with the pair eventually reaching 87.74 level.

Going forward, one way traders can earn some payouts with this pair is to conduct a thorough fundamental and technical analysis and then guess the future direction of the pair. Now those two terms might sound confusing, but their meaning is quite simple. The technical analysis covers price developments and chart observations. On the other hand, the fundamental analysis focuses on economic news publications and other indicators outside the charts.

However, the other way to earn some money trading this currency pair is to open a carry trade. The fact of the matter is that as of September 2020, the European Central Bank, which manages the Euro holds its key interest rate at 0%. In fact, the European policymakers hold rates at that level for more than 4 years now.

On the other hand, the Bank of Russia keeps its key interest rate at 4.5%. This means that the interest rate differential in EUR/RUB pair is 4.5%. The fact of the matter is that if the trader keeps the position open overnight, then the market participant will either receive or have to pay interest to the broker. This is also known as swap or rollover.

In practice, this means that if the traders open a long EUR/RUB position, this means that they are borrowing in rubles in order to invest in Euros. Consequently, they have to pay a swap to the brokerage company on a daily basis. So, in a typical example, the market participants might have to pay 4.6% annual interest to the broker. In this case, 4.5% represents the interest rate differential while 0.1% is the commission of the brokerage company.

On the other hand, if the traders open a short EUR/RUB position, they will be entitled to receiving daily rollover payments from the broker. This might be an annual 4.4%. This can be calculated by 4.5%, an interest rate differential, minus 0.1%, the commission of the brokerage company.

This means that if a trader opens a short EUR/RUB position worth $100,000, then the annual amount of swap payments will be $4,400, which is the equivalent of $12.05 per day.

This obviously does not imply that carry trades are risk-free methods of earning some decent payouts in the Forex market. Here it is very important to remember that those trades are still very much subject to the exchange rate risks.

Consequently, there is no guarantee that the currency with a higher interest rate will always appreciate against the ones with lower rates. In general, everything else being equal, higher-yielding currencies are more attractive than their lower-yielding counterparts. However, it is worth keeping in mind that when it comes to the Forex market there are dozens of variables involved, so there is always a distinct possibility of adverse market movements.

This is why it is always essential to conduct a detailed analysis of currency pairs, even when opening the carry trades. This can certainly have the potential of reducing the percentage of losing trades.

Leveraged Trades

One way in which the Forex market is attracting to many traders is the use of large amounts of leverage. This term essential represents a loan from a brokerage company to the trader for the purpose of opening positions. Here it is worth noting that the market participants cannot use the money received from this type of loan for any other purposes.

Now, the exact amount of leverage can range from 1:1 to 1:1000. In this case, 1:1 means the absence of leverage. This means that the traders only trade with their own money instead of borrowing any funds from the brokerage company.

In the case of 1:2 leverage, the traders’ funds represent 50% of each opened position, while the remaining 50% is borrowed from the broker. When it comes to 1:10 leverage, the trader invests 10% of the position, while the rest of the funds are provided by the brokerage company.

It is not surprising that many experienced professional Forex traders call leverage the ‘double-edged sword’. This is because, on the one hand, it allows the market participants to open large positions with relatively small amounts of money and consequently increase the size of their potential returns dramatically.

On the other hand, leverage also increases the level of risk. For example, a 1:50 leverage trader can open a position worth $100,000, with just $2,000, however, it only takes 2% adverse market movement for the entire position to be wiped out and the market participant to lose all of the invested amounts.

This is why regulators in some countries started imposing limits on the maximum amount of leverage used in a single trade. For example, in the United States the limit is set at 1:50 with the major currencies, while in the European Union, this limit is at 1:30 for those categories. It is also worth noting that the limits on exotic currency pairs are even lower in those countries.

Here it is worth keeping in mind that no matter the outcome of the trade, the brokerage company will always get its money back, so it is the customer who takes all the risks when executing the leveraged trades.

By Konstantin Rabin, the broker reviews editor at TopForexTradingBrokers site