Professional traders have dominated the capital markets for many years, explains Jake Bernstein.

As trading technology has advanced, making available to the average investor many of the tools once available only to professionals, one would imagine that the overall performance of the small investor would have improved. Add into the equation the fact that commissions on equity trading is now effectively zero and the advantage to the small trader improves even more so.

Nonetheless it appears to me, judging from the many phone calls and emails I get, that despite these significant improvements which should have improved the profitability of the small trader things have not changed appreciably. As with many claims that abound in the markets the belief that the small trader is “always wrong” must be investigated further. The importance of this statement, if true, lends itself to the use of small trader sentiment and trading activity as a contrary opinion indicator.

In other words if it is true that the small trader is always wrong or for that matter wrong a majority of the time, and if this tendency can be quantified, it could likely be the basis of a profitable timing strategy. In other words if we could see in numbers a particular representation of trader sentiment, we could plot in graphic form the relationship between price and trader sentiment and then statistically determine the correlation between the two and finally determine an application of the relationship if we find it to be valid.

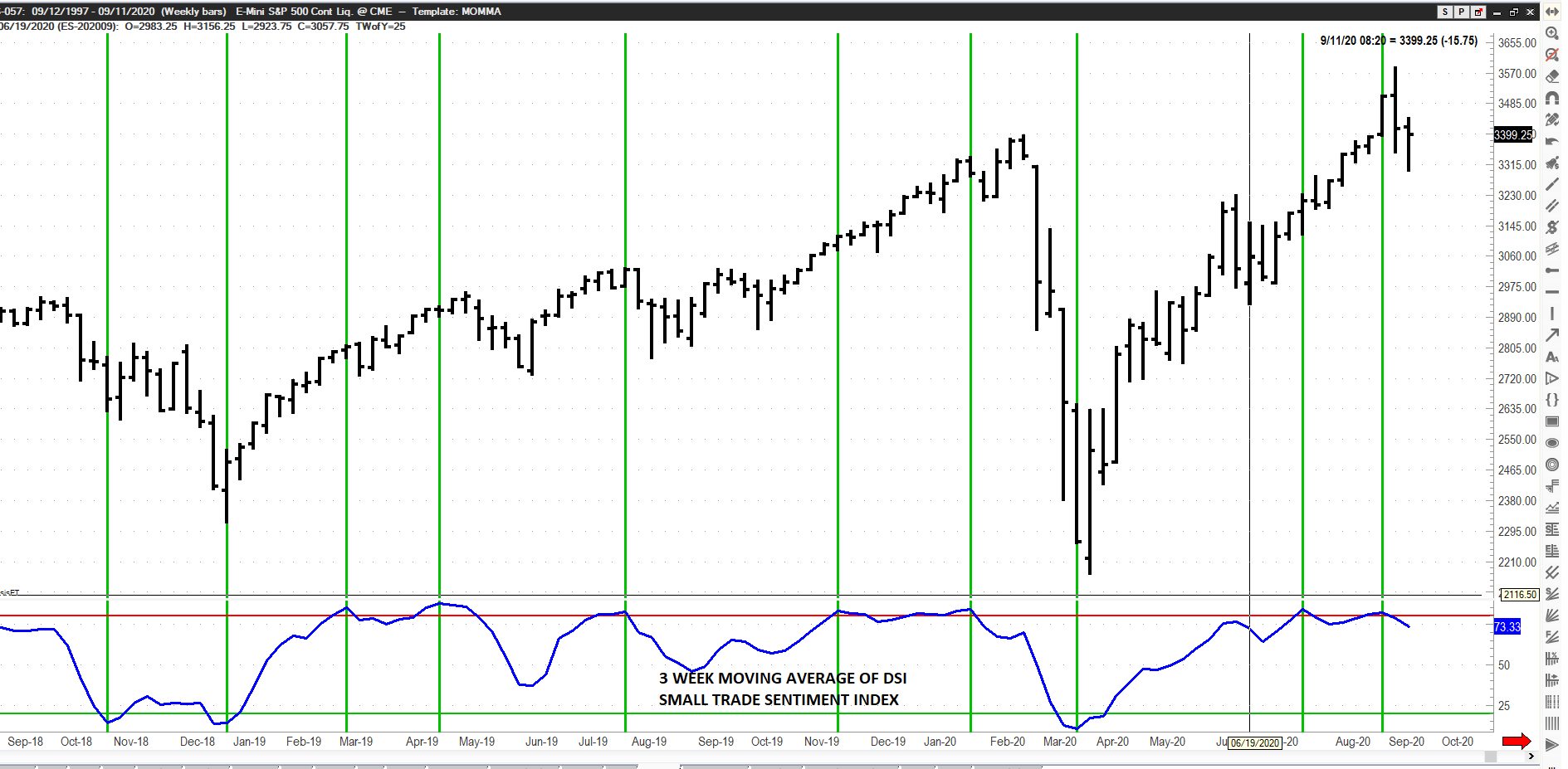

In this three-part article on small trader sentiment I will share with you the findings of my research so that you can determine for yourself its validity and potential in your trading. First, I will leave you with two charts to ponder until the next installment of this article. The first chart shows stock index futures (S&P) with The Daily Sentiment Index plotted at the bottom of the chart. The scale at the bottom of the chart is percent bullish opinion. Take a few minutes and look at the relationship between the two. What has happened when small traders were 80% bullish or more or 20% bullish or less? More next time.

To learn more about Jake Bernstein, please visit JakeBernstein.com.