Since 1987 I have been tracking small trader market sentiment daily, correlating its readings in various ways to determine whether small-trader sentiment can be used as an indicator for trading, timing, and possibly predicting market moves, says Jake Bernstein.

The massive amount of data that I have collected since then has led me to conclude that a number of important relationships exist between price and small-trader sentiment, which can be very valuable whether trading for the short-term, intermediate-term, or long-term.

After sharing with you some of the conclusions I have reached about my market-sentiment survey (called the Daily Sentiment Index – DSI) I will show you some charts about the various ways in which the DSI can be used. In examining my conclusions, remember that the daily sentiment index is not based on a mathematical manipulation of prices as is the case in most market indicators. Rather the DSI comes through the filter of the human brain and is therefore highly likely to reflect the trader’s assessment of markets. This is a very important distinction that must not be forgotten. I say this because well over 90% of all market indicators are derived directly from the manipulation of price or other market generated information.

My conclusions about small-trader sentiment:

- The small trader, contrary to popular trading myth is not always wrong

- A more precise way to state the relationship between small-trader sentiment and the market price trends is to say that when the vast majority of small traders agree on a particular orientation they are likely to be wrong

- Small trader sentiment tends to be a leading indicator as opposed to a lagging indicator such as moving averages

- The small trader as a group can remain excessively bullish or bearish for an extended period of time, however, their bullish or bearish sentiment extremes tend to lead market turns

- Small-trader sentiment as measured from 0% bullish to 100% bullish can be used as an indicator in the same way that other indicators are used (to be illustrated)

- Small-trader sentiment can remain at extreme levels for extended periods of time

- When using small-trader sentiment as a timing indicator, the best procedure is not to trade in the opposite direction immediately rather to use DSI as a set up or early warning system

- The daily sentiment index should always be used with traditional timing indicators as a complete methodology

- There is an interesting and highly predictable inverse relationship between small-trader negative sentiment and commercial buying as indicated by the Commitment of Traders report

Here are a few charts, along with my comments, to support some of the statements above. I will be adding more granularity to this topic, as well as illustrations in the next part of this series.

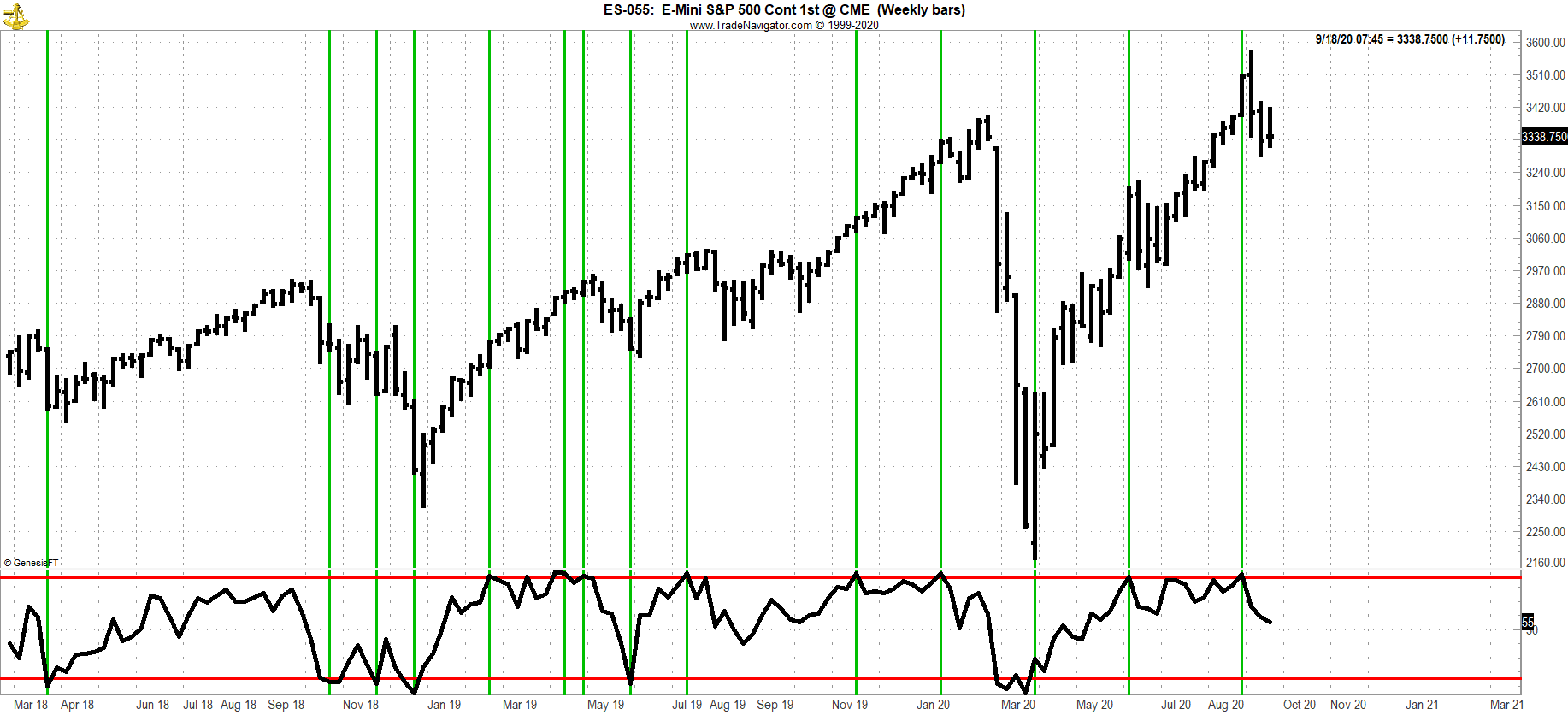

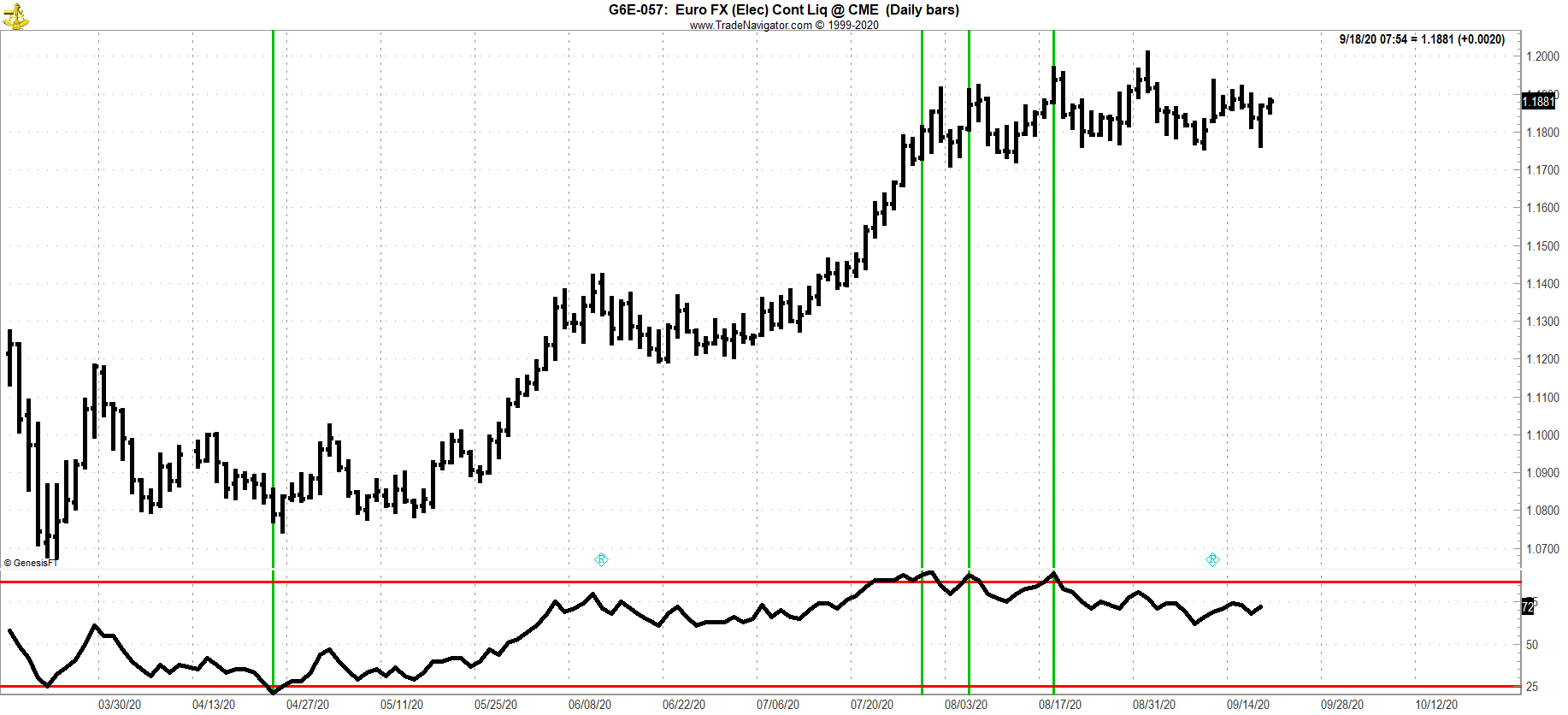

Weekly stock index futures versus extreme highs and lows in daily sentiment weekly readings. Note the tendency of small-trader sentiment to be a leading indicator of tops and bottoms.

To learn more about Jake Bernstein, please visit JakeBernstein.com.