Fresh off the success from our iPath Bloomberg Cocoa Subindex (NIB) trade, we’re going to stick to the commodities theme, states Jay Soloff of Investors Alley.

The dollar continues to come under pressure, which is bullish for all types of commodities. But, anything relating to precious metals is even more attractive.

The thing is, we’re dealing with what’s called negative real yields. That is, even if you are fortunate to get positive interest rates on bonds and bills, if you factor in the cost of inflation, your true yield is actually negative. That’s one reason why gold and silver have become so popular lately.

As impressive as gold and silver's price appreciation has been, it's been even better for the miners. However, there may still be room to run for miners—in particular, junior miners. Both gold and silver junior miners are still a long way off their highs from 2011, the last time gold was this expensive.

We’re going to take a shot on junior silver miners, using an exchange-traded fund (ETF), so we get exposure to as many junior silver miners as possible. See trade details below.

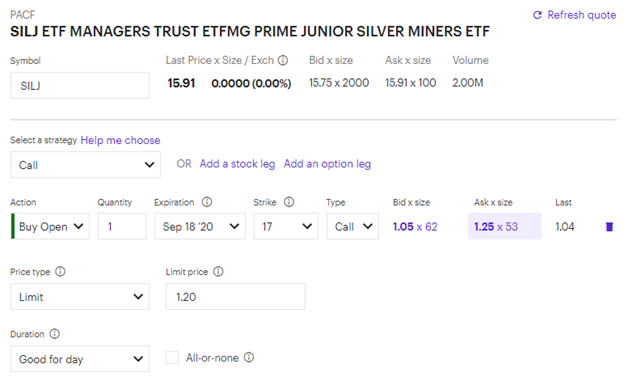

Trade Recommendation:

Buy to open the ETFMG Prime Junior Silver Miners ETF (SILJ) September 18th 17 calls for a price of around $1.20

As I write this, SILJ is trading at $15.91. The market remains volatile, so the price could change a lot by the time you see this recommendation. That's why I'm setting the buy up to price for the calls up to $1.60. The bid/ask spread could be wide, so try setting your limit order as close to the midpoint as possible to start with. You can always move the price until you get filled.

Remember to refer to the checklist if you are new to trading options. For example, step #7 is looking at the strike of the option. In this case, make sure you are choosing the 17 strike (call).

At expiration (in 38 days) our breakeven point is $18.20. I’m looking for a move to $19.00 or higher in the next several weeks. The most we can lose on the trade is whatever you pay for the premium ($120 per contract at the current price). Every dollar above the breakeven point is worth $100 to us at expiration per contact owned. However, if SILJ moves higher quickly, it will change the math (in our favor).

Remember once again, try to get filled at the midpoint of the bid/ask spread and then move the price up from there. And, don’t forget to follow the steps in the checklist, and especially double-check all the trade details before you send your order in (step #10). The price may change quite a bit due to market conditions, so be sure to check the bid/ask spread before you enter your order. Keep in mind, I may send extra trade alerts that don’t coincide with the date of one of our biweekly issues.

Trade Screenshot:

Chart:

Open Trade Review:

Hawaiian Holdings (HA) October 16th 18 Call

Buy price: $0.90 (not including roll price)

Current price: $0.70

Days to expiration: 66

HA has come back up a bit with the market, but we still have plenty of time left on this trade to wait it out.

Frontline (FRO) October 16th 8 Call

Buy price: $0.70 (not including roll price)

Current price: $0.70

Days to expiration: 66

FRO continues to push higher, sitting at $8.20 as I write this. We’re looking for a move to at least $9, but preferably closer to $10.

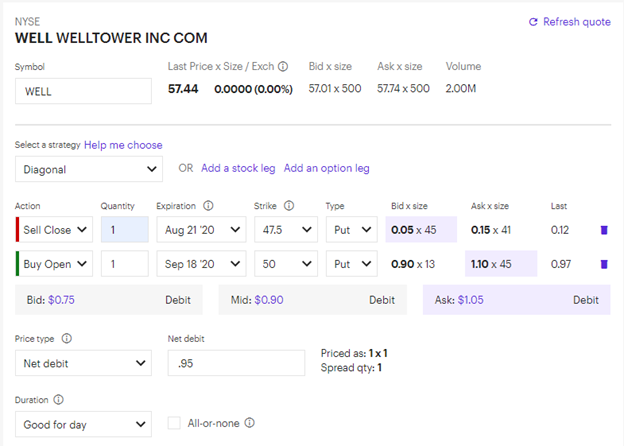

Welltower (WELL) July 17th 47.5 Puts

Buy price: $1.80 (not including roll price)

Current price: $.15

Days to expiration: 10

The rally in stock has hurt all of our bearish positions, but WELL probably most of all. I still believe this stock is due for a major sell down, so we're going to roll it out to September and raise the strike. That is, we'll close the 47.5 puts and buy the September 50 puts. You can do it in one transaction, as seen below, or as separate trades if you prefer.

Trade Details:

TJX Companies (TJX) August 21st 47.5 Puts

Buy price: $2.25

Current price: $0.20

Days to expiration: 10

Our TJX puts are being hurt by the market rally, too; but in this case, we have earnings coming out prior to expiration. At the moment, there’s no action needed as we’ll wait for earnings to decide what comes next.

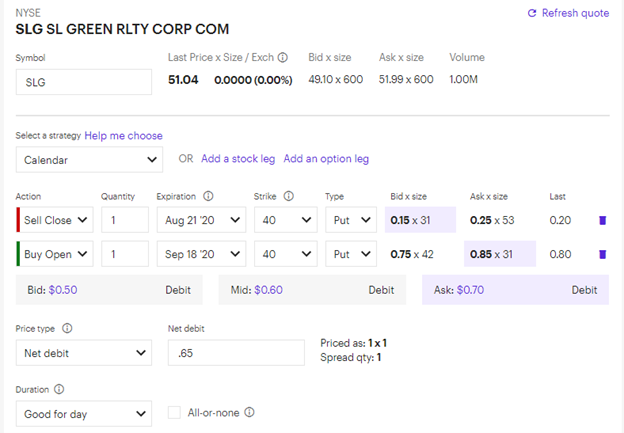

SL Green Realty (SLG) August 21st 40 Puts

Buy price: $1.40

Current price: $0.15

Days to expiration: 1

Like the other bearish trades, we have (the other puts), SLG has been hit by the broad market rally. More than any of our other positions, I believe commercial real estate is doomed to massive underperformance this year. As such, we are rolling this trade out to September. Unlike with WELL, we have to use the 40 strike again in September because the options are too expensive to use a higher strike. Like the WELL trade, you can roll out the trade as seen below or do two separate transactions.

Trade Details:

Discussion Topic: Options Analytics

Every now and then, I like to discuss somewhat more advanced topics related to options trading, usually things I haven’t spent a lot of time on in our educational space. Today, we'll revisit a discussion on options analytics—that is, how to analyze options and what metrics to use. In particular, I want to talk about the so-called Option Greeks.

We’re going to talk about the three most important Greeks in some detail, and mention another few you may have heard of. You don't need to internalize these for the types of trades we do in Options Floor Trade Pro, but if you want to advance your understanding of options, this is the place to start.

- Delta: The most important Greek for us, delta, lets us know how much exposure our option has to the price of the stock. So, for instance, a 50-delta option will move $0.50 as the stock moves $1 (up if it’s a call and down if it’s a put). The delta also represents a very rough, short-term estimate of probability. The 50-delta option (also known as the at-the-money option) has roughly a 50% chance of finishing in-the-money. The higher the delta, the more expensive the option is (in terms of absolute price) because there’s a higher probability it finishes in-the-money. A 100-delta option moves the same as the stock does.

- Theta: I’ve mentioned theta—which is also called time decay—before. It’s the amount the price of an option goes down (decays) as you get closer to expiration. That’s because when an option expires, any excess value (the part of the option that isn’t intrinsic—basically the entire amount of an out-of-the-money option) will have to go to zero. Theta allows you to measure how much your long option will lose per day. The numbers grow exponentially higher as you approach expiration.

- Vega: Vega is important, but we don’t talk about it that much because we mostly deal with shorter-term options. Vega measures how much a change in volatility will impact the price of an option. The higher the vega, the more an increase in volatility will raise the price of an option. Vega is mostly applicable to options that are far away from expiration, so it doesn’t impact us all that much. The exception is when a major volatility event occurs (like getting charged with accounting fraud), in which case volatility can have a large impact on even short-term options.

- Gamma: I won't get into gamma much here, except to say that it measures the acceleration of delta. It isn't important to us, but it is vital to market makers and professional traders.

Rho: This is how much an options price moves because of changes in interest rates. It only impacts very long-term options and has virtually no effect on short or medium-term options.

Analyst’s Note:

Besides the new trade recommendation, we have two action items in this issue related to portfolio maintenance. Please make sure you review the Open Trade Review section above. Also, just a quick reminder that if you don’t hear from me on a certain trade between issues, it means that I’m still recommending a hold. Of course, that doesn’t mean you can’t take profits/cut losses with your own risk tolerance in mind.

Learn more about Jay Soloff at Investors Alley.