As you continue to hone your craft of being a “trader,” it’s important to understand why it’s so crucial to become an expert stock picker, says Danielle Shay of Simpler Trading.

Let’s talk about Best Buy (BBY). This one right here, stuck out to me because it’s a hot stock; it’s one of the hottest stocks within this sector—which is retail.

Now, something that’s been completely different this year than really the entire time I’ve traded up to this year is you can no longer look at one sector and say, “Oh this sector (retail for instance) is going great, let's just trade this sector.” In a market environment like this, you have to become an expert stock picker. You have to be able to pick specific stocks within a specific sector and trade them. Why? Because the way that the pandemic has impacted different companies has been incredibly disproportionate.

Best Buy is one of the companies that’s been impacted in a positive manner by the pandemic, instead of the negative—and that’s one of the reasons why I was interested in trading it.

Now looking at Best Buy on the chart, there were a couple other different reasons to trade it:

- There was a squeeze

- There was a Ready. Aim. Fire! buy signal

- It was holding up on support

- And I had a target at 115

Now when the market gets volatile, typically I’ll look for easy targets instead of full targets. What do I mean by that? An easy target is going to be at resistance versus a full extension. So, in this instance I was placing a conservative trade at an easy target.

How Did I Do This?

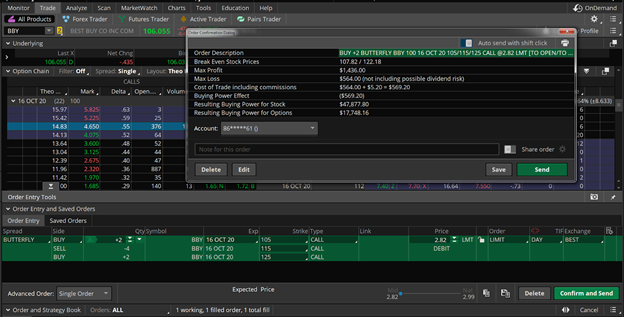

By placing a butterfly that was $10 wide, that cost me $2.82.

How Did It Pan Out?

Well, I took this trade in my Stacked Profits Mastery Program because it had a really solid risk to reward ratio: risking 1 to making a potential of 3 (max profit). In the end, I got into the trade for $2.78 and got out for $4.41. A small, conservative trade with a fantastic percentage gain.

And this was all made possible by being an expert stock picker and picking a ticker and a target zone that was realistic and within the proper time frame.

So, as you can see from this screenshot…

Best Buy hit just below my target zone at 114.2699 when I took it off.

Why Would I Want to Highlight This?

Well, you might also notice within the screenshot, that I still had 15 days on the trade. And you may ask, “Well Danielle, didn’t you say you could make a potential 3X on this trade?”

Yes, you could’ve, if you had less time on the butterfly.

In this instance, I gave it more time because of all the ongoing volatility due to the upcoming election. Because of all this volatility right now I'm taking conservatively aggressive trades as a general rule of thumb. So, I’m targeting about 50% instead of 200-300%. With this volatility, I’d rather knock out singles and doubles than shoot for homeruns.

Ultimately, in this type of market environment you’re likely to be more successful with an approach like this.

To learn more about Danielle Shay, visit SimplerTrading.com.