When asked how to play the election, we generally respond with "don't." However, we came across an option spread that seems to make a lot of sense, says Carley Garner of DeCarleyTrading.com.

It stands to make money regardless of direction, or even if there isn't a direction. The catch is, there is unlimited risk exposure on both sides of the trade and the margin required to put it on is steep at about $8,500. Further, this trade should not be entered into an account with less than $25,000 (preferably more). Thus, for some of you it might be a paper trade and learning experience, but for those willing to play the odds it could be a rare opportunity for a high-probability trade. Here are the details.

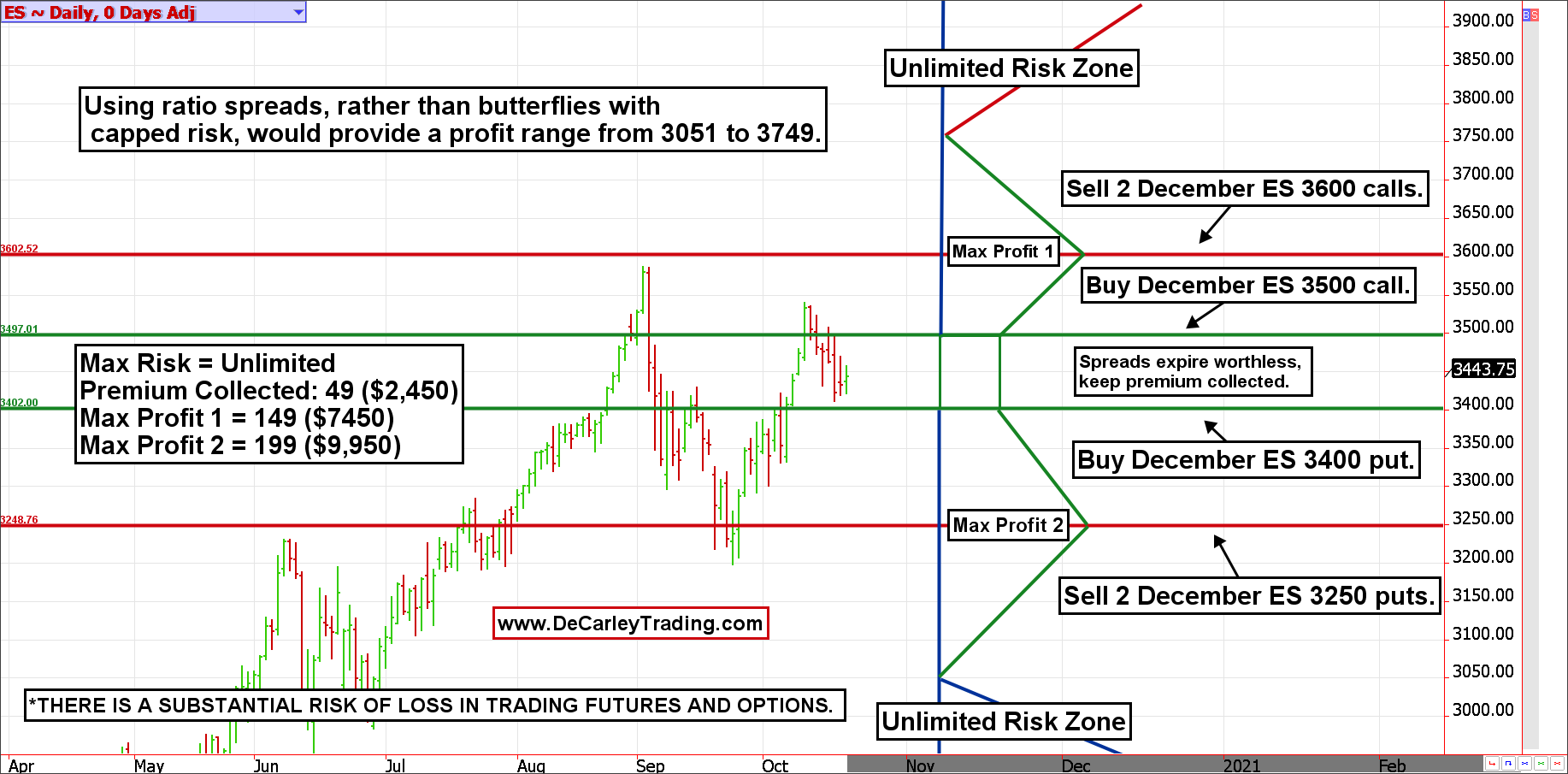

HYPOTHETICAL TRADE IDEA:

**Buy 1 December ES 3500 Call**

**Sell 2 December ES 3600 Calls**

Then...

**Buy 1 December 3400 Put**

**Sell 2 December 3250 Puts.**

**Premium Collected** = About 49 points or $2,450

**Margin** = $8,500

**Risk** = Unlimited above 3,750 or below 3,050 (but the trade makes something anywhere in between)

Because the short legs bring in more premium than the long legs, the trade collects premium to execute in the amount of about 49 points in the E-mini S&P 500 (SPX), or $2,450. This 49 points then acts as a risk buffer and enables the trader to make money even if both of the ratio spreads expire worthless. If the market moves higher or lower, the trade stands to make money on either ratio spread in addition to the premium collected. However, the benefits of the strategy run out at about 3,749 on the upside and 3,051 on the downside. If the trade is held to expiration, the trade breaks even at either of these prices. If the market is beyond these prices (above 3,750 or below 3.050) the trader is exposed to unlimited risk. Also, as the election activities unfold, there is a chance for extreme volatility, which skews the option prices unfavorably. For instance, if the S&P moves higher or lower on election night, the option market might price in a larger price increase for the two short options than is priced for the single long option. This would create a paper loss on the trade even if the futures price is within the profit zone.

These options expire in about 58 days, so there is a lot of time for the world to change. However, we believe the option market is pricing volatility in advance. Thus, unless we get a crash or an unprecedented rally, this strategy stands to come out ahead as expiration nears, after all its profit zone is roughly between 3,050 and 3,750 (depending on fills and transaction costs). The best-case scenario would be the E-mini S&P at 3,250 at expiration. If so, the position would be worth nearly $10,000. But if the E-mini was at 3,600 at expiration the profit would be about $7,500. If both spreads expire worthless (the E-mini S&P is between 3,500 and 3,400, the trade still earns the premium collected (about $2,450).

Of course, there are transaction costs involved (four of them) that work against profits. Also, when dealing with short options, sometimes the profit doesn't materialize as expected until close to expiration, so there could be a feeling of entrapment. And again, spikes in volatility could cause large paper losses as the market digests what could be an interesting couple of months.

To learn more about Carley Garner, visit DeCarleyTrading.com.