The speed and magnitude of the current selloff has led to the development of an indicator setup, which as I describe below in detail, suggests that the market is ripe for a reversal, states Joe Duarte on In the Money Options.

As Europe shuts down, fears of another extended Covid-19 lockdown in the US are on the rise, but with shifting data and regional variations on infections, some positive developments on the treatment front, and a hard-to-explain low number of regular flu cases being reported, Covid is an increasingly tough call at the moment. More likely, the lack of a stimulus package from Congress delivered what might have been at least a technical knockdown for stocks in the short term. But that story may have already fizzled out, and if history is any clue as to what the future may hold, it is plausible that this selloff will be just another opportunity to buy a profitable dip at some point, perhaps in the not-too-distant future.

When that dip comes, is certainly anyone’s guess, but it could come as soon as November 4 or even sooner. Indeed, the only real certainty is that the recovery in stocks is likely to start when there is some type of news event that the algos find enticing such as a stimulus package, a favorable outcome to the election—whatever that is, or a perceived decrease in the Covid-19 threat.

It’s All up to the Machines and Their Handlers

Of course, we should not get ahead of ourselves, as it is just as plausible that the market finally plunges into a bear market. After all, artificial intelligence is just that; artificial. The truth is that we are dealing with machines programmed to respond to headlines and front run trades at the exchanges in a fashion designed by their programmers; people who bring their own biases along with the highs and lows of their lives into the office and, like anyone who’s ever had a bad day at work let it may get the best of them and…oops!

So the bottom line is that none of what we’ve seen so far should be surprising to anyone who’s traded the market over the last decade, the period of time when the machines have finally taken over the majority of daily trading.

Indeed, as I noted last week in this space, there were clearly signs that a big move in stocks was coming. And while I noted that the odds favored an upside move, I also noted: “it makes sense to be prudent, to consider multiple trading outcomes and to be patient while at the same time being prepared for what is likely to be a significant market move as the election nears,” while adding “those investors who are not willing to take some chances should not be investing or at least being very choosy in where they put their money and how much they wish to risk on any given position.”

Taking Stock of the Moment

Of course, every time there is a massive selloff, the instinctual response may be to panic, especially when the market is making new lows on a regular basis. And while I take the market’s action seriously and I’m acting accordingly, it’s equally important to review trading principles and to stay disciplined. So here are the major ones to consider:

- Don’t fight the Fed. The Federal Reserve continues to pump $130 billion per month into the market. Certainly, that may not be enough in the short term. But it’s not chump change either, which means that at some point, when things calm down, the market will again recognize the Fed’s actions and stocks will be more attractive.

- Don’t fight the market’s momentum. With the NYSE Advance Decline line (NYAD, see below) delivering a sell signal as of 10/27/2020, it’s not a good idea to be very aggressive just yet, although if you wish to be aggressive you can use declines to add to positions that are holding up, which are showing relative strength.

- Use prudent sell stops. By placing sell stops at 5-8% below your initial purchase price and continually ratcheting them up as a stock advances you are more likely to preserve profits or get out of a position that is not working out in its early stages.

- Manage each stock individually. As the market falls, it becomes most important to see how stocks in a portfolio behave. If the stocks you own are not falling with the market, there is no reason to sell them as long as they remain above their sell stops.

- Always plan for the next buying opportunity. Market declines are the best opportunities to build your shopping list for the next rally. Thus, as your current stocks get stopped out, let the cash in your account build up as that will be your ammunition for the next buying opportunity.

- Build your shopping list now. While others panic and worry, use this opportunity to build your shopping list for the next up leg.

Critter Solutions King Rollins Capitalizes on Good Management and a Just in Time New Business Line

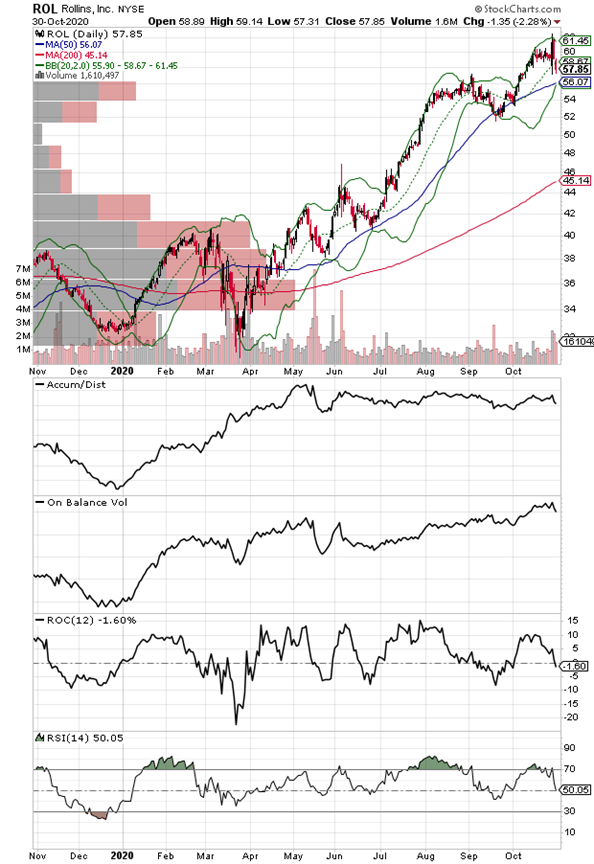

As the stock market was crashing and burning on 10/28/2020 shares of exterminator giant Rollins Inc. (ROL) were moving steadily higher after a nifty beat of its earnings and revenues expectations. Moreover, the beat came as much from the company’s cost-cutting initiatives and lower fuel expenses, as it did from the steadily growing new business brand it created in response to Covid-19—Vitalclean.

And while Vitalclean specializes in keeping businesses clean from the pandemic, Rollins’ main business, exterminator services—think Orkin and other general pest control brands including those involved with attic critters: rats, possums and the like—is growing its footprint in the residential segment as stay-at-home workers are more conscious of their surroundings and their attics.

The stock is slightly overbought, and it did pull back from its breakout slightly to end the week of 10/29/2020, but Accumulation Distribution (ADI) and On-Balance Volume remain positive and the company’s future guidance was solid. So even if ROL goes into a consolidation pattern it’s probably worth using the consolidation as an opportunity to own some shares or add to the position in a measured way given the market conditions.

Have you put your shopping list together? Maybe I can help. I have added two new stocks this week, which are benefitting from the changing trends in society due to Covid-19 while showing some excellent relative strength in a tough market.

Bollinger Bands Suggest Selloff Has Gone Too Far

Last week, I noted that the Bollinger Bands surrounding the NYAD Advance Decline line were predicting a major move in stocks as they were moving toward their 20-day moving average; usually a sign that volatility is coiling up and that something is about to happen. Certainly, that was a correct call.

But now, the same Bollinger Bands are telling us that the selling has gone too far. Specifically, the NYAD moved outside the lower band, which at first indicates that the direction of the move is accelerating. However, and more important, is the fact that once this happens, it’s usually a prelude to a trend reversal, as the trend goes too far in one direction and eventually reverts to the mean. In this case, this is a signal that the selling is nearer to exhaustion than to the start of the trend.

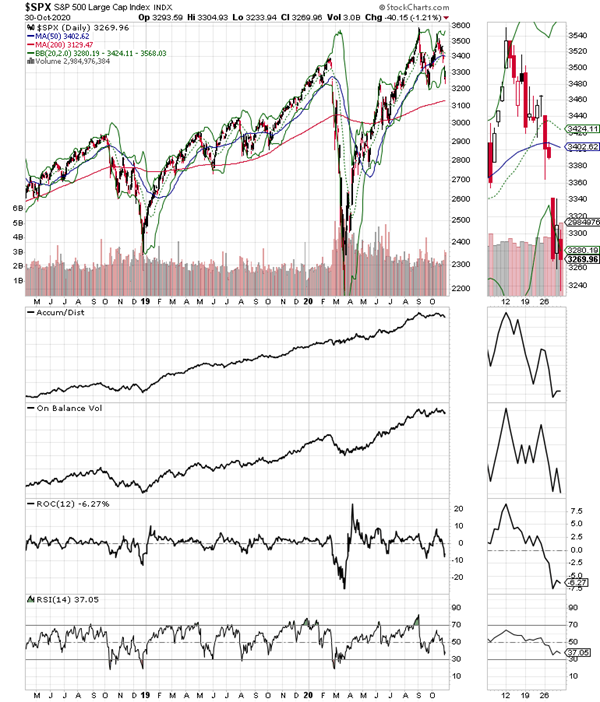

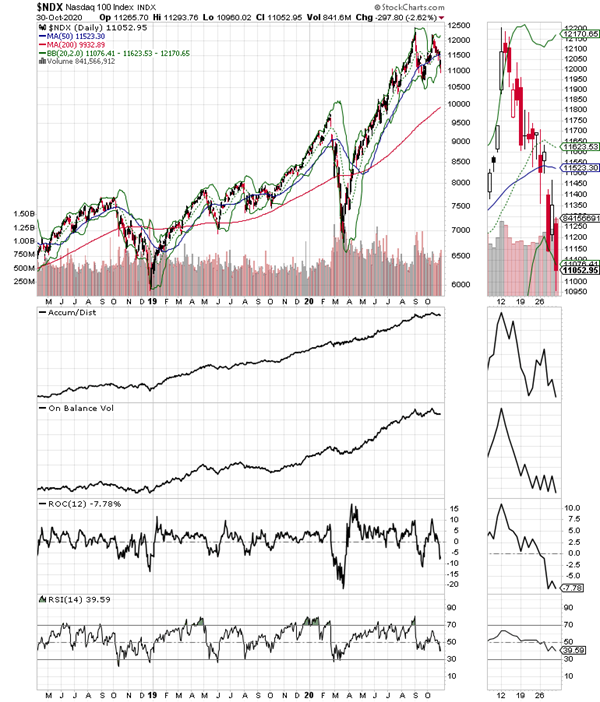

A similar picture is now evident in the S&P 500 (SPX) and the Nasdaq 100 (NDX) indexes. Nevertheless, this observation, while useful is no guarantee that the selling will stop tomorrow or even in a week. We simply know that based on the indicator’s design and its past history and accuracy, the selling is now well on its way and ripe for some sort of reversal at some point.

In other words, we are now in that grey market zone where psychology and momentum wax and wane and traders are more likely to trade on emotion rather than discipline. What that means is that we may still see more selling in the next few days or perhaps longer but that the market is now closer to being ripe for a reversal than it was even a few weeks ago.

The bottom line is that, just as I noted last week, investors should now be focusing on the direction of the next move, not of the recent past. Still, it’s important to note that the market is not completely oversold yet as the RSI for NYAD, SPX, and NDX has not hit the 30 mark. Moreover, the long-term test for the bull market is what happens at the 200-day moving averages for NYAD, SPX, and NDX.

This is a great time to have your own set of go to indicators at your fingertips.

Near-Term Bottom Plausible

As the selling goes on, and the fear reaches a crescendo, the odds of any major decline being closer to its end also rise. Nevertheless, it’s never a bottom until the market stops falling. And, of course, although we have indicators that will guide us in making decisions as to when a real bottom is in; it’s most prudent to act cautiously.

So, while it feels as if we may be getting close to a bottom, we don’t know if and when such a bottom and a subsequent trading opportunity will actually materialize. Thus, the best we can do is to manage our portfolio via our trading rules, using sell stops, hedging when appropriate, and letting our cash build up so that we are ready for when that bottom does appear and the uptrend returns.

I own shares in ROL as of this writing but may be stopped out at any time due to changing market conditions.

To learn more about Joe Duarte, please visit JoeDuarteintheMoneyOptions.com.