When we add a protective put to our covered-call trades, the strategy is known as a collar. To reduce the monthly cost of the long put, some investors will consider using longer-term put expirations. This article will explore the pros and cons of this approach using Ciena Corp. (CIEN), explains Alan Ellman of The Blue Collar Investor.

Collar Trade Information on 4/21/2020

- 4/21/2020: CIEN trading at $44.04

- 4/21/2020: 5/15/2020 $45.00 call has a bid price of $1.52

- 4/21/2020: 5/15/2020 $42.00 protective put has an ask price of 1.17

- 4/21/2020: 1/15/2021 $42.00 protective put has an ask price of $6.10

Nine-month Cost of Protective Put Using Current Option-Chain Data

- 1-month expiration: $1.17 x 9 = $10.53 per-share

- 9-month expiration: $6.10 or $0.68 per-month

- Difference = $4.43 or a 42.1% discount using the 9-month expiration put

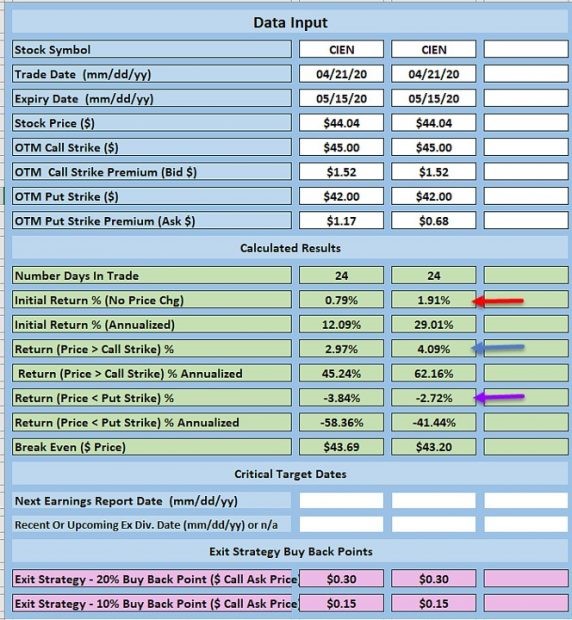

Collar Calculations Using the Two Monthly Put Costs: The BCI Collar Calculator

CIEN Calculations with the BCI Collar Calculator

- Red arrow: The 9-month put expiration results in more than doubling the initial returns

- Blue arrow: The trade with upside potential shows that the 9-month put results in a higher return by 1.12% per month

- Purple arrow: The maximum loss is better by 1.12% using the 9-month put expiration

Disadvantages of the Collar with Long-Term Protective Puts

- Trade success depends on share price remaining in a narrow trading range for 9-months

- Our bullish assumption on the underlying security may change

- Forces us to maneuver through 2-3 earnings reports (partially protected by the long put)

- If share price accelerates significantly, we maximize the covered-call trade and lose on the put side. Assignment prior to put expiration may result in a loss.

- If share price declines below the breakeven, we lose money

Discussion

Unless we are avoiding ex-dividend dates (may use 2-month expirations) , my preference is to stay with 1-month obligations. Although the monthly cost of the put will be more, having the flexibility to re-assess our bullish assumptions on a regular basis is more important. Avoiding earnings reports is also more valuable than a few percentage points.

Learn more about Alan Ellman on the Blue Collar Investor Website.