It goes without saying that there is no forex trading strategy that can eliminate the risk and always guarantee success. However, there are many hedging techniques the market participants can certainly use effectively to reduce their risk exposure and the amount of their potential losses, explains Konstantin Rabin of Axiory.com.

Here it is worth mentioning that according to the regulations, taking both buy and sell positions within the same currency pair is prohibited in many countries. For example, in the United States a trader must close the buy position for a given currency pair before he or she will be able to sell the pair.

Consequently, nowadays traders simply cannot use this type of direct hedging strategy. In fact, one can even argue that even if it were allowed, this approach would not be that effective, because of expenses associated with forex spreads.

However, this does not mean that traders cannot use other types of hedging techniques. In fact, there are some simple hedging strategies, which do not necessarily require advanced knowledge of the technical and fundamental analysis of the forex market.

One of the most popular hedging strategies is to take opposite positions with highly positively correlated currencies. This is because the currency pairs, which are highly positively correlated, tend to move in the same direction. Consequently, when the market participants use this strategy, it is likely that losses with one position will be compensated by gains made with the second trade.

Example of EUR/USD and GBP/USD

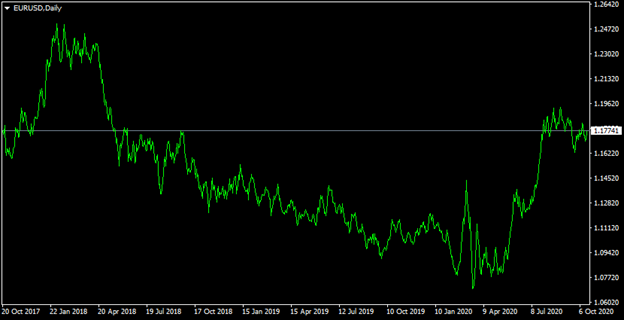

There are indeed dozens of currency pairs with a strong positive correlation. To illustrate one example of this, we can compare two charts. The first diagram below shows the exchange rate of the EUR/USD currency pair during the last three years:

As we can see from the above diagram the EUR/USD pair has essentially gone through three stages since October 2017. At that time, the euro was trading close to the $1.18 level against the US dollar. However, during the subsequent months, the single currency was in a solid upward trend, with the pair rising all the way up to the $1.25 level.

Despite those impressive gains, we can also notice that there was a major reversal during spring 2018, where the US dollar started regaining some of its recent losses. This downward trend for the EUR/USD currency pair has lasted for two years, with the euro eventually dropping all the way down to the $1.06 level during March 2020.

However, it is worth remembering that at that time the US Federal Reserve has made some drastic rate cuts, eventually reducing its federal funds rate down to 0% to 0.25%. It goes without saying that this had a negative impact on the value of USD. The result of this development was the resurgence of the euro. Since April 2020, the single currency began to recover, and by October 2020 the euro trades close to the $1.18 level.

Now, let us compare this chart to the GBP/USD diagram, which shows the exchange rate movements of this pair during the same period:

As we see from the above chart, by October 2017, the GBP/USD pair was trading close to the $1.31 level. During the subsequent months, the British currency has made some notable gains, eventually rising all the way up to the $1.43 level by April 2018. Despite this persistent appreciation of the pound, this upward trend has not persisted for long. From the next month, the GBP/USD has started a long-term downtrend.

This decline has persisted for approximately two years. The outbreak of the Covid-19 pandemic has only accelerated this downturn, with GBP/USD eventually going all the way down to the $1.15 level by March 2020.

However, this essentially marked the recovery of the currency pair. During the subsequent months, the British currency has made some notable gains and by October 2020 has already recovered to the $1.29 level.

So, as we can see from those two charts, EUR/USD and GBP/USD are highly positively correlated with each other. In fact, during the last three years, they have essentially gone through the same uptrends and downward trends. Obviously, this does not mean that the exchange rates with both of those pairs were identical. As we can see there were some cases of divergence. However, overall, they did move in the same directions most of the time.

This is exactly, the currency correlation hedging strategy comes into play. So, in this case, traders can hedge their risk exposure in two ways:

- Buy EUR/USD, Sell GBP/USD

- Sell EUR/USD, Buy GBP/USD

Because those two currency pairs have such a high degree of positive correlation, opening one long and one short position with each of them can be one way to use a correlation hedging strategy. The main idea here is that losses with one currency pair is likely to be offset the gains traders make with the second currency pair.

Although it is important to mention that there is no guarantee that this approach will always ensure that traders avoid any losses. As mentioned before, sometimes due to several reasons even some highly correlated currency pairs might diverge from each other for some time. So, this is something to be aware of.

Using Negatively Correlated Currency Pairs in Hedging Strategy

Here it is also important to point out that utilizing the currency pairs with a strong positive correlation is not the only way to form a proper hedging strategy. One alternative here is to make use of highly negatively correlated currencies. This means that given currency pairs tend to move the opposite directions most of the time.

To illustrate one example of that, we can take a look at this daily USD/CHF chart:

As we can observe from the above chart, three years ago, the USD/CHF pair was trading close to the 0.98 level. During the subsequent months, the US dollar suffered some sharp losses, eventually dropping all the way down to 0.92 level during February 2018. However, it is worth remembering that at that time the US Federal Funds rate was still rising, reaching 2.5% by the end of the year. At the same time, the Swiss National Bank, also known as the SNB, still maintained the rates at -0.75%.

So obviously, the US dollar had a considerable advantage over the Swiss franc in terms of the nominal interest rates. Therefore, it is not surprising that the American dollar started to recover from those losses, and by May 2019 has even managed to surpass the parity level, reaching the 1.02 mark with the Swiss franc.

However, during the following months, the US Federal Reserve started cutting the interest rates, weakening the US dollar in the process. As a result of this development, the American currency began its decline, eventually dropping all the way down to 0.91 level by October 2020.

So, as we can see here, USD/CHF has a strong negative correlation with EUR/USD and GBP/USD. Therefore, traders can open the following positions for the purpose of hedging themselves against the potential losses:

- Buy USD/CHF and EUR/USD

- Buy USD/CHF and GBP/USD

- Sell USD/CHF and EUR/USD

- Sell USD/CHF and GBP/USD

Therefore, traders can use currency correlation hedging strategy by opening long or short positions with two highly negatively correlated currency pairs. Just like in the previous case, traders are likely to offset the losses suffered from one currency pair, with gains made with another position.

Exceptions to the Rule

It is essential to keep in mind that despite all its uses and advantages, the currency correlation strategies cannot always guarantee a 100% success rate. We have seen from the above charts that in some cases there was a significant amount of divergence between highly correlated currency pairs.

The reasons for this can be several. For example, the interest rate changes by the central bank can have a major impact on the exchange rates and can easily lead to altering normal patterns.

For example, as we have discussed before EUR/USD and GBP/USD are usually highly correlated currency pairs. However, if the Bank of England, for example, makes some notable adjustments in terms of the interest rates or its quantitative easing program, then it might have a significant impact on the GBP/USD, but it also might not influence the EUR/USD pair.

In addition to that the economic news announcements, such as consumer price index and gross domestic product reports, other publications can also have a notable effect on the exchange rates.

Consequently, it is always important to keep in mind that when considering currency pairs for forex correlation hedging strategies, it is helpful to also take a look at the economic and technical indicators for the given currency pair, before making any trading decisions.

By Konstantin Rabin of Axiory.com - a retail trading brokerage