The stock market is firing on all cylinders as traders bet on more Federal Reserve liquidity and the potential for Congressional gridlock. Yet, with the potential for more election drama over the next few days to weeks, just about anything is possible, states Joe Duarte on In the Money Options.

Certainly, regular readers should not be surprised as to the rally, as I noted here last week that such an advance was plausible and that it “could come as soon as November 4 or even sooner. Indeed, the only real certainty is that the recovery in stocks is likely to start when there is some type of news event that the algos find enticing such as a stimulus package, a favorable outcome to the election—whatever that is, or a perceived decrease in the Covid-19 threat.”

So, as I’ve noted here multiple times, the market now moves primarily based on the Fed’s activity and how the trading machines (algos) handicap the news. And while that may be hard to comprehend, those who fail to adapt to this reality and the ensuing volatility of the market going forward are likely to have a difficult time making money in the markets for the foreseeable future.

The Post-Election Risk

The market is banking on gridlock if Trump loses and Biden takes over, but none of that is certain. Specifically, regardless of who wins, there is no guarantee that there will be gridlock, of what may change in the way of governance or at what pace any change would or could proceed.

Indeed, what is certain at this moment is that nothing is certain, especially as the Trump administration mounts legal challenges in multiple states and the odds of most, or at least some of the cases working their way to the Supreme Court increase. Furthermore, there is no way to predict which way the Supreme Court would rule or what the consequences of any ruling may be both for the markets and for real life.

What it all boils down to is that either candidate may be declared the winner and that it could take all the way through December or even longer for the final outcome to be known. Moreover, given the polarization in the population, the potential for widespread conflict, especially violent conflict well beyond cities is now plausible. Even more daunting is the notion and the possibility that no matter what the final outcome of the election there will be a significant portion of the population that is likely to disagree.

Finally, it is important to consider what the behavioral ramifications would mean for MEL the complex adaptive system composed of the markets (M), the economy (E), and people’s life decisions (L). For example, prior to the election we had two major trends in place. One was the relocation of people from high-tax to low-tax states. And the second one evolved from the first one; the effects on consumer behavior—a housing boom and a used-car-buying boom, along with the explosion in stay-at-home work and its effects on daily life.

Perhaps the most important aspect to consider is what can happen to MEL when you add the effects of the Covid-19 pandemic into the mix, along with the unknown repercussions of what may happen once the election confusion is sorted out; it looks as if the simple-minded algos may have some serious issues to work out.

Welcome to being a human, Mr. Roboto.

Of course, from a coldly clinical market standpoint, as investors we should look to those areas of the market, which would benefit from that highly complex set of circumstances. Yet as interested and highly affected citizens, it is now a possible reality that life as we know it is likely to never be the same again. As a result, it makes sense to consider where the market and the reality of daily life are most likely to meet and to act accordingly.

So here is a final thought on this. It took 36 days to settle the Bush-Gore Florida dispute. That was one state. In this instance, there is the possibility that recounts could occur in at least 5-7 states. Moreover, each state is likely to have different state laws and voting protocols. What it all means is that this will be a significant situation for the foreseeable future.

Is Grocery Outlet the Next Whole Foods?

Grocery store stocks are far from sexy Wall Street fare. Nevertheless, anyone who owned shares of Whole Foods, before it was bought by Amazon.com (AMZN) was likely to have made a lot of money, not to mention when the news of the buyout came. As a result, it’s important to consider that history is bound to repeat. And it could well be that if it does repeat, it could be with the rapidly growing discounter Grocery Outlet Holdings (GO).

Certainly, Grocery Outlet is no Whole Foods in terms of its merchandise or even its target audience. Instead, its business is all about discounting and selling overflow merchandise from other suppliers including wholesalers, as well as other grocery chains.

So, in a sense, its business is a direct opposite from Whole Foods or the non-publicly traded Trader Joe’s, which cater to premium customers whose tastes are more in the organic, non-GMO grocery categories.

But here is what reminds me of the Whole Foods dynamic in GO:

- It’s a rapidly expanding regional chain with huge growth potential as it currently only has stores on the West Coast, Nevada, and Pennsylvania. In other words, it can expand steadily for several years and still not be over exposed.

- The business model is based on local owners who are able to adapt more rapidly and effectively to local customer needs, as well as long-term relationships with its suppliers.

- The company has huge customer loyalty, which ensures stable sales that is likely to increase as the number of stores expands—they reported a 26% year-on-year growth rate in the most recent quarter and provided positive guidance.

From a technical standpoint, the stock is on the verge of an all-time high reached soon after its IPO in July 2019. Accumulation Distribution (ADI), On-Balance Volume (OBV), and Volume by Price (VBP) are all very constructive as well.

NYAD Nears New High – Uptrend Nearly Confirmed

Over the last two weeks I noted a rally in stocks was likely based on the very bullish posture of the New York Stock Exchange Advance Decline line (NYAD). Well, it looks as if the bullish tone has increased further as NYAD has is now near a new high. Moreover, the indicator is well below the overbought area, which means this rally could go significantly higher based on the Fed’s continued money pumping maneuvers into the banking system.

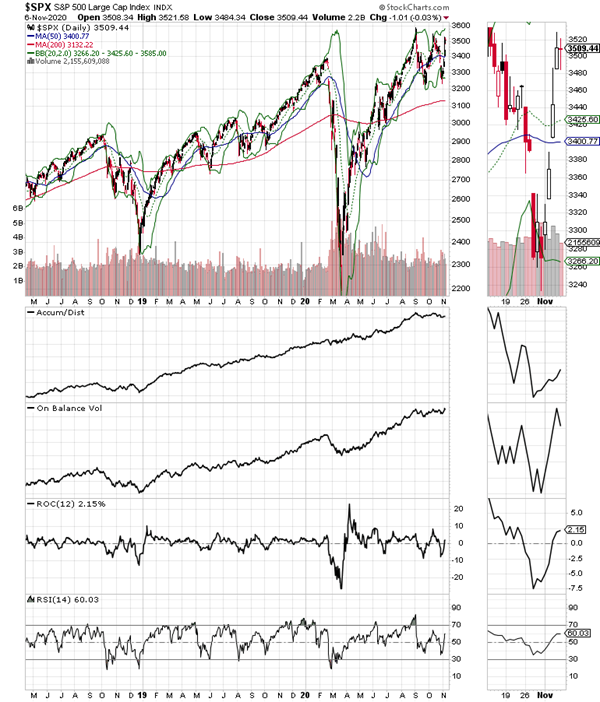

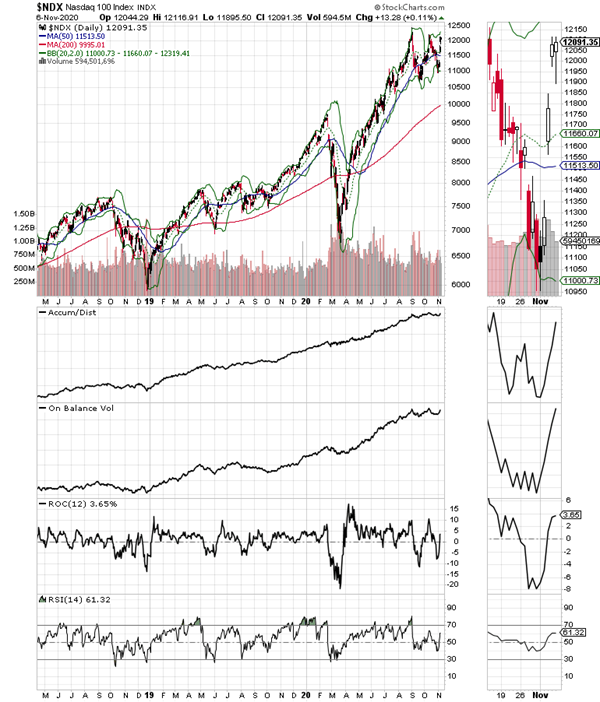

In fact, both the S&P 500 (SPX) and the Nasdaq 100 (NDX) indexes also bounced with both nearly confirming the action in NYAD.

Of the two indices, NDX has been more explosive as the previously oversold technology sector has moved aggressively higher.

Of course, things could always change in a hurry as the legal wrangling in the election develops.

Market Loves Prospect for Gridlock but There is Also a Dark Side to Ponder

The stock market loves the idea that the government won’t be able to accomplish any of the stated policy goals for either of the presidential candidates, especially when the Federal Reserve continues to pump money into the banking system. As a result, the odds of the rally continuing in the short term are above average.

That said, the odds of trouble appearing at any time are equally high as the potential for major violence in the streets is not to be ignored, especially if there are surprise developments as the process moves through the courts. The fact is that no one alive can fathom what a broad-based civil conflict in the United States would be like or what its consequences may be over the longer term, which means that aside from the confusion of the moment, there will be few, if any, with any real ability to provide guidance to those of us who would be affected.

For those reasons, and fully hoping that it doesn’t come to that, it is prudent to be moderate in one’s participation in this rally, while it is folly to be completely out of this market. Specifically, I highly recommend owning small lots and high levels of discipline when it comes to sell stops.

I own shares in GO as of this writing but may be stopped out at any time due to changing market conditions.

To learn more about Joe Duarte, please visit JoeDuarteintheMoneyOptions.com.