When it comes to forex trading one of the relatively less risky methods to use is the so-called carry-trading strategy. This might sound like a complicated term, but the basic premise behind this is quite simple, explains Konstantin Rabin of Axiory.com.

This technique essentially involves borrowing in the currency, which has low interest rates and investing this amount in a currency that has higher interest rates. As a result of this transaction, the market participant can then profit from this interest rate differential and even earn a daily income in the process as well. This payment is also known as swap or rollover.

Now, the fact of the matter is that there are all sorts of traders and investors. Some of them invest money for capital growth, however, there are also some individuals who are just interested in earning a passive income. With stock investing, market participants always have an option to find some solid dividend stocks, purchase them, and hold them for the long term.

However, when it comes to forex trading, in order to earn some passive income, traders have to use carry-trading strategies. The brokerage company pays the interest-rate differentials on a daily basis from Monday to Friday. It is important to keep in mind that during Wednesdays, brokers pay triple the rollover amount, to account for Saturdays and Sundays, where the forex market is closed.

Now, despite the obvious advantages of carry trading, it is important to keep in mind that this strategy is not without its own risks. The fact of the matter is that the invested principal in the trade is not secured and very much subject to day-to-day market fluctuations.

In addition to that, the fact that one currency has higher interest rates than the other one does not mean that it will always appreciate. It is true that everything else being equal, higher interest rates does give an advantage to the currency. However, it is important not to forget that there are dozens of different factors that influence the currency-exchange rates.

Therefore, it can happen that carry traders might still lose money due to adverse market movements. Therefore, it is important to take into account all of the important variables before opening any carry trades. Now let us go through each of these characteristics of carry trades in more detail.

Carry Trading with Major Currencies

For at least during the last two decades, the Japanese yen has been traders’ favorite funding currencies in the forex market. The main reason for this is quite clear: during the second half of the 1990s, faced with the stagnating economy and the persistent deflation, the Bank of Japan has decided to lower rates all the way down to 0.25%.

Obviously, in the aftermath of the 2008 financial crisis, near-zero interest rate policies have been adopted by a significant portion of the world's central banks and there is nothing surprising about it. However, back in the late 1990s, such a thing was very rare indeed. In fact, by 2000, the federal funds rate was as high as 6.5%.

Therefore, the interest rates on the Japanese yen was very low. This allowed the market participants to borrow cheaply in JPY and invest this amount in one of the higher-yielding currencies. One currency that was very popular for the market participants in that regard was the Australian dollar. In fact, by 2007 the Reserve Bank of Australia had increased its cash rate all the way up to 7.25%.

This means at that time, carry traders could earn from 6.5% to 7% annual interest rate with a long AUD/JPY position. The exact amount obviously depended on the commission structure of the brokerage company.

In order to see how those types of trades have affected the forex market, we can take a look at this weekly AUD/JPY chart:

As we can see from the above diagram, back at the end of 2000 the AUD/JPY pair was trading close to 63 level. During the subsequent years, the Australian currency has made some steady gains, until the AUD/JPY pair has reached 107 level. This sort of sharp appreciation was mostly driven by carry traders, who opened and maintained the long positions with this pair for an extended period of time.

However, we can also observe from the chart that during the second half of 2008 there was a collapse with the AUD/JPY currency pair, which wiped out all of the gains the Australian dollar has made during the last seven years before that point.

However, in 2008, in response to the global financial crisis, the Reserve Bank of Australia has decided to reduce its key interest rates significantly, down to 3%. It goes without saying that this decision has made the Australian dollar less attractive for savers, traders, and investors, hence the subsequent depreciation of AUD against other major currencies, including the Japanese yen.

Regardless of this development, by spring 2009 the panic selling of the Australian dollar had ceased. Instead, the Australian currency began its recovery. One of the main driving forces behind this recovery was the fact that unlike some other major central banks like the US Federal Reserve and Bank of England, the Australian policy makers already started raising rates from 2010. As a result, the Australian dollar has made some notable gains eventually rising all the way up to 103 level in 2013, which was not very far from 2007 highs.

However, this type of hawkish policy did not persist for long. Faced with the subdued inflation rate, the Reserve Bank of Australia has cut the rates repeatedly, during the second half of the 2010s. In fact, after the outbreak of the COVID-19 pandemic, the Australian policy makers went even further and reduced rates down to 0.25%. As for the Bank of Japan, since 2016, they have adopted the negative interest rates, currently still at -0.1%.

The series of rate cuts had a negative effect on the value of the Australian dollar. The result of this was the long-term depreciation of the AUD/JPY exchange rate. Consequently, by October 2020, the Australian currency has fallen all the way down to the 75 level.

Another important thing to mention here is the fact that since the outbreak of the COVID-19 pandemic, traders can no longer use major currencies in a way to earn meaningful returns from carry trades. This is because, since March 2020, all central banks managing eight major currencies, such as the US dollar, the euro, the British pound, the Japanese yen, the Swiss franc, the Australian dollar, the New Zealand dollar, and the Canadian dollar have their interest rates at 0.25% or even lower.

It is true that with some brokers, depending on the commissions, some people can still earn some rollover with AUD/JPY pair, but the return there can be as small as 0.1%, or in the base case scenario, 0.25%, which is not very attractive for the majority of traders.

Emerging Currencies as an Alternative

Those recent developments mentioned above have put the carry traders in a difficult position. They can no longer invest in major currencies, basically, they have just two options.

Firstly, they can abandon carry trading and move on to some other strategy to earn a decent return. Or alternatively, they can turn to emerging market currencies, which usually have higher yields compared to the major currencies.

For example, by October 2020, we still have high-yielding exotic currencies, such as the Russian ruble, which yields 4.25%, the Mexican peso (4.25%), the South African rand (3.50%), and the Turkish lira (10.25%).

For example, if the market participants decide to open a short EUR/MXN position, they can earn up to 4% to 4.25% annual interest, depending on the commission rates of the brokerage company. This is because the European Central Bank still holds its key interest rate at 0%, while the Mexican central bank has rates at 4.25%.

Therefore, in the aftermath of the outbreak of the COVID-19 pandemic, the emerging-market currencies can represent an attractive option for carry traders. By buying those currencies, the market participants can earn a meaningful amount of daily income from carry trades.

Risk Associated with Carry Trading with Emerging-Market Currencies

Considering the current situation, buying emerging-market currencies for the purpose of earning daily income seems the only viable option for carry traders. However, this does not necessarily mean that this approach does not have any risk or downsides.

Firstly, it is important to mention that one of the main reasons why central banks from the emerging markets have not adopted the near-zero interest rate policies is the fact that the average inflation rates are much higher in developing economies than in developed countries. Therefore, if they cut the rates down to 0.25% or to 0%, then it is highly likely that the inflation rate will simply get out of control and cause some serious problems for the economy.

Therefore, most central banks in the emerging economies are forced to keep high interest rates in place, to restrain the inflation rate. However, one downside of this reality is the fact that according to the purchasing power parity, also known as the PPP theory, currencies with higher inflation rates in the long term tend to depreciate against the currencies with lower inflation rates.

Consequently, it is safe to conclude that holding long positions with emerging-market currencies for an extended period can be quite risky. To illustrate this, we can take a look at this daily USD/RUB chart:

In terms of the interest rates, the Russian ruble is indeed one of the most attractive currencies in the market. In fact, by holding short USD/RUB positions traders can potentially earn around 4% annual interest from the brokerage firms.

However, as we can observe from the above diagram, three years ago, the USD/RUB pair was trading close to the 57.50 level. Initially, the Russian currency has made some gains, with the pair falling all the way down to the 55 level. However, from spring 2018, the US dollar has regained its losses and after more than two years of steady gains has reached the 76.50 level against the Russian ruble. Obviously, this was not the case in a straight line. In fact, there were at least three occasions, when the pair has faced a sharp correction.

However, the fact of the matter is that, despite those types of corrections, the USD/RUB pair still trades 33% higher than three years ago, which clearly demonstrates that the Russian ruble is in a long-term decline. Consequently, holding a short USD/RUB or EUR/RUB position for an extended period can be very risky and can lead to some losses in terms of the trading capital.

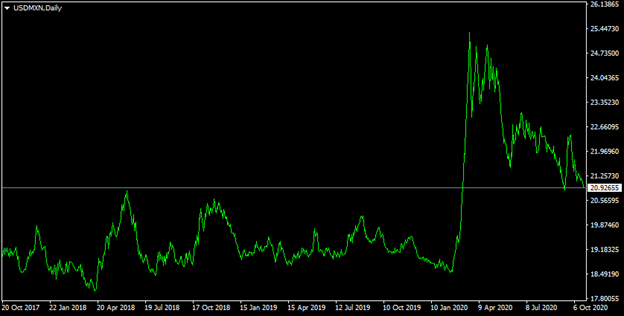

At this point, it is also worth noting that the USD/RUB pair is not the only example of the long-term depreciation of the emerging-market currency against the major currency. Here, on this daily USD/MXN chart we can look at another example of such a scenario:

As we can notice from the above diagram, three years ago, the USD/MXN pair was trading close to the 19 level. The US dollar did make some gains during the subsequent months and years, but it was during the outbreak of the COVID-19 pandemic which has seen the largest gains from USD/MXN, which has reached the 25.40 level by March 2020.

Since then, the Mexican peso got some breathing space from the market and started to regain some of its recent losses. As a result of this latest trend, the USD/MXN pair has reached the 20.90 level by October 2020. This means that the USD/MXN pair still trades 10% higher than at the beginning of this period.

As we can see from those examples, opening short positions with exotic currency pairs and holding them for an extended period can present a significant risk for the market participants.

By Konstantin Rabin of toponlineforexbrokers.com - a website reviewing online trading brokers.