The poor man’s covered call (PMCC), also known as a long call diagonal debit spread, is where deep in-the-money (ITM) LEAPS options are used in place of the long stock position, explains Alan Ellman of The Blue Collar Investor.

As with all strategies, the PMCC has its advantages and disadvantages but the main reason this strategy appeals to retail investors is that the cost to enter this trade is much less than a traditional covered-call trade. Options cost less than stocks.

Selecting the Best Delta for Our LEAPS Options

The reason we use deep ITM LEAPS strikes is because the closer to a Delta of 1, the more the price movement of the option will mirror that of the stock. Therefore, the BCI guideline is to use a Delta of .75 or higher for our LEAPS strike.

Since there will be several strikes to select from, we factor in the following:

- Cost of LEAPS must align with our portfolio cash available

- The strike selected must align with the BCI initial trade execution required formula

- The initial time-value returns must coincide with our stated goals

Real-Life Example with Intel Corp. (INTC)

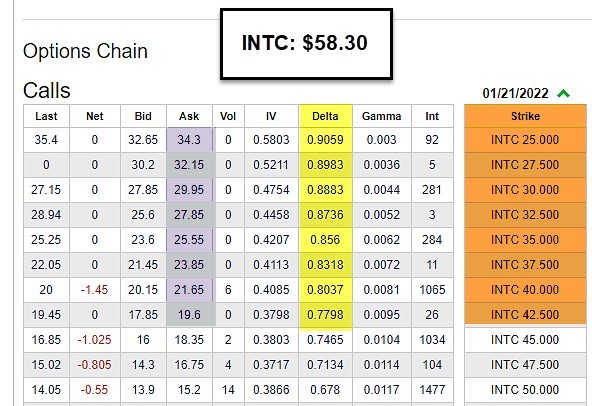

On May 18, 2020, INTC was trading at $58.30 and the $60.00 6/19/2020 $60.00 call option had a bid price of $1.75. The LEAPS option chain for the 1/21/2022 expiration showed eight eligible deep ITM strikes with Deltas ranging from 0.779 to 0.9059:

INTC LEAPS Option-Chain

- Purple Cells: Cost of LEAPS

- Yellow Cells: Delta of LEAPS

- Brown Cells: Strikes of LEAPS

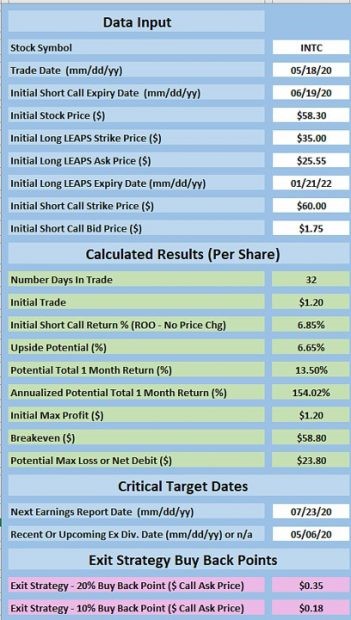

Initial Trade Calculations Using LEAPS $35.00 Strike with the BCI PMCC Calculator

INTC PMCC Calculations with the BCI PMCC Calculator

Blue Cells (top of spreadsheet): Option-Chain Information Entered

Green Cells: Key Calculation Results

- Initial trade formula acceptable with a net credit of $1.20 per share

- Initial one-month return on short call is 6.85%

- One-month initial upside potential is 6.65%

- Total maximum 1-month return is 13.50%, 154.02% annualized

Pink cells: Exit Strategy Buyback Points

Discussion

Delta is important with the poor man’s covered-call strategy because we want the security to simulate the price movement of the underlying stock. There are several parameters that must be adhered to achieve the best trade results. The BCI PMCC calculator is particularly helpful in establishing these trades.

Learn more about Alan Ellman on the Blue Collar Investor Website.