No news is good news. Stocks touched new highs this week, likely because the Covid-19 vaccine development is progressing briskly. The economy is more uncertain, as it is not clear whether there will be another federal government stimulus, explains Marvin Appel of Signalert Asset Management.

A bi-partisan group of senators floated a $908 billion plan that Majority Leader Mitch McConnell rejected. What is a cause for optimism is that for months many have warned about the dangers of failing to spend more, yet the economy has continued to recover through this week.

The markets are giving mixed signals about the economy going forward. The bond market is acting optimistic, with Treasury yields bumping up this week, the projected inflation rate (spread between 10-year TIPS and 10-year nominal Treasuries) increasing to above 1.8% and high yield bond spreads shrinking.

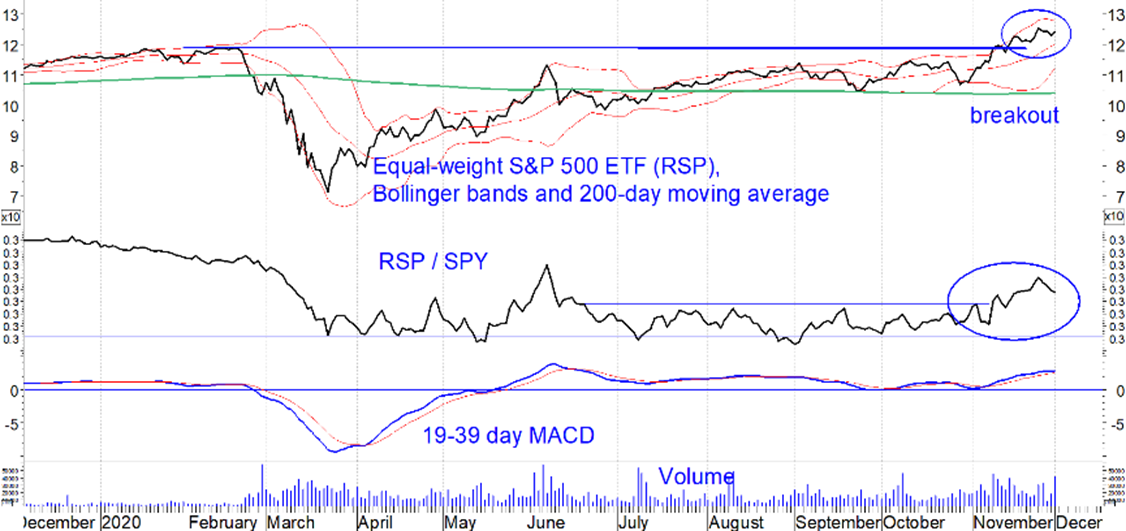

Notwithstanding the new high in S&P 500 SPDR (SPY) on Dec. 1, beneath the surface the stock market is evidencing some concern, as shown by the underperformance of the equal-weighted S&P 500 ETF (RSP) compared to SPY since Nov. 24 (circled in the RSP/SPY ratio in the chart to the right).

The equal-weighted S&P 500 ETF has roughly half the weight in technology as does the cap-weighted S&P 500 SPDR: 15% compared to 28%. But RSP has much greater weight than SPY in industrials and financials. The implication is that RSP is more sensitive to economic contraction than is SPY, so decreases in RSP/SPY represent diminishing confidence in the economy.

The economy is torn between the prospects of widespread vaccination (perhaps by July 2021), which would allow the economy to return towards normal, and the burgeoning Covid caseload that is underway and which threatens the economy in the meantime. Not only is the leisure/hospitality/restaurant sector under threat, but even manufacturing is at risk despite having recovered fully. I hear anecdotally that food suppliers are suffering from worker absences, and any visit to an online food shopping service reveals numerous items out of stock. We will know more after Friday’s monthly employment report.

Implications

I am inclined to give more credence to the bond market’s optimistic signals, meaning that on balance, it appears that the economy will manage to hold on while the broad public waits to be vaccinated. Based on this outlook, you should respect high-yield bond and floating-rate bond buy signals.

Equity markets could be rocky in the first half of 2021 but should avoid a major correction larger than the 10% swing we saw in September because there definitely is light at the end of the tunnel even though Covid is currently raging out of control in the US (European countries such as Belgium, France, and the UK were able to halt their most recent Covid surges, as severe as ours is now, by locking down for a month.)

Since the trend in 2021 will be one of economic recovery, I expect gains in equities and high-yield bonds next year. But a lot of good news seems already to have been priced in, so those gains will likely be in the single digits. I continue to recommend SPY over RSP because in the event of a market downturn, I expect SPY to hold up better at this point.

(Note: From Sept. 2-Sept. 23, RSP held up better than SPY, losing 7.6% compared to 9.4%. However, on 9/2/2020, RSP was at a relative-strength low versus SPY, whereas now, RSP is close to a relative-strength high in the range of RSP/SPY since March. For this reason, I view SPY as the more defensive equity exposure currently.)

To learn more about Marvin Appel, please visit Signalert Asset Management.