Here’s the continuation from last week’s newsletter about how to take advantage of multiple options trades on the same ticker. We’ve already looked at the butterfly portion. So now let’s dive into both the debit spread and the long call, explains Danielle Shay of Simpler Trading.

Are you ready?

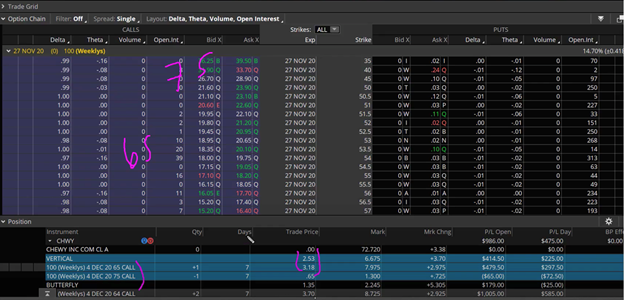

Trade #2: A Call Debit Spread:

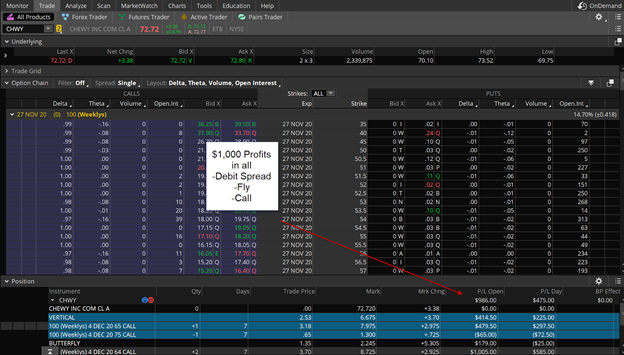

This call debit spread was a 65, 75 call debit spread that I got into for only $2.53—very low-risk. The reward isn’t as great as a butterfly, but I wanted to go ahead and demonstrate the difference between a butterfly and debit spread, as I was teaching a class on that exact thing right around this time. With the debit spread I was able to get out for a profit of about $4.00 (which is pretty good, it’s not quite a double).

Trade #3: A Long Call:

The long call is going to be the riskiest of all. It’s also going to be the most expensive. The long call was $7.70, and I got out for $11.65. So, I had a really decent return on this overall, it was about 50%. That’s exactly what I want to target on a long call.

All in all these three small trades have put me up a $1,000 with a very minimal amount of risk. So, if you’ve ever wondered how to take advantage of multiple options trades on the same ticker…this is it.

To learn more about Danielle Shay, visit SimplerTrading.com.