Exit-strategy opportunities may be created when there is a substantial one-day market decline, and we must be prepared to take advantage of these occasions, explains Alan Ellman of The Blue Collar Investor.

In June 2020, there was an 1800-point decline in the Dow 30 due to coronavirus concerns and national unrest related to police shootings. Many members of the BCI community had their buy-to-close (BTC) limit orders executed as a result of this precipitous decline. This article will highlight such a scenario with an exchange-traded fund.

Real-Life Example with Health Care Select Sector SPDR Fund (XLV)

- 5/16/2020: Buy 200 shares of XLV at $101.70

- 5/16/2020: Sell 2 x 6/19/2020 $103.00 calls at $2.07

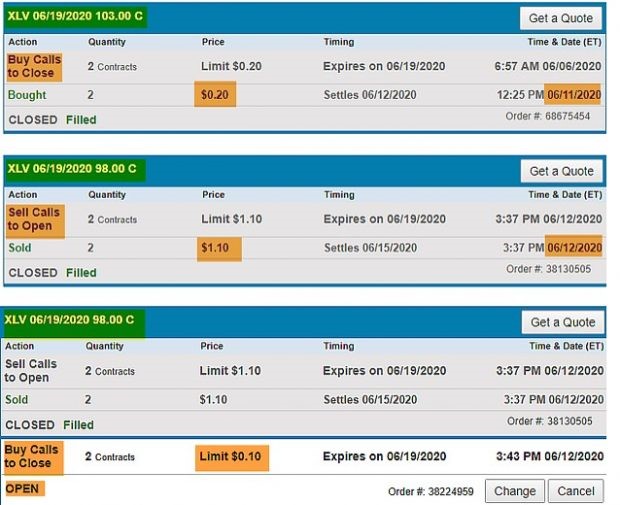

- 5/16/2020: 2 x BTC limit orders were placed at $0.40 (20% threshold) and then changed mid-contract to $0.20 (10% threshold) on June 8

- 6/11/2020: 2 BTC limit orders were executed at $0.20 due to market decline

- 6/12/2020: 2 sell-to-open 6/19/2020 $98.00 calls were sold at $1.10 (rolling down), creating a net rolling-down credit of $90.00 per contract [($1.10 – $0.20) x 100]

- 6/12/2020: Enter a BTC limit order of the rolled-down options at $0.10

Comparison Chart of XLV and the S&P 500 in June 2020

MoneyShow’s Top 100 Stocks for 2021

The top performing newsletter advisors and analyst are back, and they just released their best stock ideas for 2021. Subscribe to our free daily newsletter, Top Pros' Top Picks, and be among the first wave of investors to see our best stock ideas for the new year.

XLV-S&P 500 Comparison Chart in June 2020

Brokerage Account Screenshot of the 3 Trades

Broker Statement Showing XLV Trades

Discussion

Mastering the skill of position management will assist in elevating our returns to the highest possible levels. By placing BTC limit orders after entering our covered-call trades, we can automate this aspect of our trade management. If, and when, a BTC limit order is executed late in a contract, we can roll down to generate additional time-value premium to assist in mitigating losses or turning losses into gains.

Learn more about Alan Ellman on the Blue Collar Investor Website.