Let’s take a look at one of my favorite setups that I just took in Advanced Micro Devices (AMD). First off, AMD is one of my favorite stocks to trade, especially over the past several years, explains Danielle Shay of Simpler Trading.

Anytime it pulls back and consolidates is usually a good time to get in, especially for as long as it’s holding a key support zone.

Which is exactly what it was doing when I took this trade...

AMD was holding a Fibonacci cluster right around $90 and prices were above the moving averages.

My final factor of confluence was the $100 price point.

Why This Particular Price Point?

If you look back at the $100 price point, you can see that there are a couple of things that overlapped. The 1271 was right at $100 (which is a bit of a coincidence). But also, the timeline overlapped perfectly for a monthly expiration series. Whenever you have a key psychological value that overlaps with a Fib level that overlaps also with a main expiration series…that usually equates to a high-probability bet.

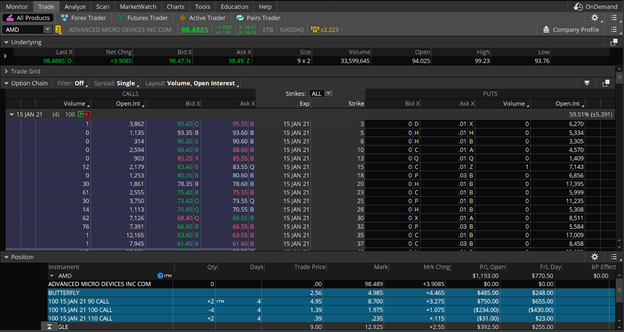

So, if you were to go look at the options chain, you’d see that at the $100 strike price you have 45,000 open contracts, while in the rest of the series you’re going to have significantly less.

For all these reasons, which I've mentioned above, I got into this trade.

Placing the Trade:

I went ahead and traded a $10 wide butterfly. I got in for $2.56, and it’s currently at $4.93. So right around a double so far. But I’m actually going to hold this trade for a couple more days because I want the $100 call to decay, so that the butterfly will mature.

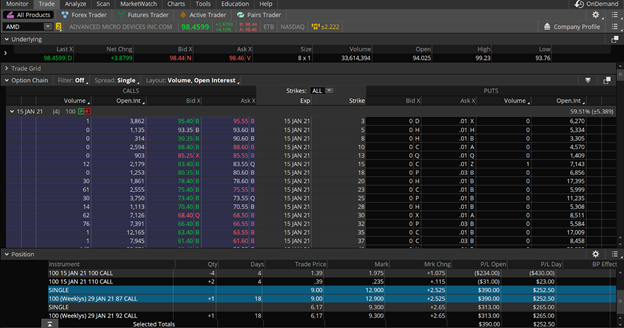

I took this in the options live trading room:

Playing the Long Calls:

First off, I had a small account option, which was a cheaper call that was at the 92 strike. When I bought it, it was just right at the money, which is why it was cheaper. That trade is currently up a little more than 50%.

MoneyShow’s Top 100 Stocks for 2021

The top performing newsletter advisors and analyst are back, and they just released their best stock ideas for 2021. Subscribe to our free daily newsletter, Top Pros' Top Picks, and be among the first wave of investors to see our best stock ideas for the new year.

However, the other call was at the 87 strike, and was a little more expensive because it was in the money. For that one, I'm up about $4 currently, which is a little under 50%. However, you can see that I’m making more money on the “in the money” call vs. the “out of the money” call.

That’s why you have to decide when you’re buying long calls if you'd rather have something that’s at the money (so it’s a little cheaper), OR if you’d rather have something that’s in the money (a little more expensive, but if the market pulls back, it’s going to hurt less because it has that intrinsic value).

I put both these trades on at the same time, so it’s a good comparison of these two ways to trade a long call.

Looking Forward:

Like I’ve said earlier, all these trades are still open, and things are looking good so far. Yesterday, January 11, AMD actually made new all-time highs.

So, my first goal for this trade is to take off my long calls because AMD has gotten a little “toppy” near all-time highs. Then my second goal is to hold that butterfly and see if I can get it to mature with those center strikes decaying over the course of the next couple days. If this happens then I can get a little bit of a better percentage gain there.

To learn more about Danielle Shay, visit SimplerTrading.com.