The Poor Man’s Covered Call (PMCC) is a covered-call-writing-like strategy where deep in-the-money LEAPS options are used in lieu of long stock positions, explains Alan Ellman of The Blue Collar Investor.

Short-term out-of-the-money call options are sold against the long position. The technical term is a long call diagonal debit spread. When setting up the initial trade, decisions must be made on the strikes of the two legs. This article will focus in on the best strike for the LEAPS position.

PMCC: Initial Trade Structuring

PMCC trades must be constructed such that the difference between the two strikes plus the initial short call premium is greater than the cost of the LEAPS option:

[(Short call strike - LEAPS strike) + short call premium] > Cost of LEAPS option

By integrating this formula into the strategy, we are assured that, if we are forced to close the trade when share price appreciates dramatically, we can close at a profit. Short call out-of-the-money premiums are based on our initial time-value return goal range. Amounts will be dwarfed by the cost of the LEAPS position or the difference between the strikes. So, how far deep in-the-money should we go to align with our initial trade structuring formula? We will use a real-life example with SPDR S&P 500 ETF Trust (SPY) to shed light on the process.

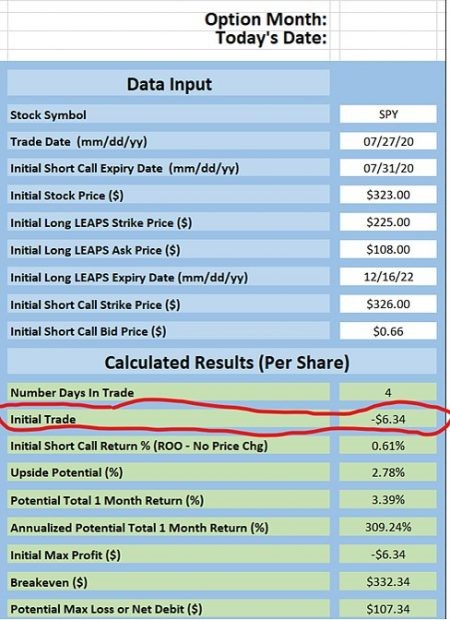

SPY: A LEAPS Strike That Doesn’t Work Using the BCI PMCC Calculator

BCI PMCC Calculator: SPY Calculations with $225.00 Strike

- SPY trading at $323.00

- $225.00 LEAPS cost $108.00

- $326.00 call generates $0.66

- Initial trade structuring results in a loss of $6.34

- [($326.00 - $225.00) + $0.66} < $108.00 (should be > $108.00)

The problem is that the time-value of the $225.00 LEAPS is way too high. The intrinsic value is ($323.00 - $225.00) = $98.00, leaving a time-value component of $10.00. To mitigate this problem, let’s look for a deeper in-the-money LEAPS strike, which has a much lower time-value component.

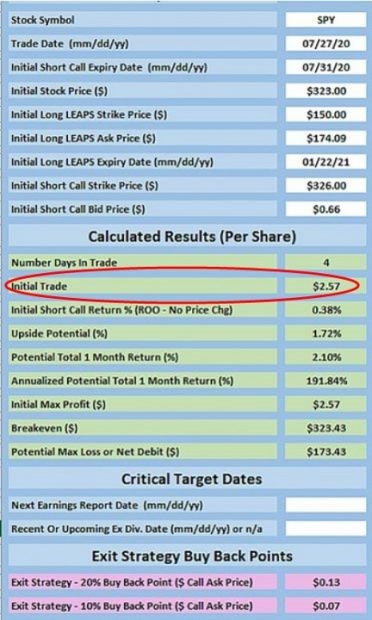

SPY: A LEAPS Strike That Does Work Using the BCI PMCC Calculator

PMCC CALCULATOR for SPY

- SPY trading at $323.00

- $150.00 LEAPS cost $174.09

- $326.00 call generates $0.66

- Initial trade structuring results in a gain of $2.57

- [($326.00 - $150.00) + $0.66} > $174.09 (meets are initial structuring required formula)

Discussion

When setting up our PMCC trades, strike selection must allow the trade to align with our initial structuring formula. This includes selecting a LEAPS option with a minimal time-value component. If the time value is too high, look for deeper in-the-money strikes that have less time value.

Learn more about Alan Ellman on the Blue Collar Investor Website.