You may have previously heard someone say, “Vertical spreads are the same as getting weekly paychecks!” Is that even true, asks Markus Heitkoetter of Rockwell Trading.

We’re going to go in-depth on each strategy to discuss each of the pros and cons. I’m also going to discuss how each strategy should be used in any given market condition. Since we’ve previously discussed credit spreads and debit spreads, you’re probably wondering…what’s the BEST vertical spread option strategy?

Let’s break down each of the vertical spread option strategies in detail

Call Debit Spread

What is a Call Debit Spread? A call debit spread is a position in which you buy a call option and sell a call option at different strike prices using the same expiration date.

When should this strategy be used? This strategy is used when you believe the stock is increasing in price, but not a dramatic movement.

What are the benefits of this strategy? Trading this position can potentially reduce the overall cost associated with taking on the trade. This type of strategy also reduces the break-even price of the trade.

When does this trade lose money? When the underlying stock moves sideways or downward.

What is the max risk for this trade? The max risk associated with this strategy is the cost of the premium paid to take on the trade.

What is the max reward for this trade? The max reward for this strategy is the difference between the strike price of the two calls, multiplied by 100, minus the premium paid to take on the trade.

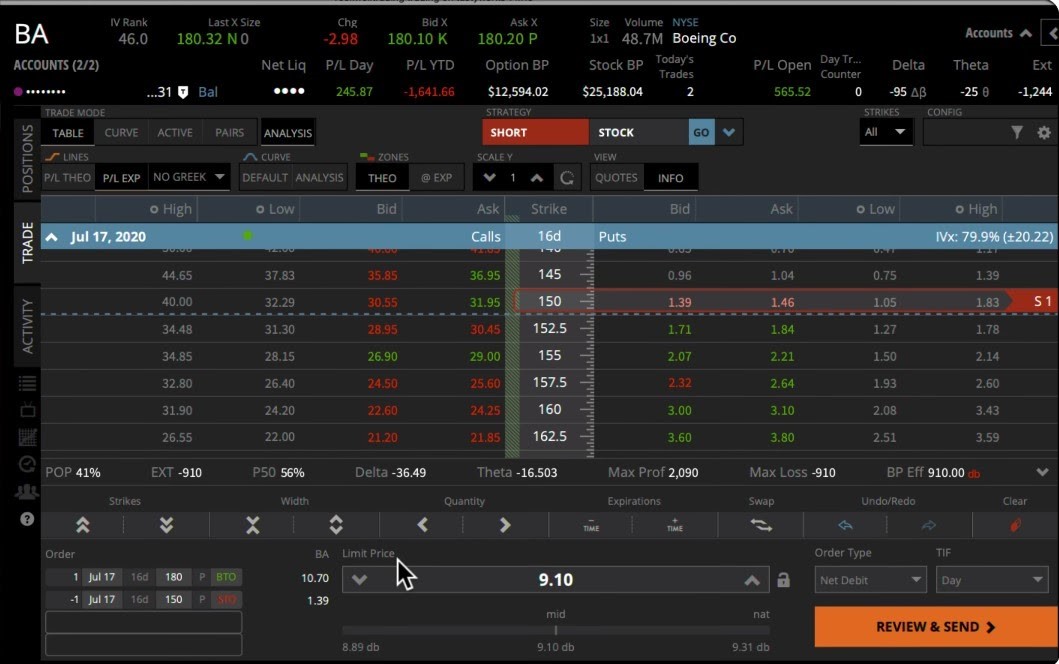

Call Debit Spread Example

- Reduced Margin Requirement: $910

- Max Risk Reduced: $910

- Max Reward: $4,090

Put Debit Spread

What is a Put Debit Spread? A put debit spread is a position in which you buy a put option and sell a put option at different strike prices with the same expiration date.

When should this strategy be used? This strategy is used when you believe the stock is decreasing in price.

What are the benefits of this strategy? Trading this position can potentially reduce the overall cost associated with taking on the trade. This type of strategy also lowers the break-even price of the trade.

When does this trade lose money? The underlying stock moves sideways or downward.

What is the max risk for this trade? The max risk associated with this strategy is the cost of the premium paid to take on the trade.

What is the max reward for this trade? The max reward for this strategy is the difference between the strike price of two calls, multiplied by 100, minus the premium paid to take on the trade.

Put Debit Spread Example

- Reduced Margin Requirement: $910

- Max Risk Reduced: $910

- Max Reward: $2,090

Call Credit Spread

What is a Call Credit Spread? A call credit spread is a position in which you sell a call option and buy a call option as protection. These option contracts have different strike prices but have the same expiration date.

When should this strategy be used? This strategy is used when you believe the stock is decreasing in price or trading sideways.

What are the benefits of this strategy? Trading this position produces a credit from the premium received for selling the put option. Buying the additional call option provides protection, limiting the risk of the trade.

When does this trade lose money? This trade loses money when the underlying stock moves up quickly past your strike price.

What is the max risk for this trade? The max risk associated with this strategy is the difference between the strike prices, multiplied by 100.

What is the max reward for this trade? The max reward for this strategy is the premium received for selling the call option, minus the premium paid for protection.

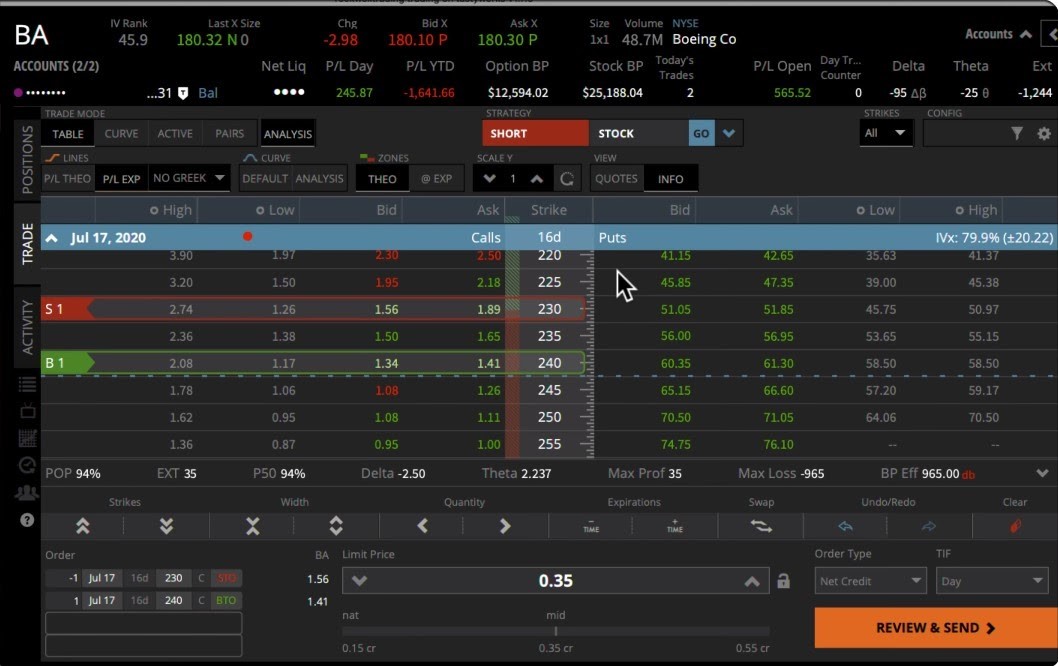

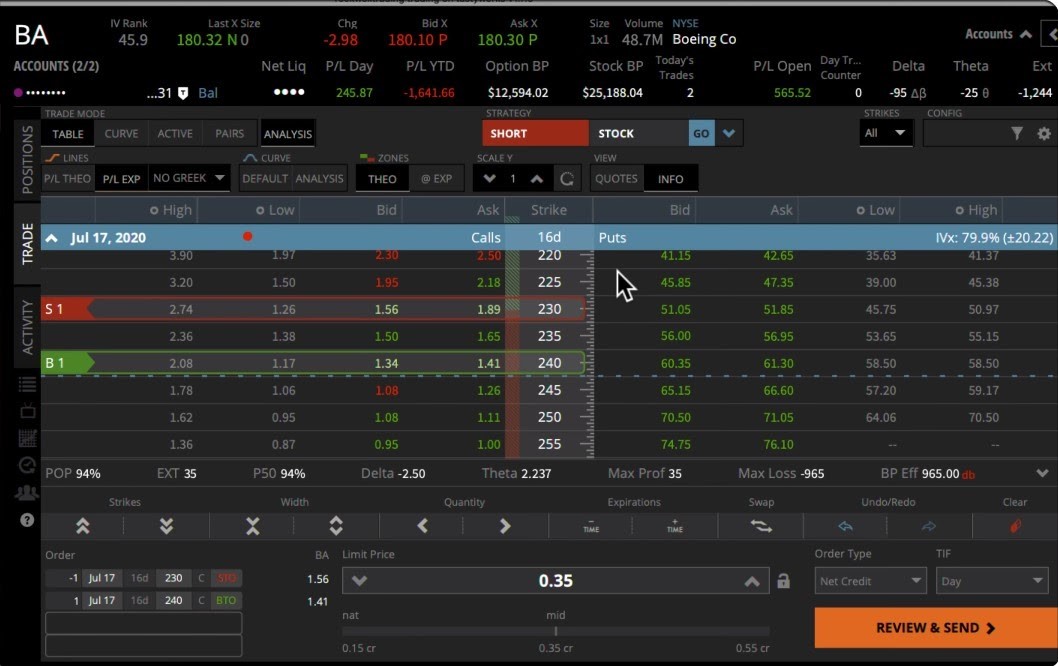

Call Credit Spread Example

- Margin Requirement: $965

- Max Risk: $965

- Max Reward $35

- Premium Received: $35

Put Credit Spread

What is a Put Credit Spread? A put spread is a position in which you sell a put option and buy a put option as protection. These option contracts have different strike prices but have the same expiration date.

When should this strategy be used? This strategy is used when you believe the stock is increasing in price or trading sideways.

What are the benefits of this strategy? Trading this position produces a credit in the form of the premium received for selling the put option. Buying the additional put option provides protection, limiting the risk of the trade.

When does this trade lose money? The underlying stock moves downward sharply.

What is the max risk for this trade? The max risk associated with this strategy is the difference between strike prices, multiplied by 100.

What is the max reward for this trade? The max reward for this position is the premium received for selling the put option, minus the premium paid for protection.

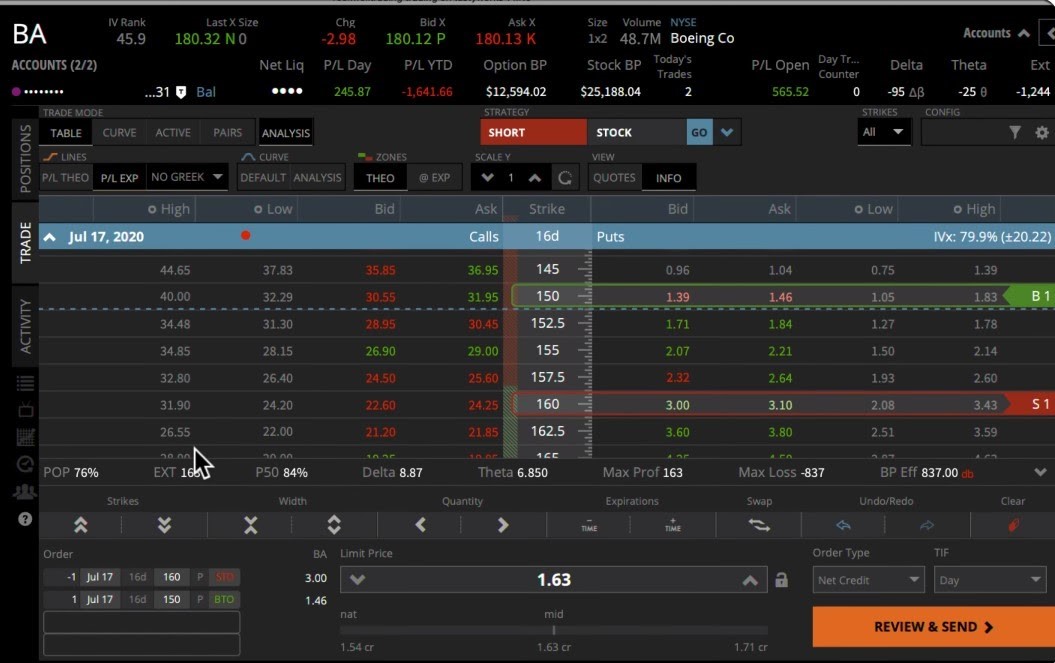

Put Credit Spread Example

- Margin Requirement: $837

- Max Risk: $837

- Premium Received: $163

- Max Reward: $163

How Do I Choose the Best Vertical Spread Option Strategy?

I personally only select options that match my trading plan. You’ve probably heard me say it a million times if you’ve heard it once…

There are three things you need to know to be successful at trading.

- 1.) You need to know which options to trade

- 2.) You need to know when to enter

- 3.) You need to know when to exit

I use the PowerX Optimizer to help me execute these trades successfully.

Learn more about Markus Heitkoetter at Rockwell Trading.