In this article, I wanted to give you a complete squad of trading tactics for trading The Wheel Strategy, states Markus Heitkoetter of Rockwell Trading.

I have compiled a list of the questions I get most often. So today we’re going to talk about the 29 things you must know when trading the Wheel Options Strategy.

The Wheel Options Strategy Overview

Let’s briefly talk about the basics. The basics of The Wheel Strategy are actually pretty simple.

Here are the three steps that we need to do when trading this strategy:

Step Number One: We want to sell put options and collect premium.

Step Number Two: Here, we may or may not get assigned.

Step Number Three: If we are assigned, we’ll sell covered-call options and collect more premium. If we’re not assigned, then we’ll stay at Step Number One and keep selling put options to collect more premium.

As you can see, it’s really not that complicated. I mean, wouldn’t you agree?

Now, I’ve divided this article into four sections: The Basics, then Picking the Right Stock, because there’s a lot of questions about this topic, and then we will also talk about Selling Calls After Getting Assigned, as well as What to Do When a Trade is in Trouble.

The Basics

1.) I have around $30,000 in my Interactive Brokers account. Is it enough to start trading The Wheel?

Here is my recommendation. You should have at least $10,000 in cash so that you can get $20,000 in margin. I highly recommend that you are trading a margin account.

If you have less than $10,000 in cash, I do not recommend that you trade with The Wheel Strategy.

If you have a smaller account, I recommend that you do a maximum of three positions in your account. As your account grows, you can go up to five positions in the account.

2.) What is the best expiration date when selling options?

What I personally like to do is go 1 to 2 weeks out, so this also means that I like to trade weekly options.

I’m looking for a really short fuse here because I believe that this is where you have the most control over the prices.

The idea is actually to collect so-called “weekly paychecks,” and I put this in quotation marks because it always sounds so glamorous, right?

However, it’s really important that you know what you’re doing here.

3.) Should I use margin to increase my buying power?

My answer to this is yes, absolutely. I highly recommend this, however, keep in mind that margin is a double-edged sword, which can work for you as well as against you.

4.) How do I know if I have enough capital if I get assigned?

It’s easy. Let’s say that you are selling a 100 put, which means a put with the strike price of 100.

This means that when you’re getting assigned, you have to buy 100 shares at $100 each totaling $10,000—this is how much capital you would need.

All you need to do is take the strike price that you are selling of the put times 100, because options come in 100 packs, and multiply this number by the number of options that you’re selling.

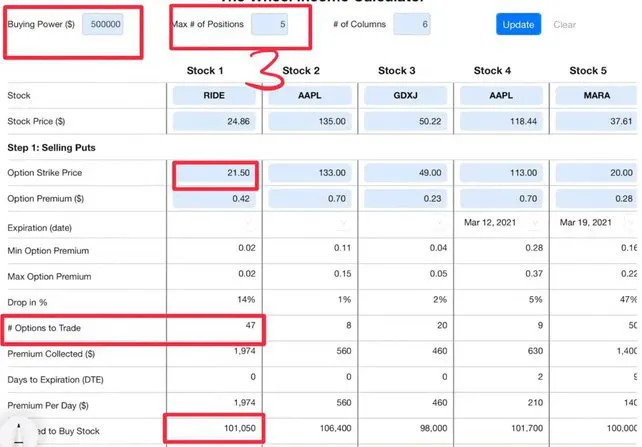

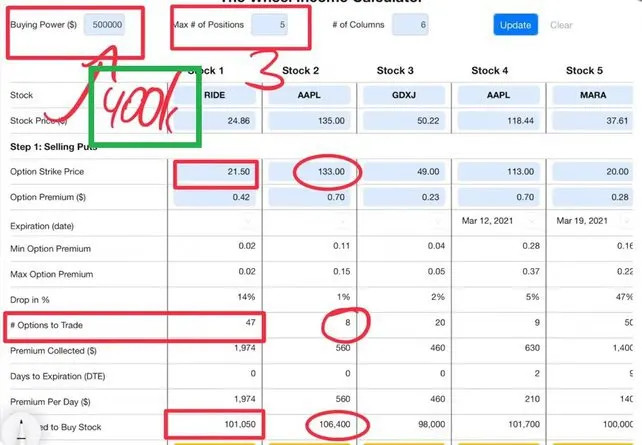

Let me give you an example. I recently sold 8 put options of Apple at a 133 strike price. So how do you know whether you have enough money in your account?

Well, this is where we are taking the strike price, 133 times 100, times 8. This means you would need to have $106,400 in your account. So please make sure that you are sizing your account appropriately.

The good news is, if you do have the PowerX Optimizer, which is the tool that I’m using, it will show you exactly how many shares you can trade.

What you need to do here is fill in your buying power, and again, your buying power might be different. How many positions you want to take, and this is where I said if you have a smaller account fill in three, if you have a larger account you want to fill in four or five.

Based on the strike price that you are selling here it will tell you exactly how many options you should trade. Then, based on how many options, it also tells you how much money you need, and how much margin is required if you were to get assigned.

I highly, highly, highly recommend that you do use a tool, because if you do all the math in your head, it can go horribly wrong.

The tool that I personally use is the PowerX Optimizer. Many of you already have the tool, many of you are familiar with it.

5.) Is there a certain percentage you buy to close at? Some people say 50% profit is best statistically too close.

I like to close a position at 90% of the max profits. So as an example, this morning (March 10, 2021) I sold puts on DKS, Dick’s Sporting Goods, and I sold them for $0.75.

This is where right now I have a working order in there to buy this back at $0.07, which is 90% of $0.75. So yes, if I can get 90% of the max profit here, this is when I want to exit.

6.) Is there a rule of thumb of what percentage this account is tied up with the strategy?

It really depends on how many trading strategies you use, right? So right now, I trade two strategies. I trade the PowerX Strategy and The Wheel Strategy.

The PowerX Strategy is perfect for a trending market, but the markets right now are far from trending. They are super choppy going up and down, therefore, right now I’m dedicating all of my money in the account to The Wheel Strategy.

Once I start trading the PowerX Strategy again, this is where I would just decrease the buying power here and say instead of using the $500,000, I might just use, let’s say 400K, and use 100k for The Wheel Strategy.

7.) What screening criteria does the PowerX Optimizer use for the Wheel Strategy?

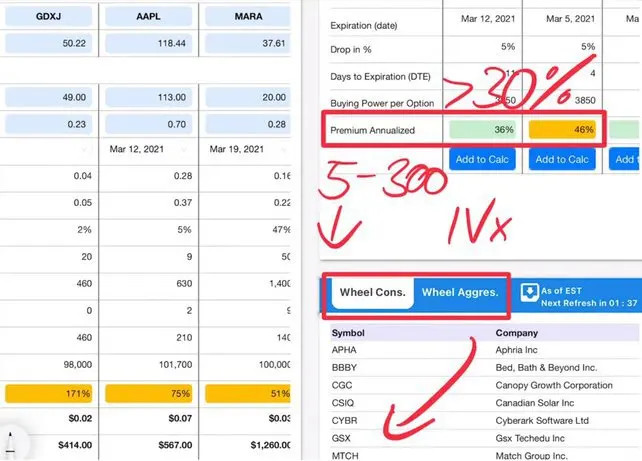

The PowerX Optimizer has a built-in scanner to find the best candidates for The Wheel Strategy, and there’s a conservative scanner as well as an aggressive scanner.

On the bottom right, you can see all the symbols that are popping up on the scanner. What are the criteria that we are using here?

First of all, we are using price as a criterion. We are looking for stocks between $5 and $300 here.

We are also looking for stocks that have a down day, because when you’re selling put to collect premium, you want to make sure that you’re selling when the market is going down.

We are also looking at the implied volatility, because we want to make sure that there’s enough premium there. Then most importantly, we want to make sure that the annualized premium is above 30%.

There are a few other minor criteria. First of all, we only look for stocks that have weekly options. This is what I explained briefly a little bit earlier, I’m not interested in trading stocks that only have monthly options.

8.) What can I expect? 30% yearly annualized based on what capital?

The capital this would be based on is the buying power. In my account I have $500,000 buying power. This means if I’m looking for 30% based on the buying power, this would yield into 60% based on the cash that I put in the account. The cash that I put in the account was $250,000.

So when I’m talking about the 30% yearly annualized, it’s based on the buying power. If you don’t trade with margin, then this would be based on your cash.

Picking the Right Stock:

9.) Do you have a defined universe of stocks that are your “good list?”

Well, first of all, I want to make sure that I’m trading the stocks from the PowerX Optimizer Scanner, and then I just look for stocks that I like overall.

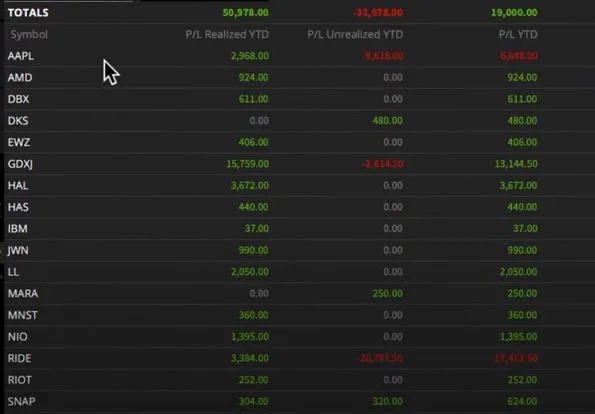

I’ll be happy to show you all the stocks that I’ve traded thus far this year. We have here DBX, DKS, GDXJ, HAL, HAS, IBM, JWN, LL, MARA, MNST, NIO, RIDE, RIOT, SNAP, and many others.

These are stocks that I really like to trade, and most of them are very well-known names, so I’m not trading any exotic stocks. You also will not find meme stocks like GME or AMC on this list here.

10.) Is there a certain level of IV, implied volatility, on a stock that you won’t go to? I’ve traded some 200% plus of IV. Is that too high?

Just as a rule of thumb, the higher the IV the higher the risk. This means that stock can really swing back and forth. What I feel is a sweet spot is that I like to see at least 40% IV, but no more than 100%.

Sometimes I do take trades that are higher than 100, but honestly, for me, the sweet spot where you find most trades that are fairly safe is anywhere between 60% to 80% implied volatility. This is where I don’t have hard rules here, but I need to like the stock.

11.) Markus, have you changed from your “When I started I just wanted to know the symbol. I did not want to know anything about the company, as it might cloud my view. Trade what you see, not what you think” mentality?

My answer is NO, for the PowerX Strategy. I absolutely do not want to know anything about the symbol. However, for The Wheel Strategy, the answer is YES. When trading The Wheel Strategy, I only want to trade super-solid stocks.

12.) I noticed that some of the stocks on your list for The Wheel have very illiquid weekly options. Do you watch for options liquidity or just the credit limit and hope to get filled?

For me I don’t care about open interest and volume, and here’s why. I’m selling premium and I’m fine letting the option expire worthless, I don’t need to buy it back. If I can buy it back I will, otherwise no. So, this is where here I don’t care about the open interest.

But again, it really depends on the strategy. I mean, if you’re trading a different strategy open interest and volume might be very important to you. For me, it is not.

13.) Besides technical support/resistance levels, how do you objectively decide which are the best stocks? Do you take into account any fundamental analysis to filter out which underlying to trade?

No. So here is what I do, and this is pretty subjective, I don’t have objective criteria here. I must like the company, because the point is, you must be OK owning this company, and I must like the story of the company.

This is where I always use Peloton as an example, because I know that many are trading Peloton and it has lots of premium in there. But you see for me, Peloton is a company that I believe can easily be ripped off, and at some point, a major competitor might swoop in.

I must like the company and the story of the company. This is fairly subjective here because the key is that you must be OK owning that stock at the strike price.

14.) Since you are suggesting not to sell puts on leveraged ETFs, why are they then included in The Wheel Scanner?

This is a great question, and we actually might exclude them in version 2.0 of the PowerX Optimizer. Right now, I thought you’re all adults, and as adults, you can do whatever you want. I did not want to restrict you, but we might exclude it or add an asterisk as a warning sign.

It’s a good suggestion, and I know that some get blinded by premium on leveraged ETFs. I do not trade leveraged ETFs, anything that has 2x or 3x in the description I stay away from this.

15.) Why do you select growth stocks only instead of a mix of value and growth stocks? Seems that growth is in trouble due to interest rates.

Growth stocks offer attractive premiums, but value stocks rarely do. I want to show you a very specific example here of IBM, because IBM is one of the value stocks that I have traded.

I traded IBM after a massive drop where I sold the 117 strike. Usually in IBM you won’t find enough premium in there. The implied volatility lately is usually around 34 or 29. So this is the very simple reason why I’m going for growth stocks because I’m looking for a minimum of 30% annualized in premium.

Selling Calls After Getting Assigned

16.) If you sell a call lower than your original put strike price, can you still make money?

This is actually super dangerous, and here’s why. When you sold a put you got assigned, and you had to buy stocks at the strike price. I’m using an example of AAPL, and I was assigned Apple at $133 per share.

Now, if I’m now selling a call, it means that I have to sell stocks at the strike price. If I’m selling, let’s say a 125 call, it means that I have to sell the shares for $125.

Now here’s the challenge with this. I bought them for $133 and now I’m selling them right now for $125. This means that I’m losing $8 per share. When you’re trading options, they come in 100 packs, so this means that you would lose $800 per option.

This is where you need to be careful when you’re selling a call lower than your original strike price. If you do this, make sure that it is above your cost basis, and we’ll talk about the cost basis here in just a moment.

17.) Why are covered calls more profitable in your experience than cash-secured puts? Are you targeting a different percentage return?

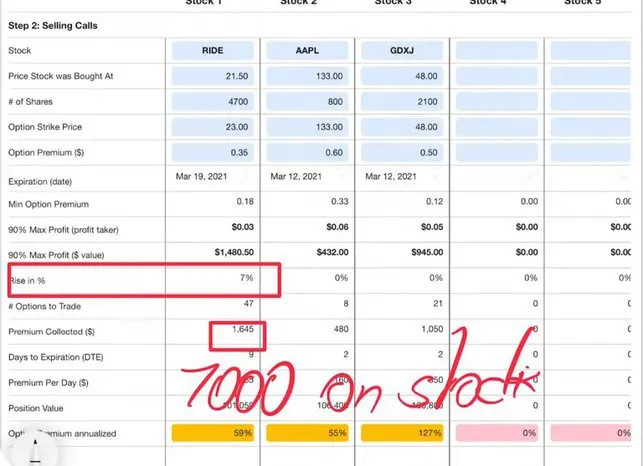

No, I do not. Here’s a rule of thumb for what I do. Let’s jump to PowerX Optimizer and go to the Wheel Income Calculator.

Here is something that I did today (March 10, 2021) where I sold calls on RIDE.

So, on RIDE I sold calls that expire March 19, and I sold them for $0.35, and the calls that I sold were at 23. By doing this, this actually gave me an annualized return.

By default, I am not going as many strikes out, because all I need here right now is a rise of 7%. If you are rising 7% here, then I will be able to make money not only on the premium that I collected, the 16.45, but also an additional $7,000 on the stock. So, this will be a total of $8,500.

It’s just the nature of the beast, because when you’re selling calls, you’re usually closer to the strike price, and therefore, usually higher premium for a higher ROI.

This is why I keep telling you I’m always looking forward to getting assigned because selling calls is actually more profitable.

18.) When you sell calls to reduce the cost basis, do you also include the premium received from selling first the put to reduce the cost basis?

Yes, I do include the premium.

19.) Is there a risk of the portfolio becoming nothing but stocks and not being able to sell covered calls out of the money (OTM) to hit your targets?

The answer to this is absolutely, yes. When trading there’s risk, and there is a possibility that you own a bunch of stocks and you cannot sell calls against.

You have to hold on to these, and so for a few weeks, it could absolutely happen that you’re not making any money. I was recently assigned shares of AAPL and have not been making any money with them because I have not been able to sell calls.

But you see, even though I have one dud in my account, it’s only one of my positions, and I still have been able to make almost $51,000 in about 8 or 9 weeks. Therefore, it’ll even out.

So, is there a risk? Absolutely. When trading there is always risk. If you are not willing to accept the risk when trading, do not trade, because there’s always the risk of losing money.

20.) Markus, if you haven’t sold a call against the Apple 103 strike price haven’t you been missing out on money?

Not really, and here’s why. Right now, if I would try to sell a 133 call on Apple, that is, for example, expiring this week, I would get $0.01. I’m not missing out on any money, right? $0.01 translates into $1. So, no, I’m not missing out.

Even if I would go out to next week and I’m looking at the 133, I would only get $0.14. That’s $14. For me, it’s not worth it. Again, everybody’s different, you might have different rules. For me, however, it’s not really worth it.

21.) When running a rescue mission on margin, how does one sell a covered call? My broker requires cash for any call that I sell.

If this is true, change the broker immediately, and here’s why. I own Apple shares, and if right now I want to sell calls against these Apple shares, let’s say 8 calls, it would not have any effect on my buying power. It’s the opposite.

So here I highly recommend you change the broker if this is true. Your margin requirements should be reduced when selling a covered call, this is how it works.

22.) Why not still sell calls at your cost basis after the stock drops?

Because sometimes there’s not enough premium. If there is enough premium, I will do it, but sometimes there is simply not enough premium and then you are sitting on your hands.

Therefore I said I have this one dud in my account, AAPL, that is not making me any money, but everything else IS making me money.

I was able to sell calls against GDXJ and RIDE. With DKS, MARA, and SNAP, I sold puts. So everything else is making me money. I can’t change the wind, I can only adjust my sails, and this is what I’m doing here.

What to Do When a Trade Is In Trouble

23.) What do you mean by “rescue mission” for those who have not heard it before?

A “rescue mission” is where you have been assigned shares, and now the trade is going against you. You sell more put options below the assigned strike price.

By doing this, you collect more premium. If you are assigned you lower your cost basis, making it easier to get out of that trade.

You only should consider flying a “rescue mission” if the stock is down at least 30% from your assigned price.

24.) Why not still sell calls after your stock drops?

Because there might not be enough premium in there. Very simple, right? If there is, we will do it, if not like with AAPL for me right now, then it is what it is.

25.) What happens when you run out of buying power and can’t sell calls at your target?

First of all, you can always sell covered calls, because you will not run out of buying power for selling covered calls.

What they probably meant is what about not being able to sell puts, and there are two things that you can do.

Number one, you can wire more money into your account, which is not always feasible.

Number two, you can simply close some positions to free up some buying power.

26.) Is it possible to buy options rather than sell options because selling options is supposed to be very dangerous?

Well, of course, and that would be the PowerX Strategy. With the PowerX Strategy, you are buying options if this is what you prefer to do. If you’re trading The Wheel Strategy, this is where you’re selling options.

Pick your poison. I mean, you’ve got to do one or the other, either you’re buying options or you’re selling options. I have a strategy for each of these.

27.) Any point in waiting to make sure that the market has stopped dropping before flying a rescue mission?

Yes! You don’t want to try to catch a falling knife. Wait until you see that the market or the stock is stabilizing here.

28.) I understand starting the rescue mission when the stock drops 30%, how do you determine the new put strike price to enter? The next support level?

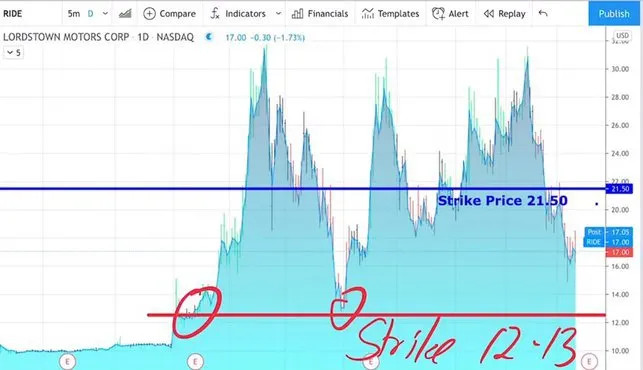

Yes, absolutely. This would be the next support level that you’re looking at. Let me show you an example with RIDE.

I got assigned at 21.50, and if we are looking at the long review here, then we see that the next possible support level is at around I want to say 12 or 13. So this here it would be a strike price of 12-13, and this is where I would do it.

If we go to Apple, which is another stock that I have, I did get assigned here at 133. As you can see, the next support level is probably somewhere around 108, right? I would probably be most interested in selling the 108 strike price.

29.) It’s hard to make money on a small account unless you get assigned.

Yes, it is hard to make money on a small account, period. I know that many want to start with a smaller account, like $500 or $1,000, but honestly, it is super, super, super difficult to make money on such a small account.

In order to do this, you would have to trade this account way more aggressively, which means that you are basically risking a whole lot. If you want to try to double a $500 account, you basically have to risk the full $500.

This is what many Robinhood traders and these YOLO’ers do. It’s all-in, and maybe it doubles, or you lose all of the money. So, yes, it is absolutely difficult.

This is why the capital requirements; I highly recommend that if you want to trade the PowerX Strategy that you have at least $5,000. If you want to trade The Wheel Strategy, you should have at least $10,000 in cash, which gives you $20,000 in buying power. This is super important.

If you do have smaller accounts, there might be trading strategies for you. I want to be honest with you though. If there are, I don’t know them.

When I started trading, I started with an $8,000 account and I shredded that account into pieces down to $1,600.

Then the second account that I was trading was $16,000. Now that one, I also lost more than half. I traded this down to $8,000 and this is when I put some more money in, brought this up to $12,000, and this is when it finally clicked.

So again, if right now you have a smaller account, good luck, there might be strategies out there. I wish I had some for you. I promise, if I knew how to grow a $500 account, I would tell you.

If right now all I had to trade with was $500, I wouldn’t do it. I would find a way to save money or make extra money with Door Dash, Insta Cart, or something like this until I have at least $5,000.

I wish that I could tell you something different, and unfortunately, I can’t. I’m not saying that it is impossible, all I’m saying is that I’m not the right person to teach you these strategies because I don’t know them.

Closing

If I didn’t cover a question here in this article that you may have, I promise I will answer them in an upcoming article.

Learn more about Markus Heitkoetter at Rockwell Trading.