When writing covered calls and selling cash-secured puts, the implied volatility of the underlying securities is directly related to the premiums we receive and also measures the risk we are taking with our option-selling trades, explains Alan Ellman of The Blue Collar Investor.

We protect ourselves from using IVs that are too high or too low by defining our initial time-value return goal range and then selecting options that meet these criteria. Recently, there has been interest in 2 IV metrics: IV Rank and IV Percentile. These give a historical perspective of the IV itself. This article will explain the terms and their applications, if any, as they relate to our low-risk, option-selling strategies.

Definitions

Implied Volatility (IV): This is a forecast of the underlying stock’s volatility as implied by the option’s price in the marketplace. It is generally based on a one-year time-frame and one standard deviation (accurate 67% of the time).

IV Rank: Measures IV in relationship to its one-year high and low. If the current IV is 20% and the one-year range is 10% – 40%, the IV Rank is 33%. The formula is:

[100 x (current IV – 1-year low)/(1-year high – 1-year low)]. In this hypothetical:

[100 x (20 - 10) (40 - 10)] = 33%

IV Percentile: The percentage of days the IV is below current IV in the past one-year. It does not factor in yearly high and low. If the current IV is 30% and 200 of the past 252 trading days the stock’s IV was below 30%, the IV Percentile is 79.4%. The formula is:

(# days IV is below current level/252). In this hypothetical:

(200/252) = 79.4%

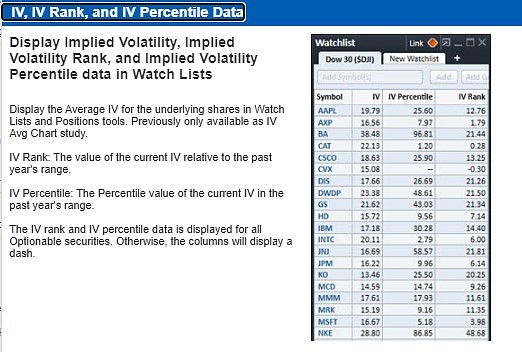

IV Rank and Percentile Data can be found in most broker research platforms (Schwab here)

IV Rank and Percentile Stats at Schwab

General applications

Some option traders will use IV Rank and Percentile to determine which strategies to use. For example, if a stock has an especially high IV Rank or Percentile, a strategy may be selected to take advantage of the mean reversion concept that suggests a return to average. The same holds true for a low rank or percentile.

Applications for covered call writing and selling cash-secured puts

I put significant emphasis on implied volatility but little on IV Rank and Percentile. We are undertaking one-week or one-month obligations and re-evaluate our bullish assumptions on a frequent basis. We have our initial time-value return goal range in place as well as our buy-to-close limit orders. We have screened the heck out of our stocks from fundamental, technical, and common-sense perspective. I submit that adding historical perspective on our options may be a case of analysis/paralysis.