I know that if you are reading this, you’re probably interested in trading options, or maybe you are already trading options, but are new. In this article I want to show you how to start trading options in five simple steps, states Markus Heitkoetter of Rockwell Trading.

Step Number One – Learn the Basics

The first step is to learn the basics about options. What are the things that I believe you need to know? For starters, you need to know the difference between calls and puts, because there is a huge difference between the two. If you’re trading the wrong instrument, then you might get results that you don’t want.

Next is you want to know the difference between buying and selling options. There are massive differences between the two, and I’ll talk about them in the next step when we talk about different strategies.

So the next thing that you should know is the basics of options assignment. It’s very important to understand when you can get assigned. If you’re selling puts, you need to know this.

It’s also a good idea to learn the basics about the Greeks, because depending on your strategy, the Greeks might be an important factor here. Now, the Greeks are the so-called Delta, Theta, Gamma, and Rho.

Step Number Two – Choosing Your Strategy

The second step is where you choose your options trading strategy. I recommend two very specific option trading strategies, The PowerX Strategy and The Wheel Strategy.

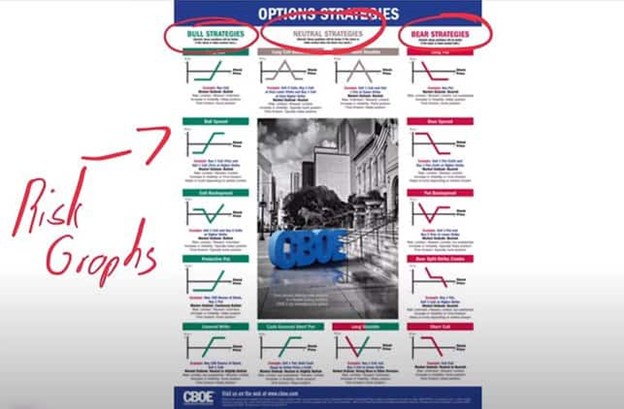

There are many options trading strategies. This is actually from the CBOE, the Chicago Board of Options Exchange, where they actually list quite a few of the strategies that are out there.

As you can see, there are several strategies for a bullish market, several strategies for a bearish market, or neutral strategies. They all have so-called risk graphs because each of these options strategies has a different risk ratio. So you need to know what each strategy does.

When it comes to best options trading strategies, here are a few things. First of all, you can either have a directional or a non-directional strategy.

A directional strategy means that you’re taking advantage of the market when it’s going up or when it is going down, these would be bear strategies or bull strategies.

You could choose to trade non-directional strategies, which are when the market is rather neutral and just going sideways, as it has been doing for most of the year thus far.

Then you want to know, are you interested in buying or selling options? Now, I like to do both. As I mentioned, there are two strategies that I personally like to use. So the first one is The Wheel Strategy.

The Wheel Strategy is a rather non-directional strategy. So what does The Wheel Strategy do? It is about selling options and collecting premium. It’s perfect for the market that we have right now where its just diddling around. I know the Dow Jones made new all-time highs, 17 record highs in fact, this year.

But overall, the markets are rather choppy. Keep in mind, in the Dow we only have 30 stocks. The S&P and the NASDAQ are also doing more diddling around, and there are way more stocks in those. So this is where I like to use The Wheel Strategy.

Now, then I’m also trading the PowerX Strategy. So this is a strategy, on the other hand, that is a directional strategy. With this directional strategy you are buying options and paying premium and you hope that the underlying stock goes up or down.

Each of these strategies has pros and cons.

Step Number Three – Using the Right Tools

Step number three is to get the right tools. Options trading can be complex, and especially when options trading, it is great to have two main tools that I like to use. The first one here that I like to use is a scanner. And what does a scanner do? A scanner finds the best options to trade.

If you look at an options chain you will see there are so many possibilities, and you need to know what is really the best option. Should you buy a call that has a strike price of 200 or 210? Is it in the money, or out of the money? At the money? What is the best option to trade?

The second thing that I believe you need is a calculator. When it comes to options, you need to calculate the premium that you either pay or receive per day, right? And there are other KPIs, or key performance indicators, that I feel are important for me to make a decision of what option to trade here. So getting the right tools is super important.

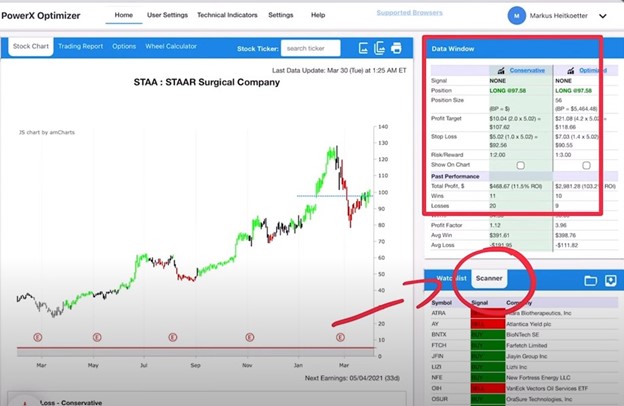

Now, the tool that I like to use that helps me a lot is the PowerX Optimizer. With The PowerX Optimizer, it doesn’t matter what strategy I’m trading here. This powerful scanner finds the best opportunities, whether it’s stock or options. Then it also has a calculator that gives me the important data that I need.

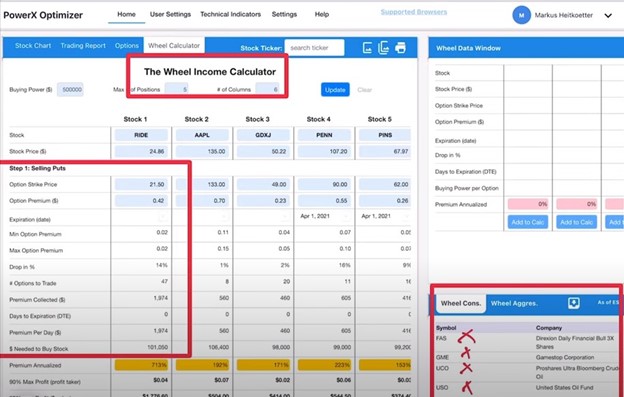

Or when I’m trading the other strategy, The Wheel Strategy, this is where right here, as you can see, I again have a Wheel Scanner right that is super important for me to find the right stocks or options to trade right now.

Then I have the powerful calculator that helps me to get the key performance indicators that I need. For example, what is the drop in percent that I can afford in this particular stock? How many options should I trade? What is the premium that I’m collecting? How many days to expiration do I have? What is my premium per day? Also, how much money is needed to buy the stock?

As you can see, it’s not really that complex, it’s rather simple calculations, but it definitely helps to have a calculator and a scanner, otherwise, it will be challenging. This is where I believe that you need to have the right tools.

Step Number Four – Trade on a Simulated Account

Step number four is to test your strategy on a simulated account. This is a step that is often overlooked by traders because it’s kind of boring.

I mean, this is when you’re not making real money, right? You are playing with fake money. So this means this is just simulated money and if you’re making money, it’s not transferred into your account, but the good news is you’re also not losing any money.

So why should you do this? Well, there are two main reasons why you should trade on a simulator, and here’s the first reason. First, you want to make sure your strategy actually works.

I mean, some of you might have seen me trading my accounts on my YouTube channel, and you might have seen that I make thousands and ten thousands of dollars. But just because I can do it doesn’t necessarily mean that you can do it. So you want to make sure that your strategy actually works and that you understand the strategy.

Secondly, you want to make sure you understand the rules of the strategy. You see, a trading strategy will fail if you misunderstand the rules. This is super important because if you don’t understand the rules, you will lose money even though the strategy is a profitable trading strategy.

I recommend at least 40 trades on a simulator. Now you might say,

“40 trades? Can’t I just do two or three and then I got it?”

No, trust me, you want 40 trades, and here’s why. First of all, with 40 trades you get statistically relevant information. Secondly, when you’re trading over 40 trades, you’re trading probably for a month or two. So you’re experiencing different market conditions.

You’re experiencing market conditions when the market is volatile, and when it is quiet. You’re experiencing market conditions when the market is going up, when it is going down, and when it is going sideways, and you will make mistakes, right?

You will make mistakes, especially when you’re new to trading, so you want to make sure that you’re really making all the mistakes on a simulator so that you don’t make them with real money. Because trust me, once you make mistakes with real money, it’s usually very expensive.

Step Number Five – Keep a Trading Log

Step number five is you need to keep a trading log and evaluate your results, and here’s why.

It’s so important whether you’re trading live or on a simulator to write down every single trade. You want to analyze what’s working and what’s not working. `What does it mean when you’re analyzing what’s working and what’s not working?

You want to find out what is your biggest loss, your biggest win? What can you expect on average? What is your average win or loss? What is your winning percentage? You want to know your overall profit, of course, but you want to see if this overall profit is it coming from one big win, or is it coming from a lot of small trades, right? And if you want to get advanced, you can also calculate your profit factor if you want.

Summary

Trust me, if you’re new to options trading and you’re doing these five steps you’ll be way ahead of everybody else. So let’s recap.

Number one, you want to learn the basics about options trading. You really don’t have to spend hours and hours learning the basics, what you should spend more time on is choosing the right options strategy.

And before you can choose the right options strategy for step number 2, you need to understand what this options trading strategy does and if it’s a good fit for you.

This is what I always say, there is no “best” strategy. There’s only the best strategy that fits your personality, that fits your criteria, that fits your account size, that fits your risk tolerance, and that fits your availability to trade.

Moving on to step number three, you need to have the right tools. It will make your life so much easier. Without the right tools, trading can be super frustrating. With the right tools, it can be super rewarding and it can be super fun.

Step number 4, it’s very important to test your strategy on a simulated account. Please do not skip this step. This is really the difference between traders who are making it and traders who are losing money. Most traders are jumping into trading without testing the strategy.

Again, trading on a simulator serves two main purposes. To make sure that the strategy that you selected is actually working, and also make sure that you understand the rules of the strategy.

Finally, step number five, keep a trading log, evaluate the results, and see is it working for you or not.

Learn more about Markus Heitkoetter at Rockwell Trading.