You might have heard the saying “Sell in May and go away.” It’s an old investing adage that has been around for decades, but does it actually work, asks, Markus Heitkoetter of Rockwell Trading?

In this blog post, we are going to find out what’s best to do.

We will discuss:

- What is the meaning behind “Sell in May and go away?”

- Does sell in May and go away work?

- Should you sell in May and go away?

- Two reasons not to sell in May and what to do instead.

Let’s get started:

1. What Is the Meaning Behind “Sell in May And Go Away?”

The saying “Sell in May and go away” has been around for a long time. It was first recorded in 1937 by John Hill via the Financial Times of London. The original saying was “Sell in May and come on back on St. Leger’s Day.” This phrase refers to a custom of aristocrats, merchants, and bankers who would leave the city of London and escape to the country during the hot summer months.

St. Leger’s Day refers to the St. Leger’s Stakes, a thoroughbred horse race held in mid-September and the last leg of the British Triple Crown. And it seems that American traders have adopted the saying. Americans are more likely to spend more time on vacation between Memorial Day and Labor Day.

2. Does “Sell in May and Go Away” Work?

And indeed, for over 50 years, the stock market performance supported the theory behind the strategy. In 2013, Forbes published an article showing the past performance of the Dow Jones (click here to read it).

From 1950 to around 2013, the Dow has had an average return of only 0.3% during the six-month period from May to October period. In comparison, the Dow had an average gain of 7.5% during the November to April period.

It seems that “Sell in May and Go away” is a strategy that may have worked for many years. But in recent times, it seems like the strategy has fallen out of favor.

Technical analysts at Merrill Lynch looked at historical data and found THIS out: Looking at three-month seasonal data going back to 1928, the June-August period typically is the second-best of the year, with gains 63% of the time, and an average return of 2.97%!

3. Should You Sell in May and Go Away?

With all this conflicting data, does it make sense to sell in May and go away? Is this a good investment strategy?

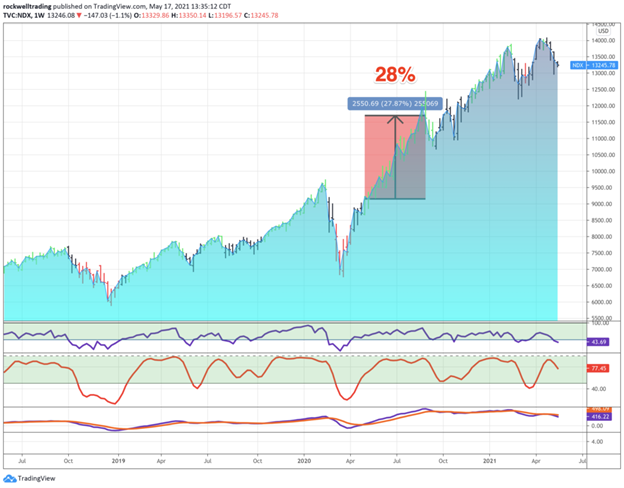

You know me—I always say “Trade What You See and Not What You Think!” Always look at the market data! As an example, last year, between May 4 and and August 3t, 2020, the Nasdaq rose 28%.

If you would have sold in May and gone away, you would have missed out on these gains.

4. Two Reasons Not to Sell in May and What to Do Instead

Maybe it makes sense to sell in May and go away when you’re an investor. Maybe. But as a short-term trader like me, May is a GREAT month to trade, and here’s why:

I like to trade The Wheel Strategy. With this trading strategy, you are selling option premiums. And there are two factors that influence options premiums:

- Volatility

When volatility is high, option premiums are higher.

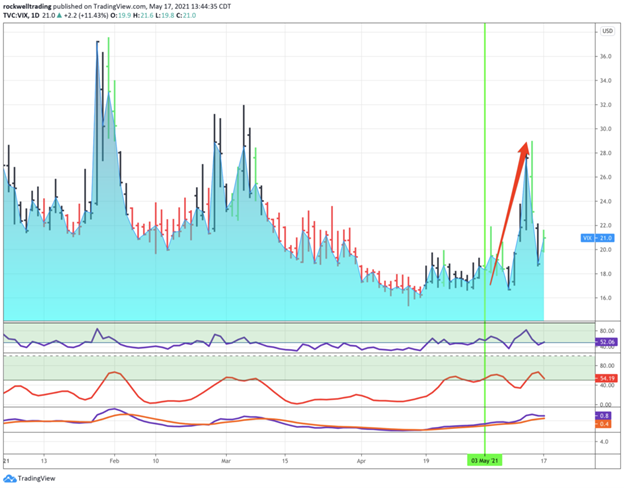

Here’s a chart of the Volatility Index (VIX) for the past few months:

As you can see, the VIX has been pretty low in March and April. But now, in May 2021, it’s spiking up again.

This means that options premiums are higher, which is perfect for a seller like me. I can get more premium!

- “Down Days”

Step 1 of “The Wheel Strategy” is selling puts.

And you get more premium for puts on “Down Days” for such strategies. Take a look at the chart of the NASDAQ:

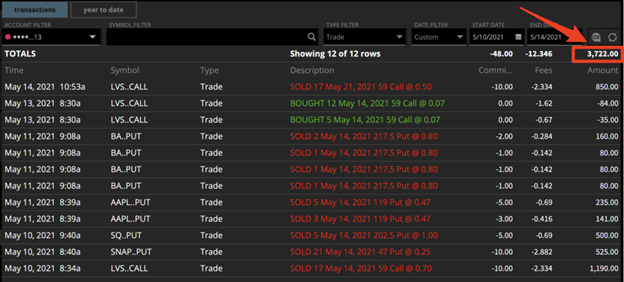

Thus far, in May 2021, we had seven “down days” and only four “up days.” On “down days,” there are many more trading opportunities. Last week, when the Dow Jones Industrial Average (DOW) had its worst week since February, I made $3,722 in profits.

Here are some of my trades in May. Let’s take a look at these trades in more detail:

- Trade #1: Snapchat (SNAP)

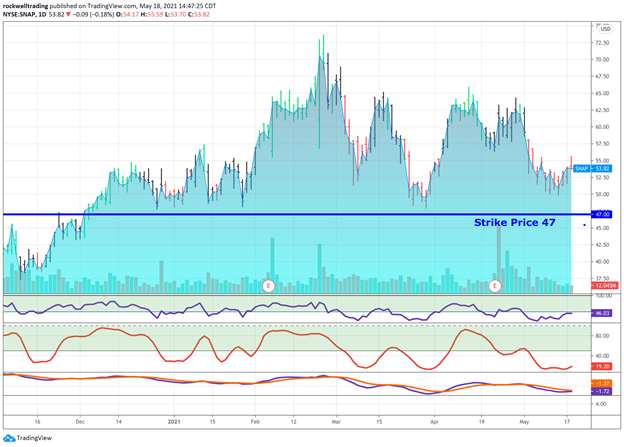

As you can see in the chart below, Snapchat (SNAP) had some rough weeks. In less than two months, it traded from a high of 72.50 to around $50 where it found some support.

Most retail investors would stay away from a stock like this, but I saw an opportunity to “buy it at a discount.” I sold puts with a strike price of 47 and an expiration of four days.

If SNAP would close below $47 on May 14 (the expiration date), I would get assigned and BUY SNAP for $47. I would consider that a bargain. If SNAP closes above $47, I would just keep the premium that I received for selling calls. In this case, that’s $525.

SNAP did close above $47 on May 14, and I collected $525 for four days of exposure in the stock market.

- Trade #2: Square (SQ)

Square (SQ) looked very similar. Mid-February, the stock made a high of $280, but then it retreated to $200.

Most market participants would not trade a stock like this but looking back over a six-month period I saw some good support around the $200-$203 level.

I sold five puts with a strike price of 202.50 and an expiration date of May 14. I received $100 in premium for each put, so I collected $500 in premium. On May 14, SQ closed above $202.50, and I made $500 in only four days. That’s a very nice return.

Other Trades:

Here are some of the other trades that I did. I sold 119 puts on Apple (AAPL):

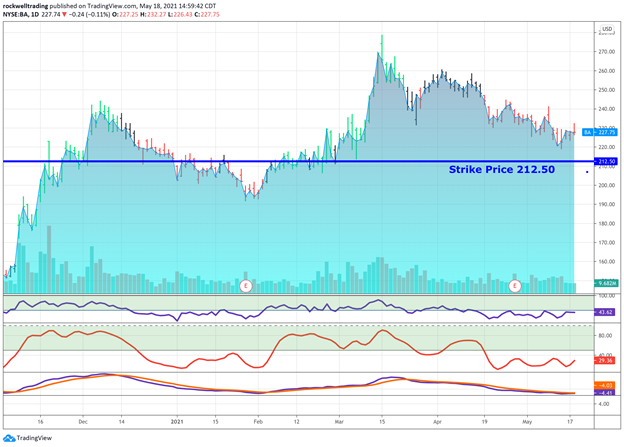

I sold 212.50 puts on Boeing (BA):

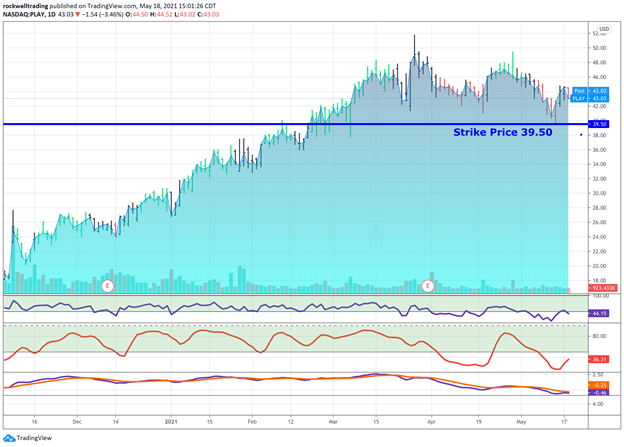

And I sold 39.50 puts on Dave & Busters (PLAY):

As you can see, all of these stocks have lost in value over the past few months. Investors who follow a ‘buy-and-hold approach” would lose money in this scenario, but as an active investor, I can apply trading strategies that make money even if the stock is going sideways or even moving lower.

Summary

“Sell in May and go away” is an old Wall Street adage that might be useful for buy-and-hold investors. But active investors like me are always on the lookout for trading opportunities. And with the right trading strategy, the increased volatility combined with markets that are moving lower is a dream come true.

You need to have the right trading strategy. I personally like to use the “PowerX Strategy“ for markets that are trending, and I trade “The Wheel Strategy” in choppy market conditions as we experience right now. With such a strategy, I am able to make money even if the stock is going sideways or lower.

I for one will NOT sell in May and go away!

Learn more about Markus Heitkoetter at Rockwell Trading.